Pre-market update: Asian markets traded 0.4% higher. European markets are trading -0.3% lower. US futures are trading -0.3% lower ahead of the market open. Economic reports due out (all times are eastern): Chicago PMI (9:45), Pending Home Sales Index (10), Dallas Fed Manufacturing Survey (10:30) Technical Outlook (SPX): SPX has started to breakout of

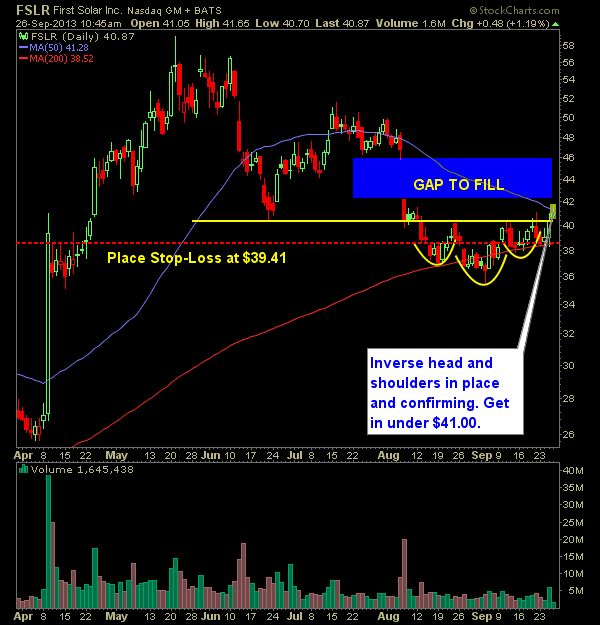

Today’s SharePlanner Hangout! In it I go over each of the main indices including: S&P 500, Russell and Nasdaq. I also discuss my failed trade today in Kate Spade & Company (KATE), and the successes like that of Facebook (FB), First Solar (FSLR), Youku Tudou (YOKU), and 3D Systems (DDD). I also

Pre-market update: Asian markets traded -0.7% lower. European markets are trading 0.1% higher. US futures are trading -0.3% lower ahead of the market open. Economic reports due out (all times are eastern): Consumer Sentiment (9:55), Farm Prices (3) Technical Outlook (SPX): Strong recovery yesterday after the initial morning sell-off creating a long lower candle

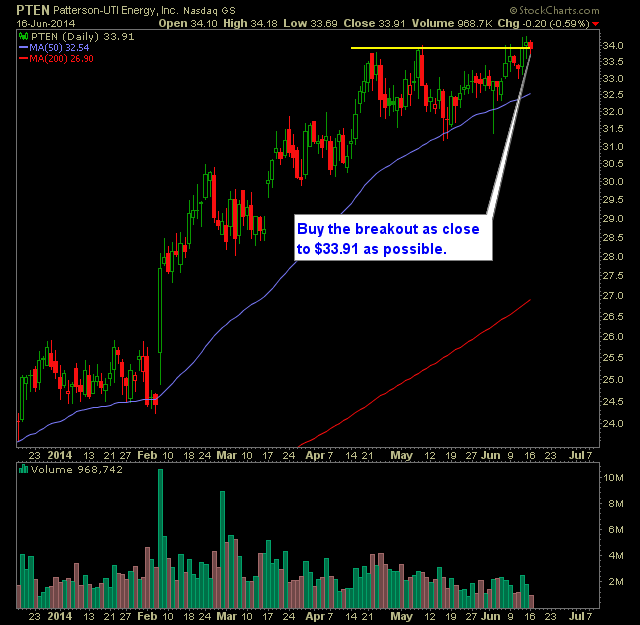

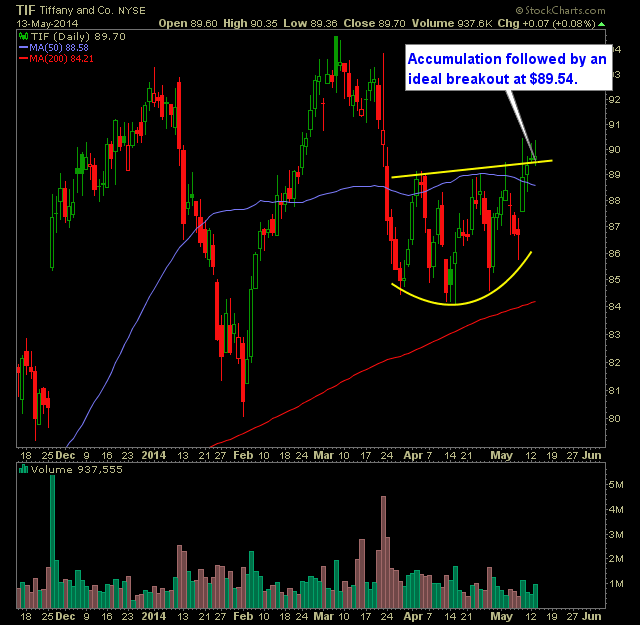

If you’d like to see how my well my trading pans out then take a look for yourself as I am one of the only services out there that has a track record worth publishing. All the rest simply try to keep it hidden from you. Checkout my Swing-Trading Past Performance here. Here’s tomorrow’s swing-trading

Here’s tomorrow’s swing-trading watch-list: Long PulteGroup (PHM)

Tomorrow’s Swing-Trading Setups: Sign up for a free 7-day trial to the SharePlanner Splash Zone and receive all of my real-time trade alerts and access to my trading room. You can also automate all of my trades through Ditto Trade. Long Tiffany and Co. (TIF)

Here’s tonight’s watch-list for tomorrow’s market: Long Lamar Advertising (LAMR)

Today’s day-trading in the SharePlanner Trading Block was simply awesome. With the Primary gains coming from CSIQ, DDD, LULU, and FSLR, Oscar managed to add a nice $361 to our minimum sized portfolio of $25,000 and increasing our gains for the month to 8.6%. Not bad. Not bad at all! Here’s all of Oscar’s

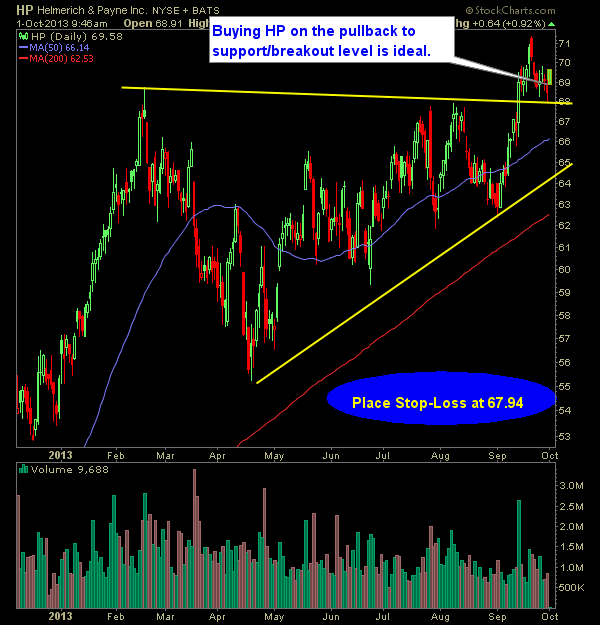

Finally a bounce in this market – lets see whether it can 1) be sustained and 2) can be significant enough to call it a “bounce” Here’s today’s swing-trade hit list, I’ll focus some more on short setups as well starting tomorrow. Long Helmerich and Payne (HP):

Here are my three long setup and two short setups that I am watching today. My aplogies for just now getting this posted. I had a detenist appointment in the pre-market that went slightly longer than expected. I guess there was more house cleaning than what was expected. Long First Solar (FSLR):