Technical Analysis:

- Massive rally yesterday across the market landscape on the news that FBI didn’t consider Hillary Clinton a criminal.

- Essentially one day to the upside erased 6 of the 9 down days the market had recently experienced on the S&P 500 (SPX).

- However, this is a meaningless rally in the grand scheme of things, because if Trump wins tonight there will be a significant sell-off because he is not Wall Street’s candidate of choice.

- Careful with how heavily long/short you get ahead of the election. More cash is ideal. The profit potential is to the downside while the upside is somewhat limited following yesterday’s rally. Should Trump win, you could see a Brexit-sized sell-off.

- Volume on SPDRs S&P 500 (SPY) was slightly higher than the previous day’s total and well above recent averages.

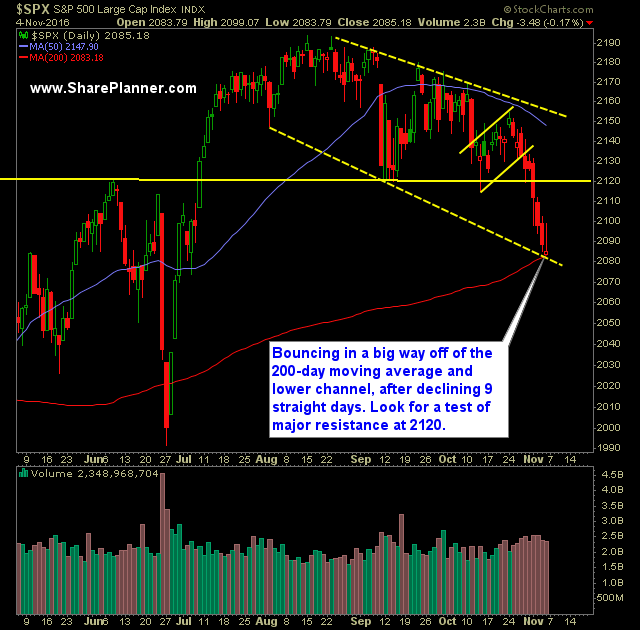

- Bounce occurred right off of the 200-day moving average yesterday after having perfectly tested and held it on Friday.

- CBOE Market Volatility Index (VIX) melted away yesterday, dropping 16.9% down to 18.7.

- Barring a tie tonight or a contested election, I expect that the market will begin trading in a more trending manner.

- United States Oil Fund (USO) bounced yesterday but technical damage is already taking hold with the uptrend that started back during the February lows having broken.

My Trades:

- Did not add any new positions yesterday.

- Will look to position myself short today.

- Closed ADBE yesterday at $108.34 for a 2.3% loss.

- Will look to add 1-2 new swing-trades to the portfolio today.

- Currently 100% Cash

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Trading what you see and not what you think is one of Ryan's popular trading expressions that he has lived by in his 30 years of trading experience. In this podcast episode Ryan explains why it is so important to not think your way through the market but to be a trader who sees what to trade and reacts accordingly. If you are struggling as a trader, it may very well be that you aren't seeing but thinking your way through your swing trades.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.