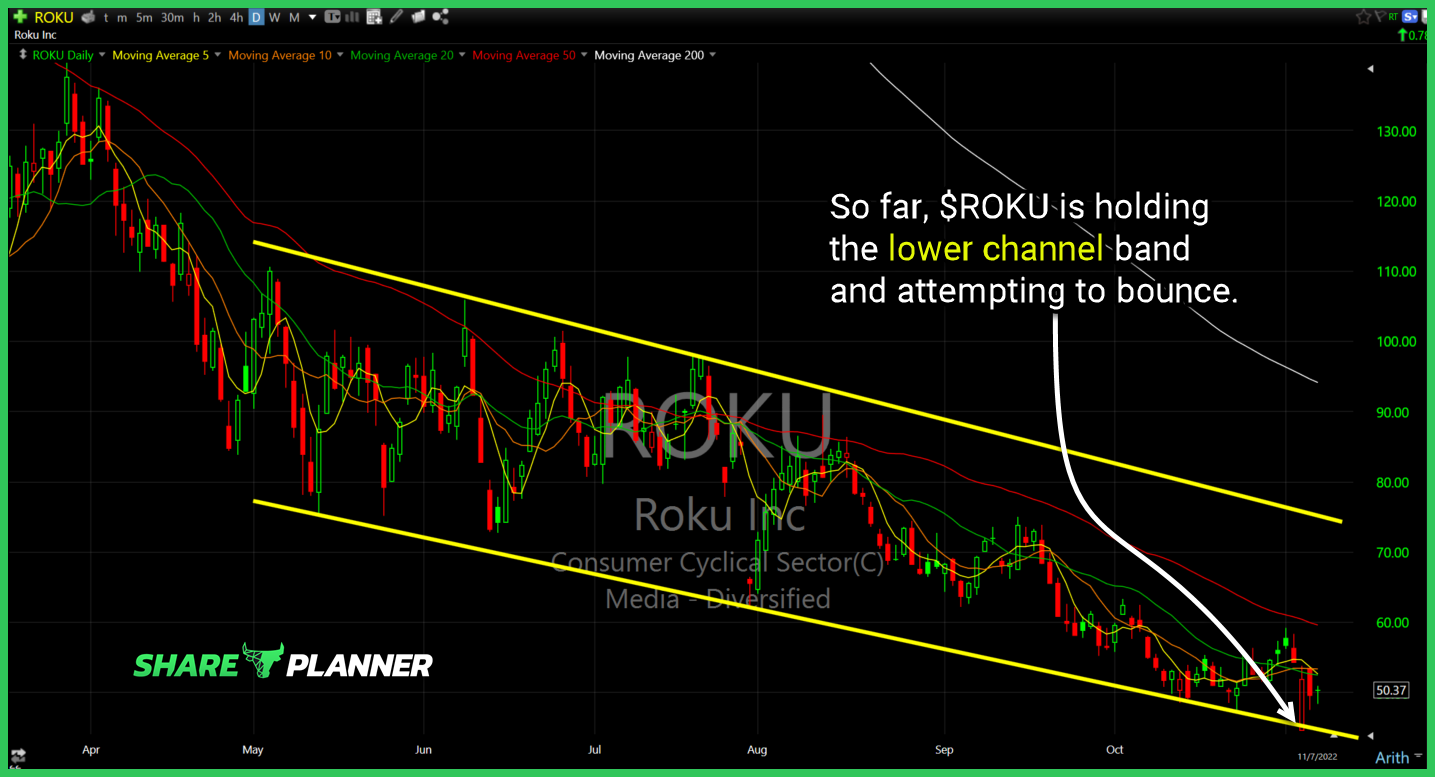

So far, $ROKU is holding the lower channel band and attempting to bounce.

Watch this resistance on $SHOP that is being tested.

Is the stock market setting up for another epic stock market rally and bounce off the recent lows, or are we just going to continue chopping around?

$M worth watching if it can eventually break out of this wedge pattern.

$GME triangle pattern forming. If you see a break to the downside, $19 becomes the next area of support.

The stock market crash of 2022 continues and the indices are at new year-to-day lows. Is now the time for a stock market bounce and a potential bottom to the chaos that has been seen all year long, or are we do for additional selling going into the CPI report and FOMC Minutes?

$DKNG breaking below key support.

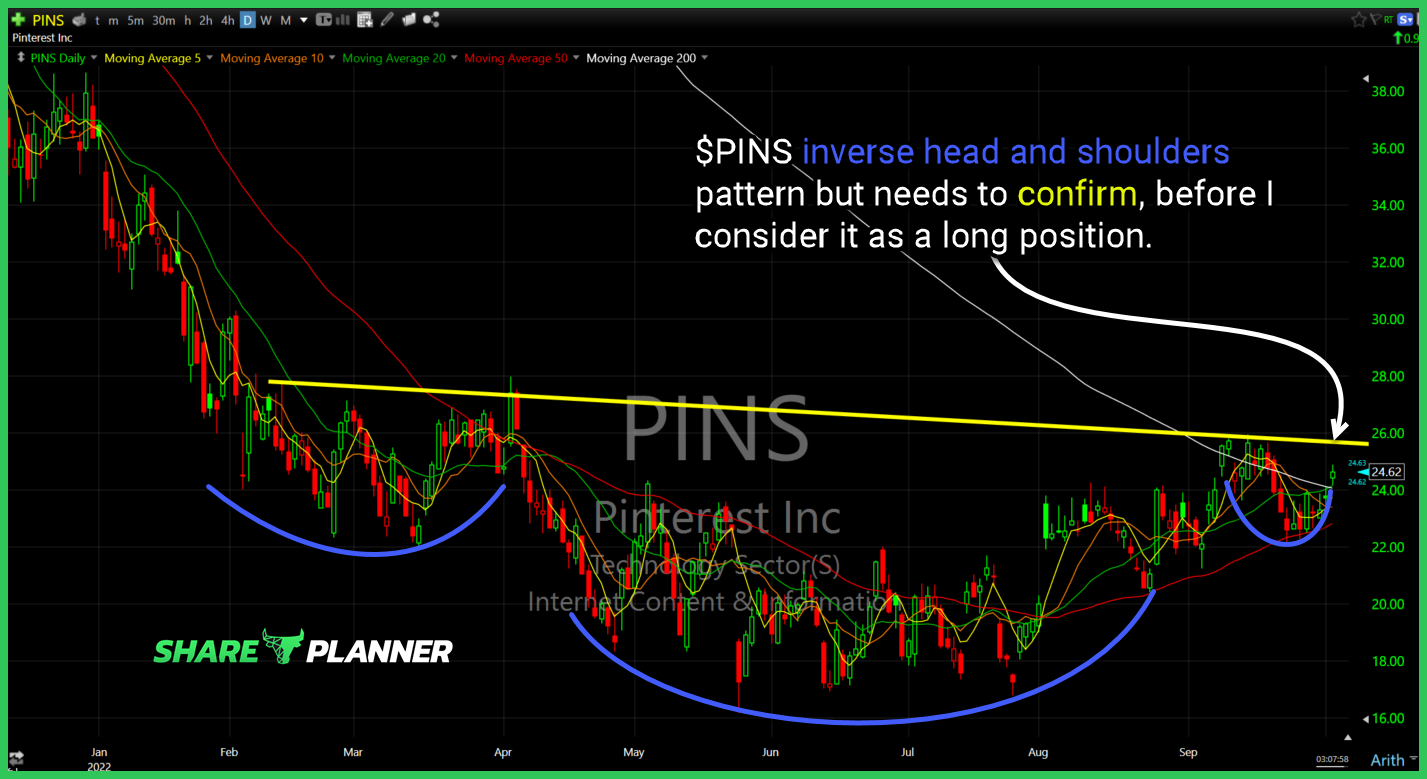

$PINS inverse head and shoulders pattern but needs to confirm, before I consider it as a long position.

$XLE attempting to sustain a bounce off year-long support, following heavy selling.