Understanding a Counter Trend Rally The Importance of Context in Trend Analysis Let’s talk about a counter trend rally as it applies to the stock market. The SPDR S&P 500 Trust ETF (SPY) mirrors the S&P 500 and its price action and for swing traders trying to predict and capture its price swings and

No, the stock market crashing - at least not yet! The stock market is not crashing right now and the question that should be asked is not whether the stock market is crashing, but how are we going to respond to what the stock market does next. In this video, I provide my technical analysis

Market Rotation Into Small caps is unfolding. IWM ETF appears to be set to make another rally here to the upside as the market rotation into small caps continues. Russell 2000 (IWM) pulled back late last week and is now bouncing off of the Fibonacci retracement levels and sets up for a potential rally

Nasdaq 100 (QQQ) 30 min chart will zero chill in it. Another breakout attempt unfolding on Russell 2000 (IWM) today. A solid push through resistance so far. If US Global Jets ETF (JETS) breaks out of the continuation triangle, then it has to immediately contend with long-term declining resistance. A no-go for me. Heavy resistance

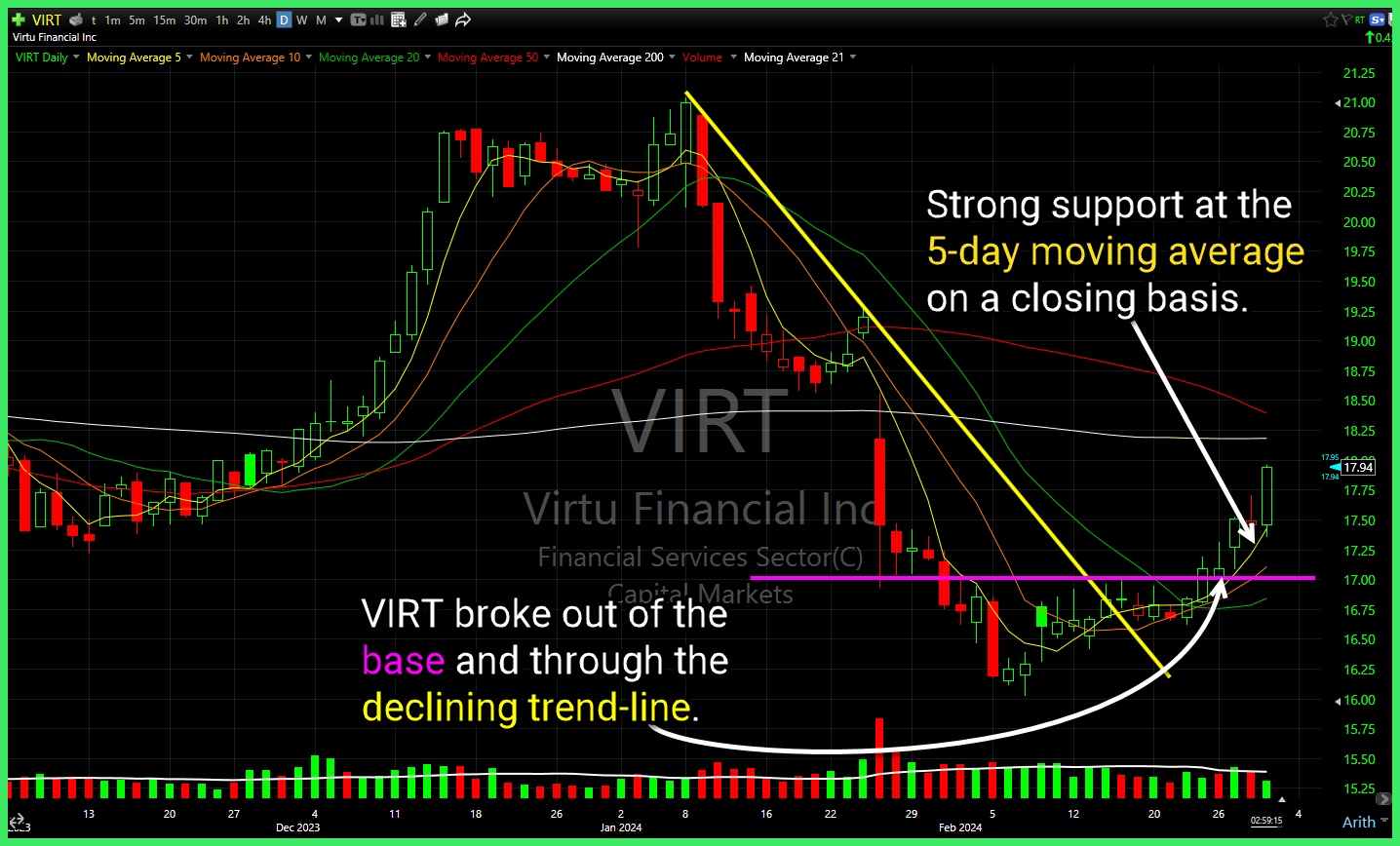

$VIRT broke out of the base and through the declining trend-line. . $IWM gapped above resistance today, and has since pulled back for a retest. Watching here to see whether that level holds, or if it starts to fade and close the gap from this morning. Bull flag in $WYNN attempting to breakout. Rising trend-line

$PLTR - major gap still left unfilled, and a pullback to one of the two support levels underneath would be the best opportunity to me. $XHB consolidation prior to the the break through resistance, sets up well for higher prices with tight risk management. $IWM two hard rejections off of the 200-day moving average Heavy

$SMCI nearing a triangle breakout. $IWM declining trend-line getting tested here, with a massive gap underneath.

MO getting steamrolled post earnings, but may find some support here off of long-term rising trend-line at $36. A lot of chasing taking place in SAVA over the last two days, but you'll want to be mindful, if long, that there is some heavy resistance looming above. LLY looks like it is on a crash

$GLD getting some push back here at the resistance from the broken descending triangle $XLE Watching for a pullback to the rising trend-line here. $IWM broke the rising trend-line today, and looking at another test of major price level support. Below that, watch for October '22 lows retest. $TPST Couldn't have seen that one coming...

The S&P 500 and Nasdaq 100 has been on a 3 day rally and the Russell 2000 has been on a 5 day rally! But can it last? How much more room to rally does the stock market have to rally. Or are we simply looking at a bear market rally coming to an end