The stock market continues to rise ahead of the 2020 election, and there is plenty of concern among investors in deciding will the election affect the stock market. Stock market analysis during election years has shown, historically, to perform well, and it isn't normal for even contentious presidential elections to cause a stock market crash before

If you saw futs overnight drop over 50 handles you probably assumed that today was going to be a real clown show for the market. But then when you woke up, you probably found yourself rubbing your eyes again to make sure you weren't being deceived when you saw /ES trading 10 points higher. It

With the election tomorrow, you could see some of the overnight volaility on Tuesday/Wednesday morning similar to the 2016 election. Hard to say what the final outcome will be, here’s how I see it:

Technical Analysis: Another “sell-off” that was hardly a sell-off on Friday, where price basically stood still. Right now, it is more likely that the bulls are alleviating overbought conditions through “time” rather than “price”. The steep rising uptrend on S&P 500 (SPX) could possibly be tested today at 2252. The only rising uptrend that has been broken

Technical Analysis: Big day for S&P 500 (SPX) as price broke out of its 3-day doji-range and pushed to the upside. SPDRs S&P 500 (SPY) saw its volume drop for a fourth consecutive day and fall below recent averages. The 5-day moving average continues to hold strong for SPY as it has tested and bounced each

Technical Analysis: On the only attempt at a move lower last week by the S&P 500 (SPX), the dip buyers re-emerged and bounced the market off of its 5-day moving average. Friday’s slight sell-off ended SPX’s 4-day winning streak. Short term, the market is undoubtedly overbought. Volume on SPDRs S&P 500 (SPY) saw a massive drop-off compared

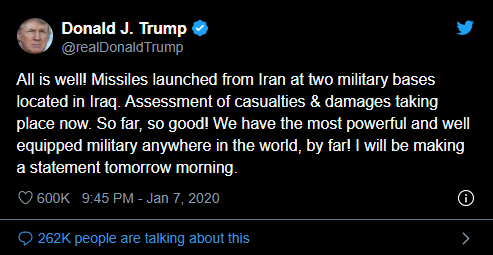

Technical Analysis: Futures taking a notable dip this morning, though it has recovered about 2/3’s of its losses, as the S&P 500 and Nasdaq had actually limited down during the election coverage last night. With Donald Trump as the President-Elect, I highly expect the Fed to raise rates in December, since Yellen isn’t beholden

Technical Analysis: Massive rally yesterday across the market landscape on the news that FBI didn’t consider Hillary Clinton a criminal. Essentially one day to the upside erased 6 of the 9 down days the market had recently experienced on the S&P 500 (SPX). However, this is a meaningless rally in the grand scheme of things,

Technical Outlook: Yes, for an 8th straight day, the S&P 500 (SPX) sold off. The expectation of a bounce is strong here, and quite surprising we haven’t even seen any significant attempts at it yet. Last time SPX was down 8 straight days was in 2008. The most troubling aspect of this decline is how light it

Technical Outlook: A significant technical breakdown played out yesterday on the S&P 500 (SPX) with price breaking down and below major long-term support at 2120. Bear flag was also confirmed by yesterday’s price move. Volume saw a notable uptick yesterday as well on SPDRs S&P 500 Trust (SPY) with volume well above recent averages. In the past, SPX