Technical Outlook:

- Major reversal on Friday’s price action when the market went from being firmly in the green, to instantly into negative territory on news that Hillary Clinton’s email investigation was being re-opened.

- This creates some fresh volatility for the market as it had seemed, until Friday’s news, that it was comfortable just remaining dormant and buying any and all dips that it was presented with.

- Ironically, Friday marked the most bullish trading day of the year for the S&P 500 (SPX) – though it didn’t help any.

- Volume on SPDRs S&P 500 Trust (SPY) saw its volume rise for a fourth straight day and well above recent averages, and nearly double what was seen the day prior.

- CBOE Market Volatility (VIX) spiked into the 17’s but sold off hard as soon as it touched the declining trend-line off of the June highs.

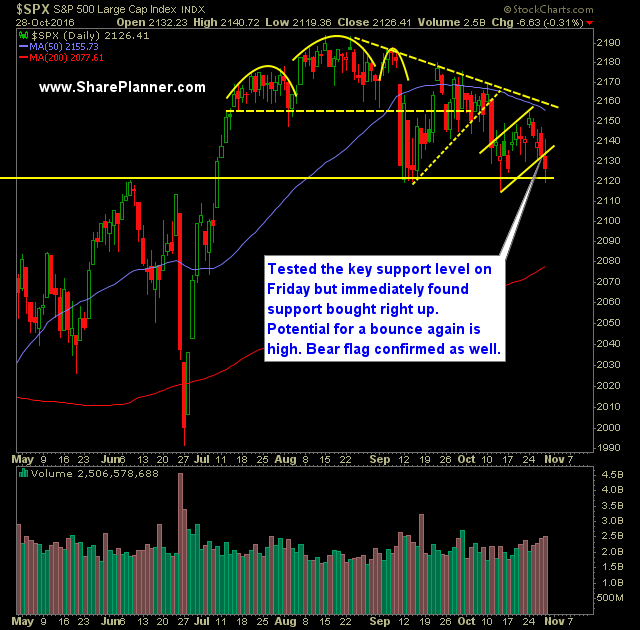

- Bear flag over the past two-plus weeks on SPX was confirmed to the downside.

- Support at 2120 remains thick, as another attempt to break it on Friday fell by the wayside as the bulls managed to rally stocks off of key support.

- Very real chance here that the market rallies off of this support level just as we have see the previous two tests of this support level at 2120.

- Very little support under 2120 on SPX if it breaks, with the next support level coming in at the psychologically important 2100, then 2050.

- Head and shoulders pattern forming on Nasdaq (QQQ).

- Russell 2000 Index (IWM) has clearly confirmed the double top from the past few months, and has consequently broken down hard.

- United States Oil Fund (USO) showing additional weakness and could see a test of the mid-$10’s very soon.

My Trades:

- Covered MRK on Friday at 58.67 for a 3.7% profit.

- Sold SPXU on Friday at $24.42 for a 3.2% profit.

- Did not add any new trades on Friday.

- Will look to add 1-2 new swing-trades to the portfolio today.

- Currently 10% Long / 20% Short / 30% Cash

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.