My Swing Trading Strategy The last two trading sessions have seen the bulls slip in holding their intraday gains, so at this point, I am not willing to add more positions to the portfolio until the uptrend shows signs of wanting to resume moving higher. Indicators Volatility Index (VIX) – Finished higher by a smidge yesterday,

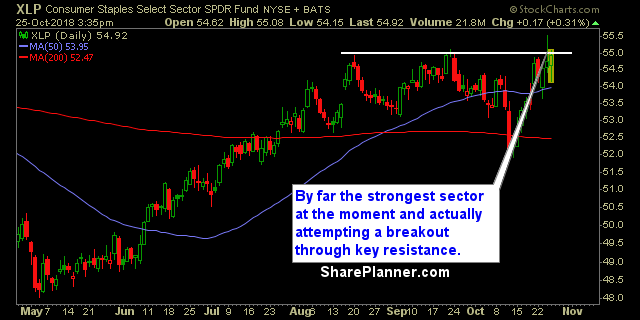

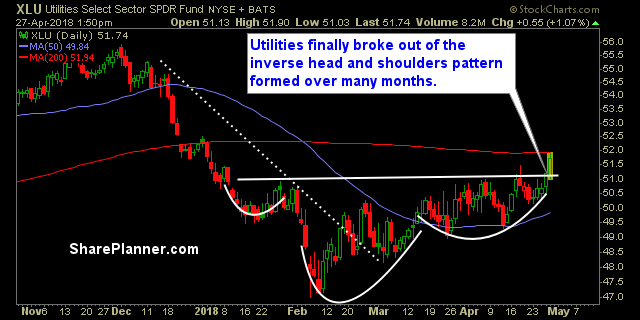

Technicals are pretty much a disaster for all the sectors. Except for Staples and Utilities, which are actually on the up and up, but that is to be expected when the street is looking for safe havens for its capital. The bulls have suffered for five weeks strong, and it is showing on the charts

My Swing Trading Approach I will look to be playing the bounce, should it hold through the first 30 minutes of trading today. I will only add 1-2 new positions depending on the strength of the market today. Indicators

My Swing Trading Approach The sell-off on Friday, cast a dark cloud on the market as Amazon earnings was unable to lift the market as most expected. I am out of tech for now, and will will keep my portfolio light going into the week, and will only add new positions if the market can

My Swing Trading Approach Follow the trend and the market intraday action. If price action is favorable and the setups are there, I’ll take them. Meanwhile, I plan on raising the stops in my open positions where it is possible to protect profits. I expect a low volume day in the market today and that

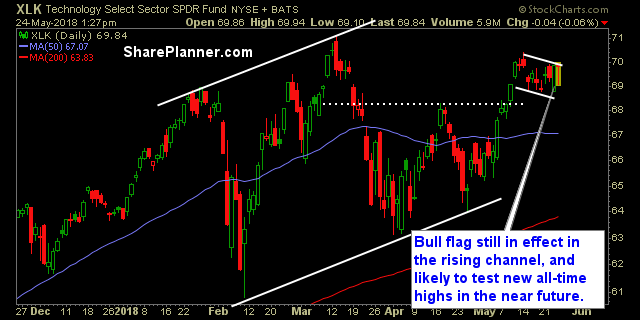

My Swing Trading Approach I’m focused on managing my existing positions coming into today and the risk associated with each of them. Tech will negatively affect the market today, due to Facebook (FB) earnings. I’m not against adding more positions today, but the market will have to show it is willing to look past FB’s sell-off

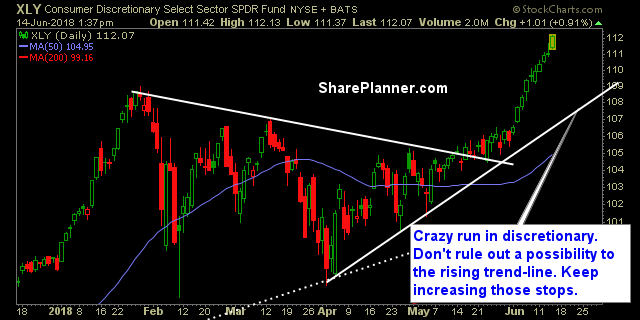

The Leaders of this market still leading In fact if you look at my top three sectors below the only difference is I have swapped out Industrials for Healthcare. Otherwise, the 1-2 punch of this market still remains Technology and Discretionary.

Most of the sectors are in good shape right now. This bodes well for the overall direction that the market has been on this month. Yes, there are some obstacles for it to overcome, in forms of strong price resistance overhead, but we are seeing the typical market resiliency that we saw during much of

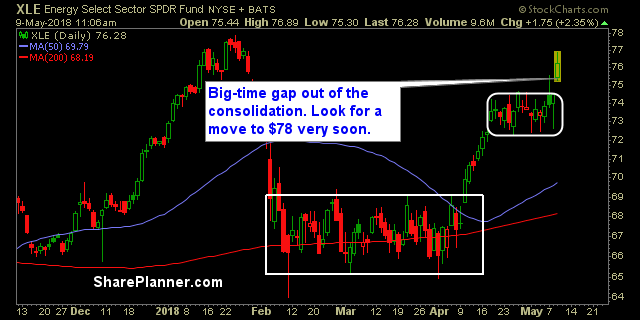

There are a lot of positives and a lot of negatives in this market right now. Not all sectors are soaring as you might think. A lot of them are downright miserable. There are also a lot of failed patterns breakouts as you will see below. Those lead the way in terms of worst sectors

Sectors losing their long-term trend and have been extremely choppy When you have a market that isn’t establishing new highs, nor is establishing any new lows on the charts, mix that with huge price swings for the past three months and you have some very confused, and in some cases, directionless sectors.