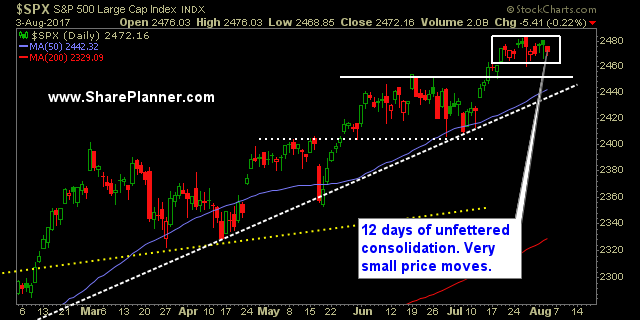

My Swing Trading Approach I’ve been aggresive with booking gains and will continue doing so going forward until the market breaks out of the current range that it is trading in.

My Swing Trading Approach Get more short if necessary. Right now, I am slightly short on this market. Need to see that the bears want to continue yesterday’s selling first.

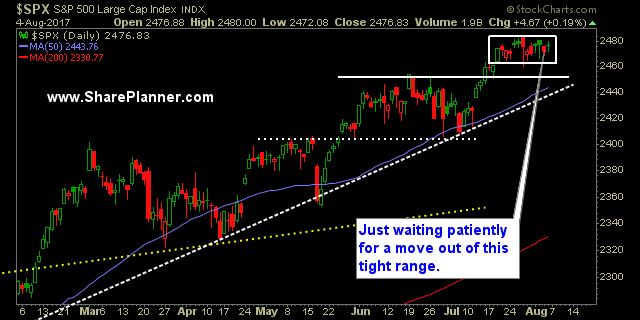

My Swing Trading Approach Flexibility is key for me here. I want to flip my portfolio in either direction based on what it does with the current tight trading range.

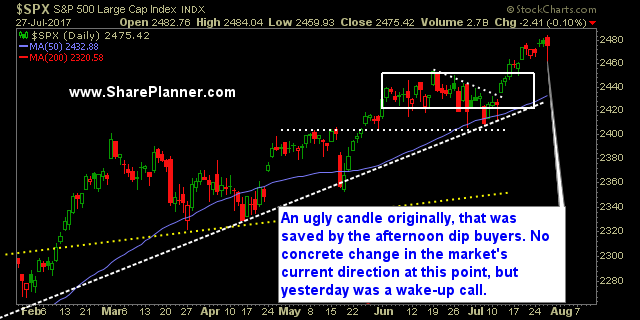

My Swing Trading Approach We are stuck in a 13-day consolidation pattern. That sucks on many, many levels. But it’ll breakout one way or another. However, the market isn’t providing what I would necessarily call a clear-cut edge. As a result I have been booking profits where it makes sense. Right now, I am net

My Swing Trading Approach Right now, I will probably limit the number of positions in my portfolio and stay as close to neutral as I possibly can until the market makes its move. Then I will foll along.

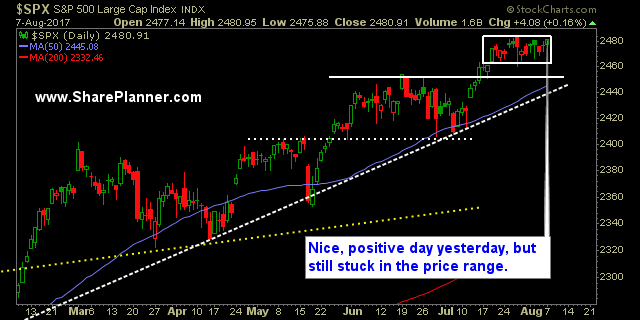

My Swing Trading Approach We have the S&P 500 stuck in a 10-day trading range. I am keeping a neutral portfolio until it can determine a direction coming out of the range. At that point I’ll either get more bearish or more bullish, depending on the direction that the market takes.

My Swing Trading Approach I’ve become suspicious of the market rallying whenever has blow out earnings. It is easy to assume when Apple rises in a big way, that the rest fo the market will follow suit, and that will, no doubt, be true with the Nasdaq today, but there is a good chance

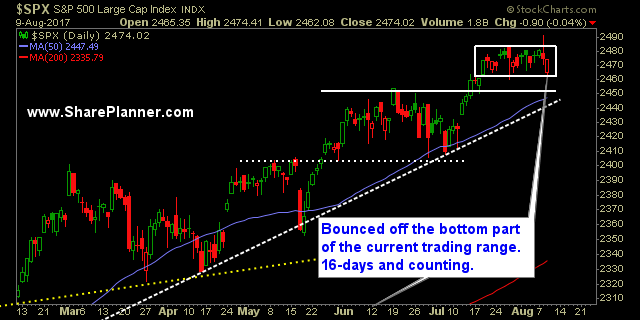

My Swing Trading Approach August tends to be a rather bearish month for the market. But then again, we’ve seen the bears blow every opportunity that comes their way. I’m sure seasonal opportunities won’t be seized upon either. I plan to cover my one short early on here if this market decides it wants to

My Swing Trading Approach I’m net long following Friday’s inability to sustain a sell-off to the downside. With the rally back, I flipped back to the long side. I would like to add a couple of more positions today, should the rally off of Friday’s lows continue.

My Swing Trading Approach I plan to play it cool today. Right now, I have one short position as I exited my long positions yesterday. I could get heavily long on this dip, but I need to see some evidence out of this market that the lows from yesterday want to hold into today.