Join me by signing up for a Free 7-Day Trial where you will be given access to the member chat room as well as receive all my swing-trade alerts via email and text (international too). If you’d like to see just how good my past performance has been, you can do so by clicking here. Here’s tomorrow’s swing-trading

Members of the SharePlanner Splash Zone are having an outstanding month (and year) – and I encourage you to become part of our success by signing up for a Free 7-Day Trial to the SPlash Zone where you’ll receive access to my Trading Room and Real-Time Trade Alerts via text and email (including international numbers). You

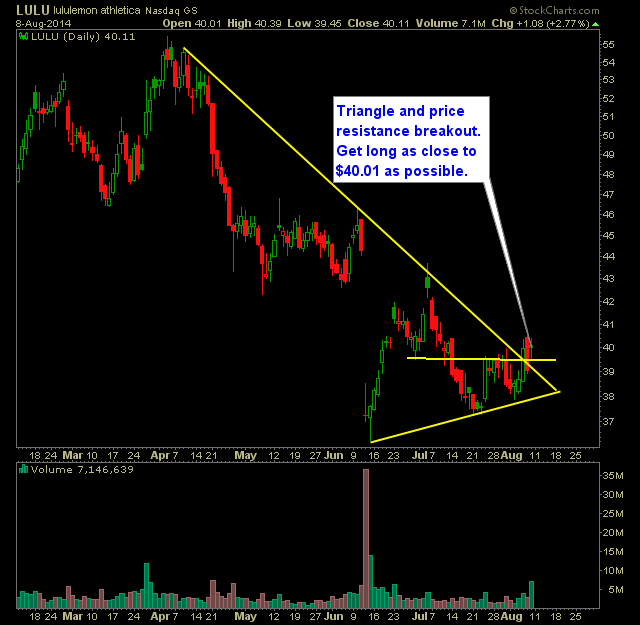

Be sure to sign up for the SharePlanner Splash Zone Free 7-Day Trial and receive access to my chatroom and real-time trade alerts via text and email (including international). You can also automate all my trades through Ditto Trade. Click here to subscribe. Here is tomorrow’s swing-trading watch-list: Long Lululemon (LULU)

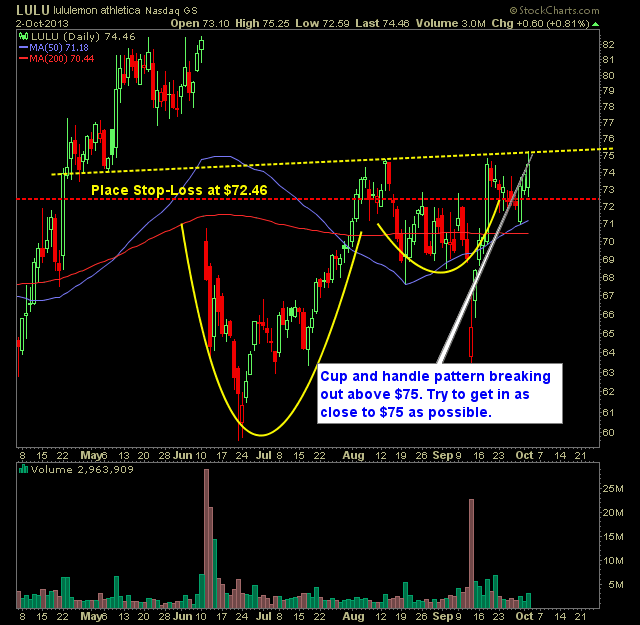

Today’s day-trading in the SharePlanner Trading Block was simply awesome. With the Primary gains coming from CSIQ, DDD, LULU, and FSLR, Oscar managed to add a nice $361 to our minimum sized portfolio of $25,000 and increasing our gains for the month to 8.6%. Not bad. Not bad at all! Here’s all of Oscar’s

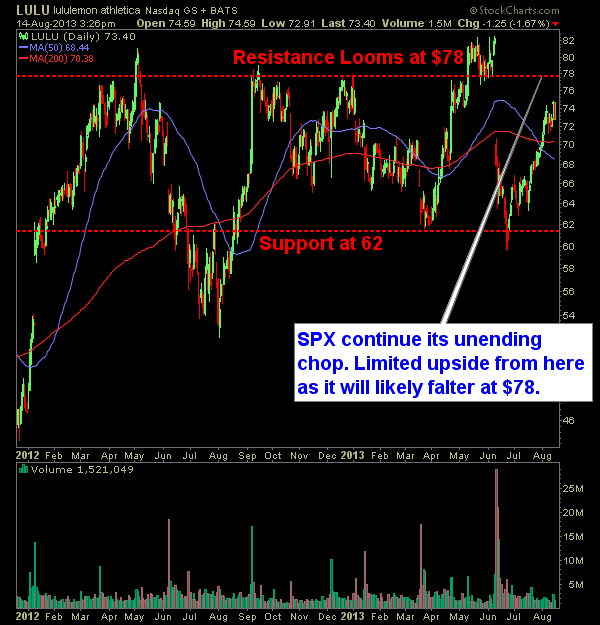

Cup and handle pattern breaking out above $75. Try to get in as close to $75 as possible. I’d place my stop-loss at $72.46. Here’s the trade setup:

Lululemon has been a volatile beast of late, but in the midst of all that, there is a perfect triangle pattern forming, and once it can get above that $74 level than $75, a move into the $80’s should be all but certain. I’m not trading this one yet, but once it starts crossing certain

If someone made a bet with you, and you should to lose $12 at the chance to win $4 would you take it? That is the risk-to-reward scenario that Lululemon Athletica (LULU) is offering at this point. Or what I would call an unfavorable 3-to-1 Risk/Reward setup. So while it is in this large scale