The bulls should be getting worried here. Yes, they find a way to rally the market off of its steep lows every time we see a sell-off, and we are seeing that happen again today, but the theme is that the bears are being relatively persistent in the last few weeks by putting its boot

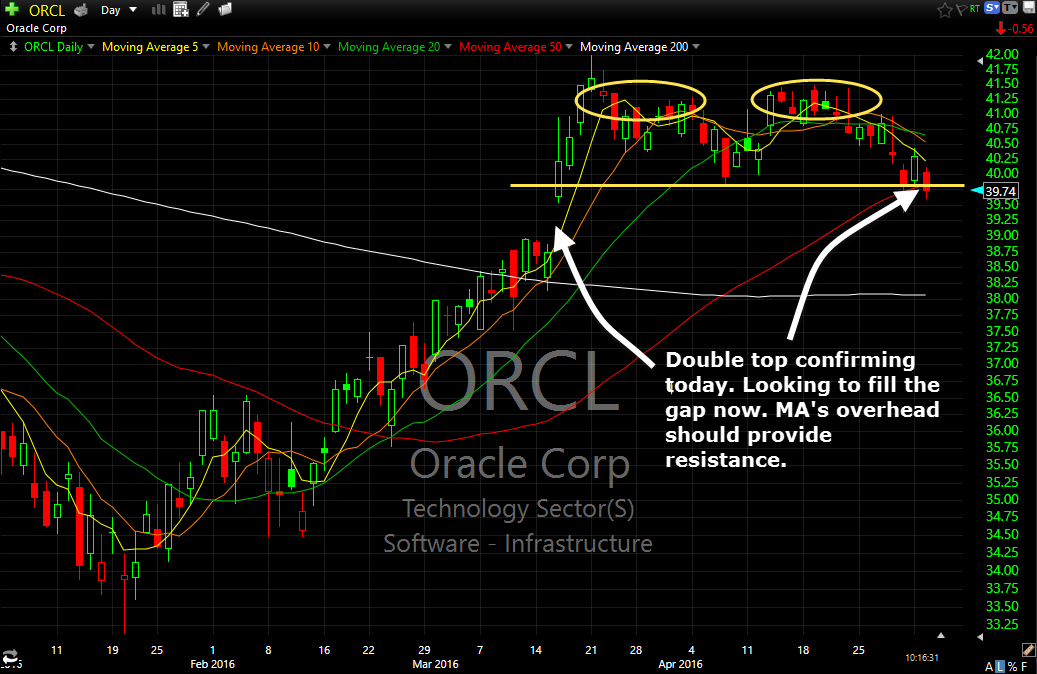

ORCL is sporting a perfect double top and and confirming the pattern today as well as breaking below the 50-day moving average. There is also a gap in the $38's that remains unfilled and continued weakness in this market would likely lead to that gap being filled.

4/21: Crude hitting major resistance on the chart. Since I don't trade futures in the Splash Zone, I have elected to short USO instead. There is plenty of long-term resistance overhead on the price of crude, which I will provide a chart for.

Just think… just a little over two months ago, SPX was down almost 12% year-to-date with what appeared to be no end in sight. Since then, the market has been on an unabated rally that has erased all of those losses that the market was experiencing.

Let’s face it, the Central Bank Bubble is still on the up and up. Yes, it was off to a rocky start this year, and last year, well, last year was a total bore. But the the Fed, ECB, BOJ, and PBOC are clearly doubling down on their desire to keep the rally from 2009

I’m actually net short on this market – that is 10% short, 90% cash. I honestly see the reward being to the downside, while the market to the upside has hardly no reward until the market does in fact pullback. Basically the market is stuck in a conundrum. Bulls want this market to go higher,

Yeah, I know, the bulls, even with today’s weakness, still have a firm hold on this market. But there are some conditions underneath the surface that suggests conditions are weakening a bit. Look no further than the small caps which has led this market higher all along. Today they are hitting new low after new

This is really a “choose your poison” type of moment for the markets. Here is what it boils down to:

The market is down today but for how long? To say this is another top in the market and now there is going to be a retest or break of the February lows is insanely premature. Heck, no one can even say for certain that this market is going to even be willing to close