I’ve already bought GOOG this morning at $524.81 on what I believe is a stock prime for a bounce somewhere in the realm of 3-4%. With that said, the stock offers a very nice risk/reward setup with upside as much as $540 and down side of about 517, which is a 2:1 reward/risk. The

Current Long Positions (stop-losses in parentheses): CPWR (10.90), TICC (11.90), NFLX (199.75), PFE (18.89), PGH (12.65), SCO (43.99) Current Short Positions (stop-losses in parentheses): None BIAS: 45% Long Economic Reports Due Out (Times are EST): Monster Employment Index (6am), Jobless Claims (8:30am), Productivity and Costs (8:30am), ISM Non-Manufacturing Index (10am), EIA Natural Gas Report

Tim Bourquin: Hello, everybody and welcome back to TraderInterviews.com. Thanks for joining me for another interview. We’re going to be speaking with Ryan — Ryan Mallory and we’re going to talk to him about how he trades, how he finds good opportunities in the markets, and basically maybe his story about a trade or two

Market has managed, quite well, to keep a bad employment number, which jumped from 9.6% all the way up to 9.8%, from driving the markets lower. In fact the action that we saw today is actually a good testament to the health of the market. While I think we may see some profit taking in

Current Long Positions (stop-losses in parentheses): TICC (9.62), BRKR (14.54), ITW (47.40), QQQQ (49.25), TIE (19.73), BEAV (31.75), PAG (13.62), DTV (41.09), ZION (21.59), ACI (25.54) Current Short Positions (stop-losses in parentheses): None BIAS: 82% Long Economic Reports Due Out (Times are EST): Bernanke (8:15am), Consumer Price Index (8:30am), Retail Sales (8:30am), Empire State Manufacturing Survey (8:30am),

About a month or so ago, I wrote a post describing the details of my trading computer. However, as you know, a computer with great hardware setup doesn’t mean much unless you have the right software in relation to how you trade. So this here will be the second installment of the “Trading Desk”. For

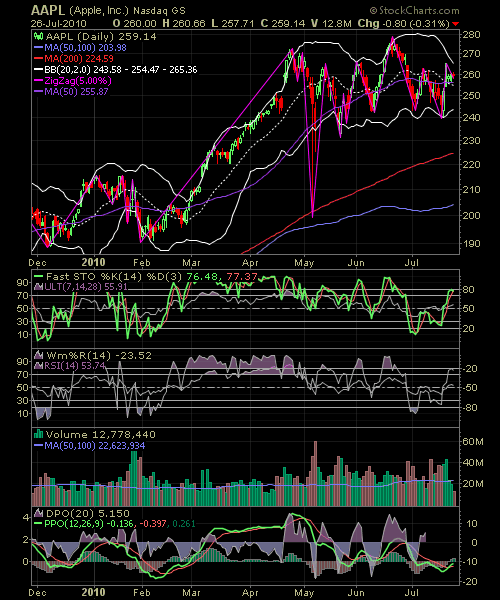

Please say it ain’t so! But believe it or not, there are a lot of traders out there that have charts that are as convoluted and messy as the chart you see above.

Current Long Positions (stop-losses in parentheses): None Current Short Positions (stop-losses in parentheses): ESV (42.84), MR (32.80), WTFC (37.71), SLAB (44.80), CERN (83.56), ALB (43.59), HIBB (26.65), LYV (11.95), WRC (40.95) BIAS: 93% Short Economic Reports Due Out (Times are EST): Consumer Price Index (8:30am), Treasury International Capital (9am), Consumer Sentiment (9:55am) My Observations and

Current Long Positions (stop-losses in parentheses): None Current Short Positions (stop-losses in parentheses): ESV (42.84), MR (33.39), WTFC (37.71), SLAB (44.80), CERN (83.56), ALB (43.59), HIBB (26.65), LYV (11.95), WRC (40.95) BIAS: 103% Short Economic Reports Due Out (Times are EST): Producer Price Index (8:30am), Empire State Manufacturing Survey (8:30am), Jobless Claims (8:30am), Industrial Production

Recently I have tried to provide readers on the weekend with the most interesting article from the past week. The article below comes from MarketFolly.com. It details the most popular stocks among hedge fund's top-ten holdings. Perhaps you may be able to find a trading idea or two as a result. Given our focus on