Pre-market update: Asian markets traded 0.5% lower. European markets are trading -0.7% lower. US futures are trading 0.1% lower ahead of the market open. Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), International Trade (8:30), Redbook (8:55) Technical Outlook (SPX): Technically, SPX finished a shade above 1883, at 1884.66 but

Pre-market update: Asian markets traded 0.5% lower. European markets are trading -0.7% lower. US futures are trading 0.4% lower ahead of the market open. Economic reports due out (all times are eastern): PMI Services Index (9:45), ISM Non-Manufacturing Index (10) Technical Outlook (SPX): An impressive start on Friday turned red and despite trading at

Here’s tonight’s trade setups for tomorrow’s market. Remember I’ll be publishing my entire bullish watch-list tomorrow, followed by the complete bearish watch-list Tuesday. So check back for that. It’s hard to lean anyway but bullish until we can see some support levels violated and right now that isn’t in the cards. When it will be

Couple of things to note here on the JPM chart: 1) HUGE head and shoulders pattern in place, but needs to clear $49.70 to confirm 2) Downward ascending trend-line is broken off of the July highs. Could negate the H&S pattern. Right now the head and shoulders pattern may be compromised, especially if price

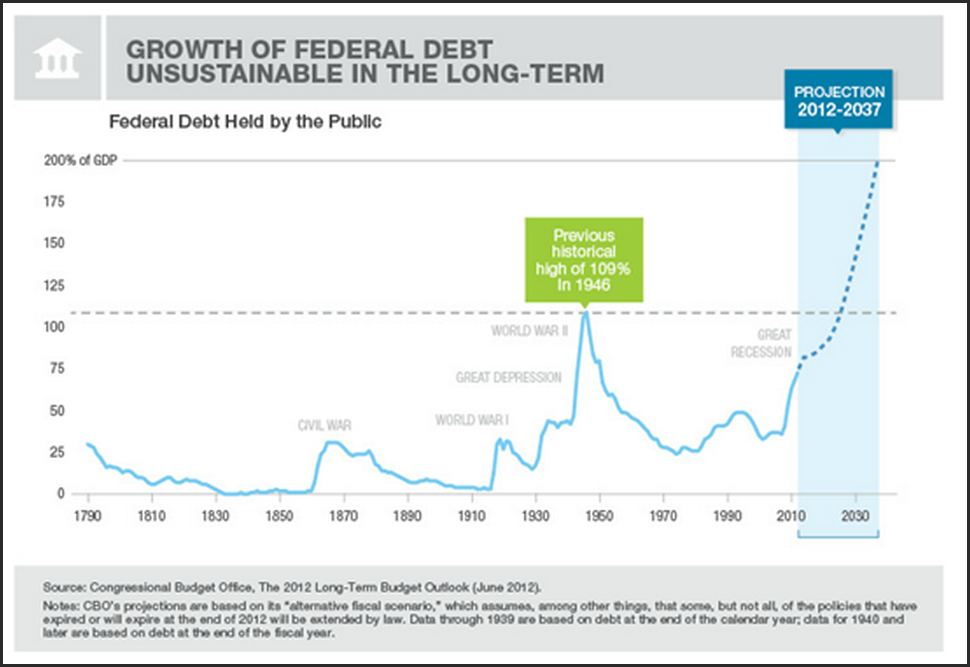

The Chart of the Day… Think about this chart when you are heading to the polls next Tuesday and ask yourself whcih candidate is most likely to curb the unsustainable growth of debt to GDP. From SocialTrade Quick Glance at the Market Heat Map and Industries Notables: Tech has come alive! Banks, particularly JPM

As I always try to do, when we are selling a bit of heavy selling, I’ve provided for you a handful of stocks that are showing signs of, or already in the process of, breaking down as the smart money appears to be leaving them in a subtle manner. There are stocks trading at its

The great attempt at a new bear market has finally ceased – done – over with. My attempts to short this market were deemed futile – and in the end had nothing to show but a sea of shorts that mounted to really nothing but red in brokerage statements. The action that the market portrayed early

My Goodness! Bust out the Champagne, because the market finally closed down today! You know you need a little “pick-me-upper” when you get aroused by a 2 point decline in the S&P. My gosh these bulls can really wear me out. Nonetheless, it is two days in a row now of positive gains for my

Thought I’d throw out a nice Friday afternoon bone to ya’ll before you head out for the weekend. I just initiated a new short position in JPMorgan Chase (JPM). I like the setup and we’ll see how well it goes. This was also one of my morning short trade setups that I spoke of.

I couldn’t be more excited about my prospects for the shorting this market than I am right now, with the market staring down the barrel of two percent gains, I just need those bulls out there to keep telling themselves “I think I can…I think I can”. As it stands right now, I am looking