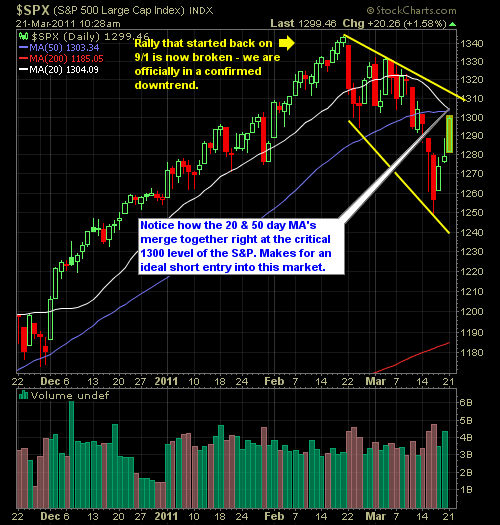

Technical Outlook: Bigger than usual trading range for S&P 500 (SPX) yesterday, and biggest sell-off that the market has seen August 2nd. Would have been the biggest since the Brexit sell-off, but the bulls stepped in during the last 10 minutes and goosed the market off of its lows. More importantly, SPX broke the 20-day moving

This market melt up is extremely common when a large amount of shorts are found with their hand in the cookie jar. What happens here is the market slowly bleeds out the last of short sellers from this market, and while the rally isn't as big as the initial few days of the rally, it is enough

Learn to take low-risk swing-trading setups by joining me in the SharePlanner Splash Zone. You can try try it out today with a with a Free 7-Day Trial. With your membership, you will receive all of my swing-trade alerts via email and text (international too) as well as access to my world-class chat-room that I trade in

Despite recent market weakness – members of the SharePlanner Splash Zone are still profiting in turbulent times. Join me by signing up for a Free 7-Day Trial where you will be given access to the member chat room as well as receive all my swing-trade alerts via email and text (international too). Join Today! Here’s tomorrow’s swing-trading watch-list:

I allocated some more of my portfolio to SPY on the pop that we are seeing this morning at $129.81. Between 1300 and 1302 there is a lot of technical resistance that should cause some headaches for the bulls to push through. On the Fibonacci retracements we’ve seen the the S&P give back +50%

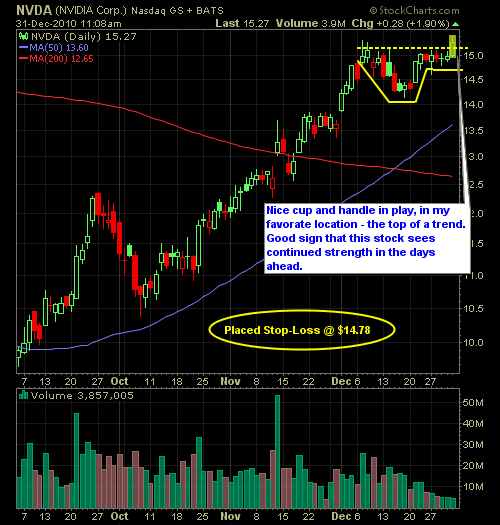

After finally seeing some signs of life from this market, I decided to go long on NVDA at $15.28. My stop is pretty tight, at $14.78. The setup is no doubt appealing and one worth jumping on with the cup and handle in play and could easily see a move into the $16’s in