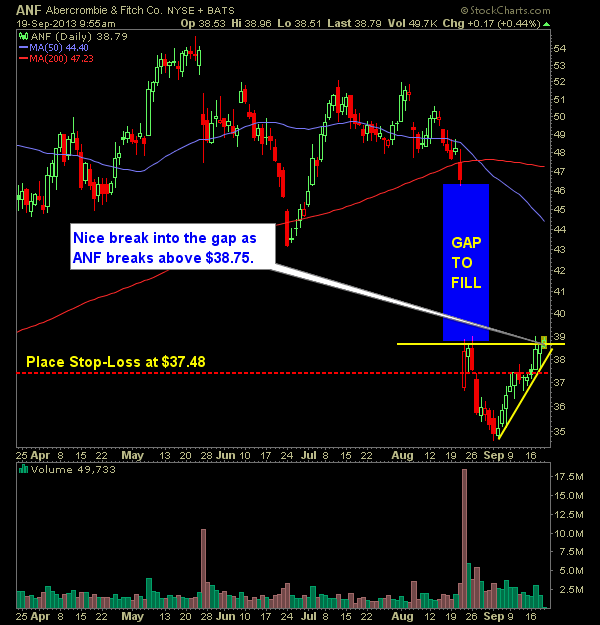

Here are my Swing-Trading setups that I am watching today: Long: Abercrombie Fitch (ANF):

It was not an easy month for me. I had a bad start, and at some point I was down -$3,700.00. Like any good trader, I decided to go back in all my trades and look ate what I was doing wrong, and figure out what needed to be done to bring myself from this

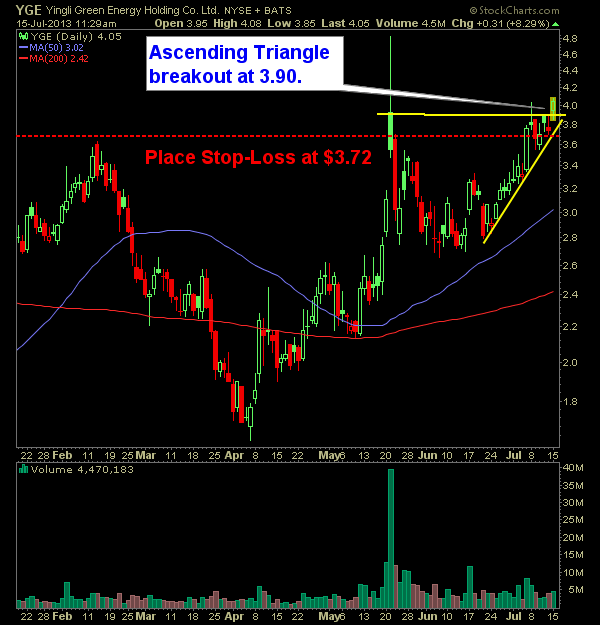

Not a lot of words needed for this post - the charts pretty much say it all. Solars are running today and they can be played. Some require patience while a couple of others require an immediate decision whether you want to play them long or just stand aside. Here are the Solar Setups: Long:

$AMRM Daily Chart - gaping over the 1st fib level. As long as it can hold the 7.53 level, this setup loks very bullish. $BCRX Daily Chart - Needs to hold above 2.01 which represents the 50% Fibonacci level. This could be a nice runner today. $FSLR Daily Chart - There is no setup in

I haven’t been actively trading in the market today, mainly because the market is really hard to predict with the massive sell-off yesterday whether we just bounce right back up, or we go further south from here. In particular, today just felt like a massive short covering, so there’s not much to lead me to

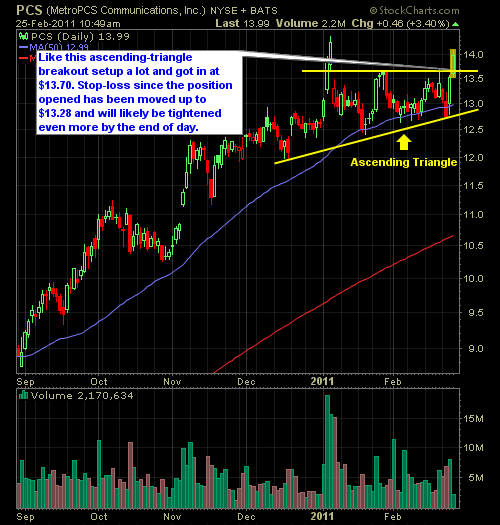

Another mix of swing-trades to the long and short-side today. The market is looking indecisive, but that should not come as a surprise considering the run we’ve been on of late. LONG: Universal Desplay (PANL)

I was at a fire station with my 2 year old and missed this. These don't come around every day!

This is a crazy downturn in FSLR today. The CEO announced his leaving and this is what happened. I actually wanted to short it earlier in the day as I saw it set-up for a possible break of the daily low (it's on my watchlist of about 20 stocks or so) but no shares were

Current Long Positions (stop-losses in parentheses): None Current Short Positions (stop-losses in parentheses): None BIAS: 100% Cash Economic Reports Due Out (Times are EST): Empire State Manufacturing Survey (8:30am), Treasury International Capital (9am), Housing Market Index (10am) My Observations and What to Expect: Futures are mixed, with the Nasdaq down over 15 points