Technical Outlook:

- S&P 500 (SPX) continued its sell-off yesterday for the seventh straight day, and the nineth time in the last ten days.

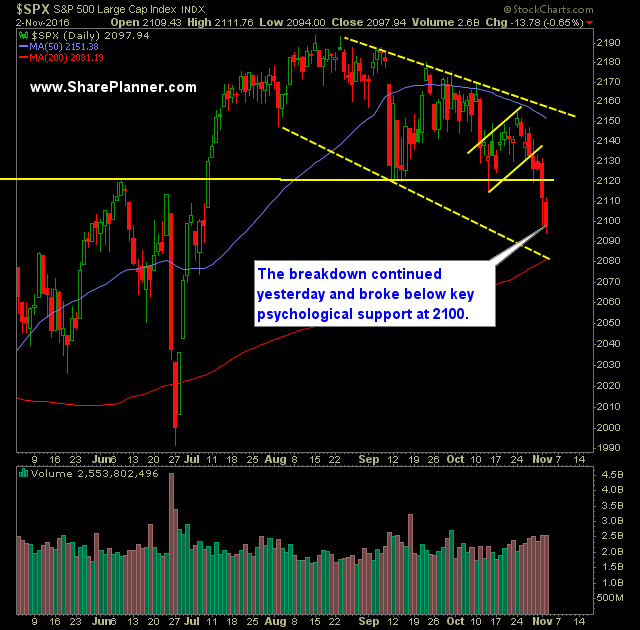

- More importantly, SPX broke key psychological support at 2100 yesterday.

- Considering SPX is down seven straight days, it is extremely light that the market is only down -2.5% during that time.

- Considering the last time the market was down seven straight days was in 2008 – SPX had declined 22% during that time period.

- CBOE Market Volatility (VIX) rose another 4% yesterday closing the day at 19.32 and at its highest closing level since June 27th.

- I expect the market to act much like it did in the days leading up to the Brexit, where polls by various news agencies will create sudden drops and buying sprees depending on their results.

- Another above average volume day on SPDRs S&P 500 (SPY) yesterday, though slightly less than the day prior.

- Very possible in the coming days that SPX tests the 200-day moving average. This was the area that the Brexit started its rally at (it broke the 200-dma before rallying hard immediately thereafter).

- United States Oil Fund (USO) tested the rising trend-line from the February lows and hed the level.

- 30 minute chart of SPX shows a market that has sold off significantly and in need of a bounce.

- FOMC Statement 11/2/16 yesterday was a dud – little to no market reaction from it.

- Look for the Nasdaq (QQQ) to be under pressure today with the hard drop in Facebook (FB) following their earnings report yesterday.

- The election is five days from today, and there will be more and more moves like what we saw on Friday where major moves occur out of nowhere, and is completely unexpected.

My Trades:

- Covered ACM yesterday at $27.14 for a 1.4% profit.

- Added one new short position to the portfolio yesterday.

- Will look to add 1-2 new swing-trades to the portfolio today.

- Currently 20% Short / 80% Cash

sp

sp