I am not a fan of adding long positions in this current market environment. Especially after yesterday when the bulls gave up all of their gains following what is now a dead-cat bounce. The market looks to me to be setting up for further downside. You have the FOMC Statement next week, and that

Technical Outlook: SPX rallied for the 10th time in the last 12 trading sessions. A rally that is as good as any we have seen over the past few years, except this rally established new all-time highs, and still hasn’t stopped yet. Terrorism struck again, this time in Nice, France. Absolutely, and utterly disgusting, the

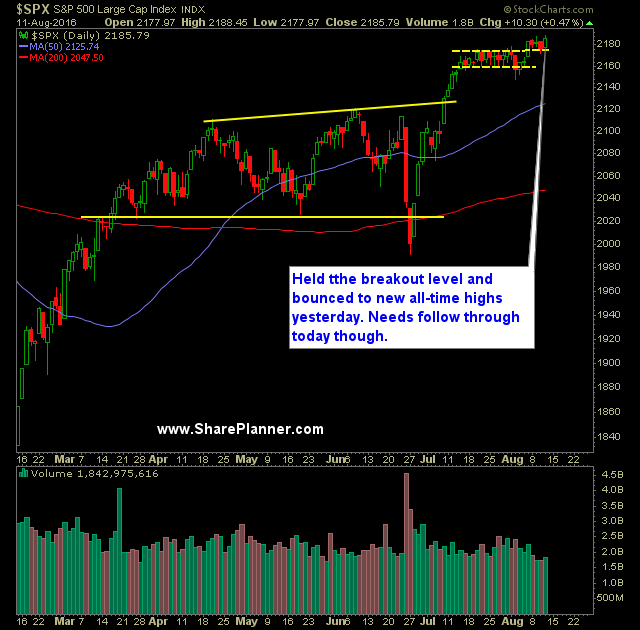

Technical Outlook: SPX closed above closing and intraday all-time highs yesterday. A feat that hadn’t been achieved since May of 2015. It is important that the S&P 500 can string together a few strong days after establishing the new all-time highs. SPY’s volume fell off quite dramatically yesterday, coming in well below recent averages. Not

The bulls have it – barring an end of day sell-off, that takes price back below 2034 or worse, 2030, the bulls will have closed as new all-time highs (as long as it is above 2030, it is above all-time closing highs). To be shorting this market at this level, I don’t see why you

So far the month of June has been extremely tricky for traders. Overall it is down and in 13 trading sessions, 7 of them are negative. But at the same time, this market marched right up to within 1% of new all-time highs just a week ago. But as we have seen plenty of times

The one question I would have you ask yourself, and I’ll leave my commentary at this… “Would you buy an individual stock after it ran 15% simply because it is starting to finally break through a major resistance level?” I wouldn’t either, and that is what traders are faced with deciding here on the S&P

Technical Outlook: Three day rally this week continues to maintain a strong course higher that will likely test 2100 either today or next week. Since the initial break, volume has dropped each of the last two days and was dramatically weaker yesterday and well below recent averages. Personally, I wouldn’t be surprised to see the

Technical Outlook: Strong open yesterday that was erased gradually as the day wore on resulting in a lower close. SPX dropped below the 20-day moving average again. Declining trend-line off of last July's highs remains a continuous level of support for the market. Possibility that the price action over the last two weeks has formed

Technical Outlook: Thursday marked the third straight day of selling for the S&P 500 (albeit barely), but the day’s results saw a hard bounce off of the morning lows. Potential higher-low established on Thursday for the current trend off of the 2/11 lows. Last week marked the first time in six weeks that SPX