Some good and bad in the market right now. Despite some willingness by the market to try and rally in recent days, there is still a lot of pressure weighing on the sectors across the board. The headline risk is at extreme levels, and that is keeping me from being too aggressive on the long

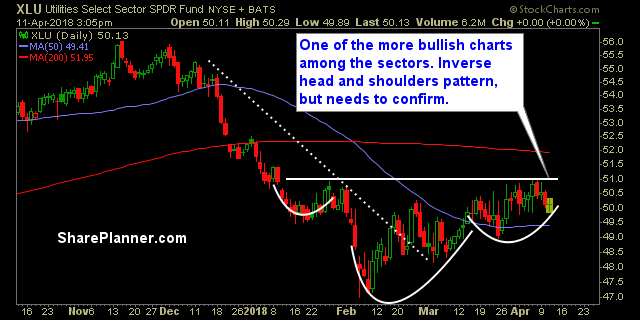

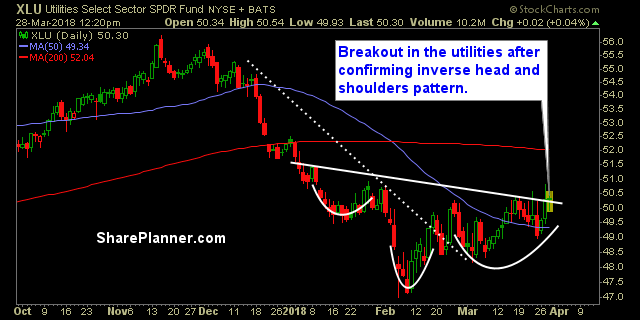

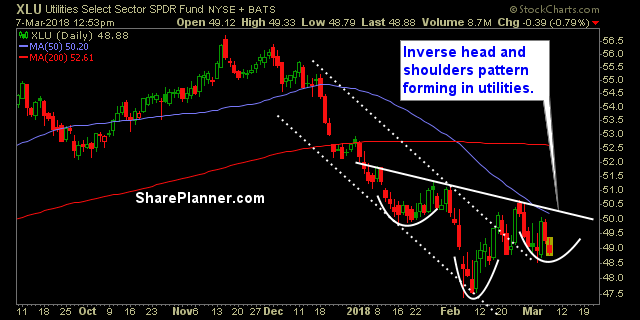

There are drastic differences in each of the sectors That is usually not the case. They tend to represent some off-shoot of the S&P 500, or in the case of Technology, as resemblance of the Nasdaq chart. But now, each chart has a different look. obviously the majority of them are trending downwards, but still

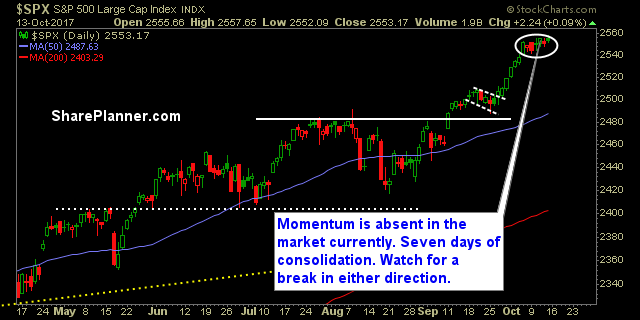

Stock Market is on shaky ground here. Direction is Uncertain. So lets take a deeper look at the sectors themselves. Which ones are most favorable and the ones that are not.

My Swing Trading Approach I have large gains in Bank of America (BAC), Apple (AAPL) and Amazon (AMZN) after buying the dip last Friday, and have added a few more positions since. Will look to add more if there are more opportunities that arise. Indicators

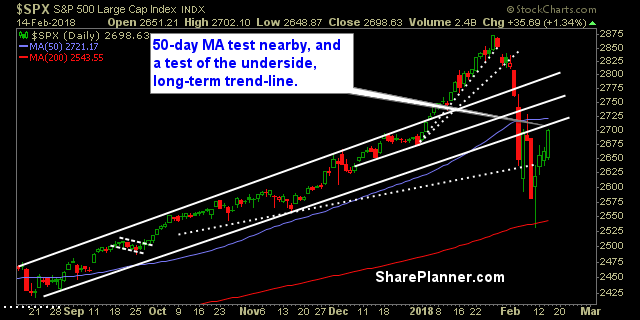

Market’s have rebounded well since the sell-off that led to a test of SPX 200-day moving average. Following today’s CPI report in the pre-market, and the subsequent sell-off, I was ready for the market to begin its selling yet again, so I raised my stops to protect all profits.

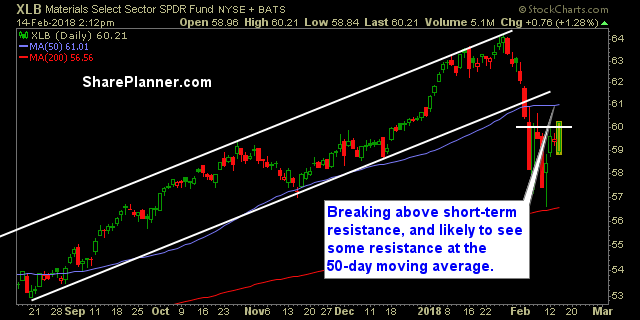

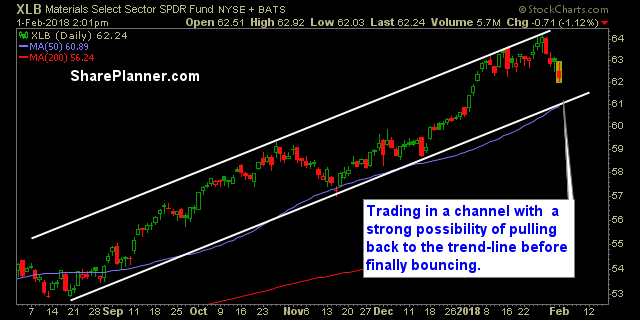

Beyond the technical analysis of the overall market, it is critically important to keep tabs on each sector, to know where the strength lies. For instance, had you invested in utilities over the past two months, you would be down royally, on your trade, while the rest of the market rallied. The same could be

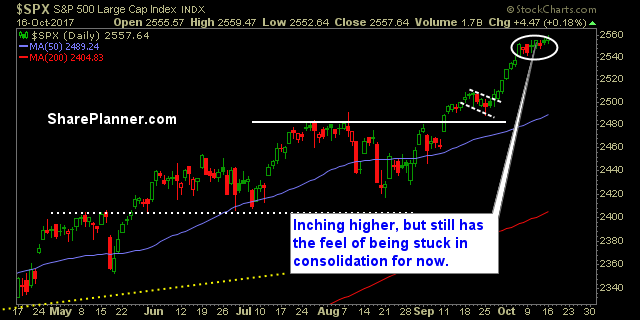

My Swing Trading Approach I have plenty of flexibility to play the market in either direction, depending on what the market ultimately wants to do. Only way I will get short is if the market shows signs of breaking down. Indicators

My Swing Trading Approach I’m looking to add some long exposure today, should the market show enough bullishness to support a move. Still maintaining the ability to get short quickly, should the opportunity arise. Indicators

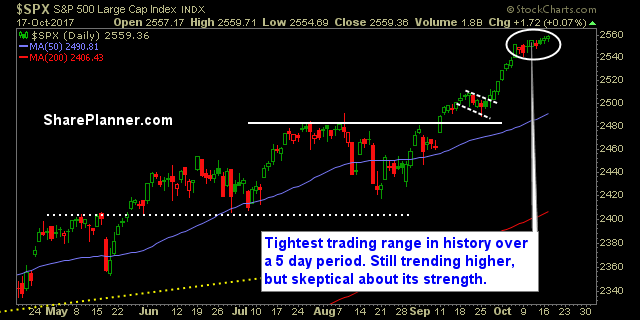

My Swing Trading Approach I would like more price action from this market, but I can’t force that. I have to wait for that to happen, and to place my trades accordingly. Right now, I don’t want to add additional long exposure, until this market can put together a decent breakout to the upside. Indicators