$DKNG breaking below key support.

$MSOS testing resistance on the spike higher.

$MA bear flag pattern could lead to a test of long-term support.

Like $BAC I also see $JPM ultimately pulling back to the rising trend-line.

One of the biggest problems among traders in the stock market is in the inability to not trade. To show patience and wait for the right setup. Ryan Mallory talks directly to traders to make them look at patience as a strategic approach to trading successfully in the most volatile and unpredictable of markets in

$AMGN double bottom and impressive action, but the breakout is well underway following the move above $220. Also in a very difficult sector and industry right now, and one of the few bright spots. Not enough though to interest me.

As a new feature to SharePlanner, I’m going to roll out, the SharePlanner Notebook, where I essentially “clear out my notebook” of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading

Swing Trading Strategy: Kicking off Earnings… The earnings weren’t good at all from the banks, and while no one really expected them to be, they were even worse than expected. JPM’s EPS came in at $0.78/share despite analysts expecting $2.16/share. However the market was not phased by this at all. The market right now is

I'm doing the technical analysis trade updates for the latest and hottest stocks and what you should be buying vs selling, and what stocks you should be staying away from all together. In this video I cover: $FB $AMZN $AAPL $GOOGL $TLT $SHOP $BABA $JPM $BAC $OSTK $BLDP $APRN $AMD $CARS $AVGO $SPX $VIX.

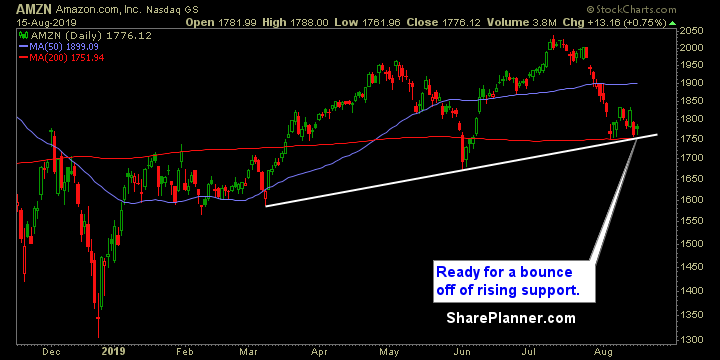

Friday’s Swing-Trades: $AMZN $JKHY $JPM Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Swing-Trading Splash Zone and start making some profits for yourself! Long: Amazon (AMZN)