Technical Outlook:

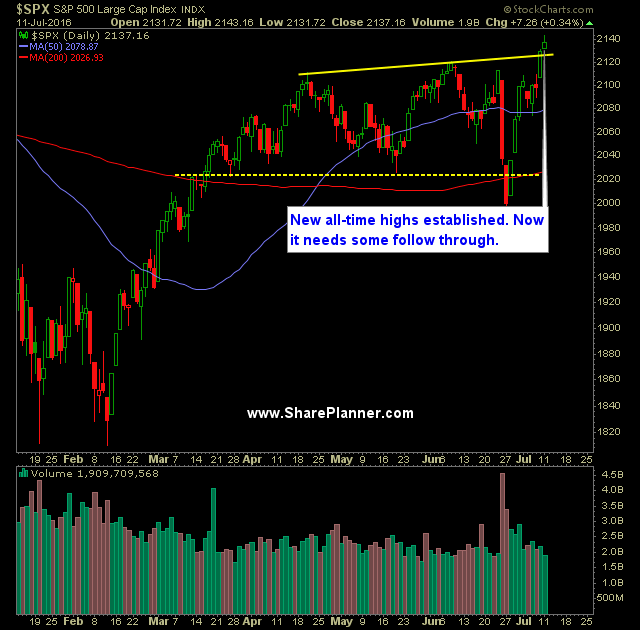

- SPX closed above closing and intraday all-time highs yesterday. A feat that hadn’t been achieved since May of 2015.

- It is important that the S&P 500 can string together a few strong days after establishing the new all-time highs.

- SPY’s volume fell off quite dramatically yesterday, coming in well below recent averages. Not overly surprising as the market tries to trend higher, as low volume readings has become quite “normal”, contrary to popular theory.

- The most significant divergence yesterday was on the VIX as it managed to bounce 2.6% higher to 13.54 yesterday, despite the market’s rally. Which is at a major support level that it has struggled to break through. See exactly how the VIX keeps managing to find key support here.

- At this point, I would track the market as it continues to make new highs against the 5-day moving average. There may be some short squeezing still as the shorts have their stops run above all-time highs and it will provide a good short-term reading on the strength of the market.

- Yesterday started earnings season with the traditional Alcoa (AA) report jump starting things.

- Oil has been on a slide of late, dropping three out of the past four weeks, and down again to start this week. Potential bounce off of the 38.2% Fibonacci Retracement level.

- SPY has plenty of gaps below to fill following the Brexit lows.

- T2108 (% of stocks trading above their 40-day moving average) rose another 6% yesterday to 69%. Still well below recent highs or even the June highs. Could mean that 1) Stocks aren’t participating in this market as much as the indices are suggesting, 2) There is still plenty of upside remaining 3) Stocks are tracking the progress of the Nasdaq and Russell rather than the S&P 500.

- Yesterday marked the fourth consecutive year that SPX make a new all-time high, going back to 2013.

- At this point, it can be said that the market is climbing the “Wall-of-Worry”.

- Market is assuming that rate hikes are pretty much off the table for all of 2016.

My Trades:

- Added three new long positions to the portfolio yesterday.

- Covered remaining short positions at the market open yesterday.

- Will look to add 1-2 new long positions today.

- Currently 30% Long / 70% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.