Most of the sectors are showing sideways trading patterns. The market isn't entirely untradeable but it is getting pretty darn close to it. I'm finding the breakout plays to be more difficult than most, and instead focusing on the stocks that are forming a base and coming out of that base, following a sell-off. Most

My reversal indicator is still providing me with a very strong bullish reading. As a result, I remain bullish on the market as a whole, but in a tepid fashion. I’m not going out and buying everything I set my eyes on, in fact, I am trying to stay away, as much as possible from

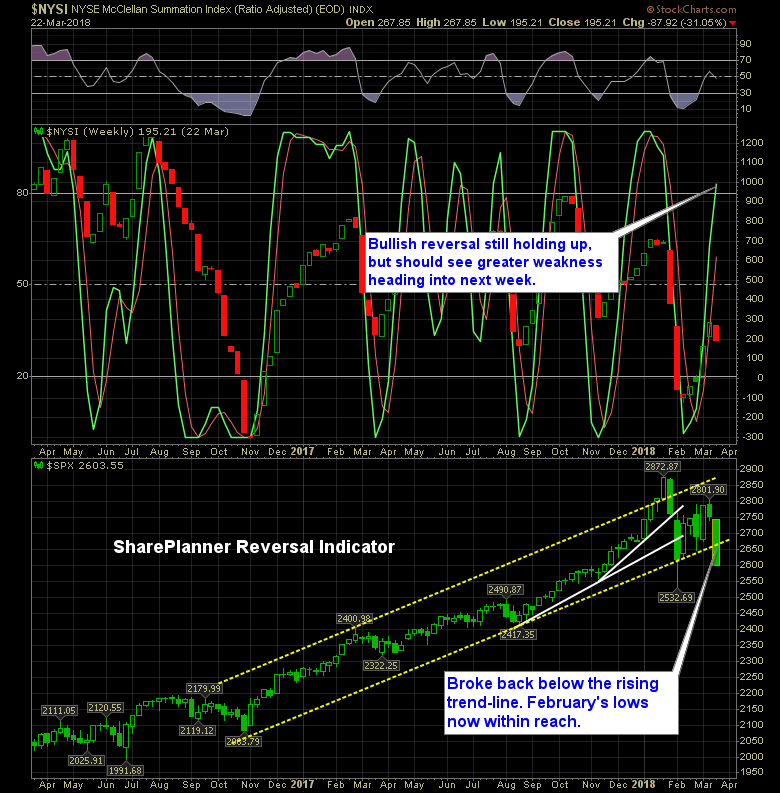

This has not been a good week for the bulls. They have fully lost control of the market. When I pulled up the SharePlanner Reversal Indicator, I fully expected it to show a bearish reversal in the works, but it is still riding strong to the upside. Of course, it hasn’t priced today’s action just

Bulls are off to a solid start for 2018 with a solid rally. Not a major rally, but considering the sell-off that concluded 2017, there was some pause among traders as to whether the selling would carry over into the new year.

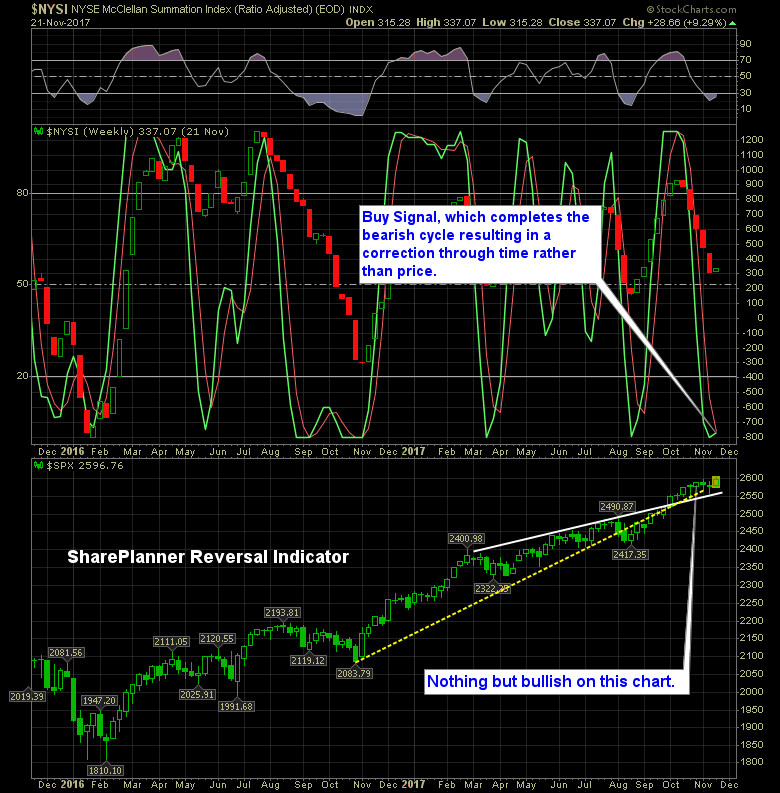

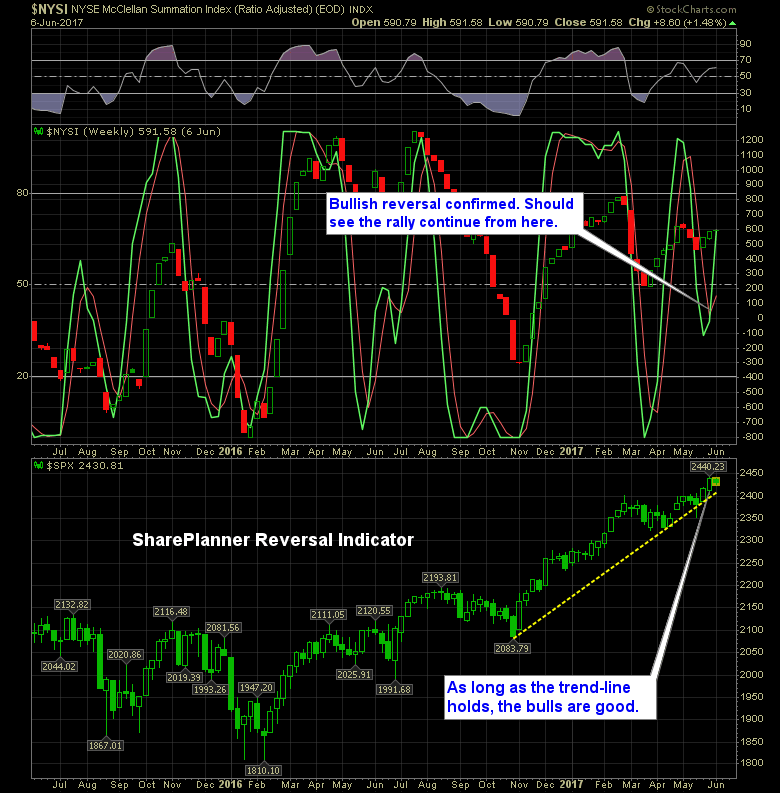

Alright, it might sound humorous in saying this, but the SharePlanner Reversal Indicator just flashed a bullish reversal signal. But hasn’t the market been in bull mode all year long?

S&P 500 is off to a respectable start on the most bullish week of the trading year. Historically, Thanksgiving tends to be a good week for traders. Low volume, but by-and-large, it tends to perform most consistently to the upside than any other trading week of the year.

The SharePlanner Reversal Indicator is lighting up with green. After a good solid month of August where price action spent most of its time in the red, the last three days have been uber-bullish for the S&P 500 (SPX) and may even finish in the green to close out the month, which would really be

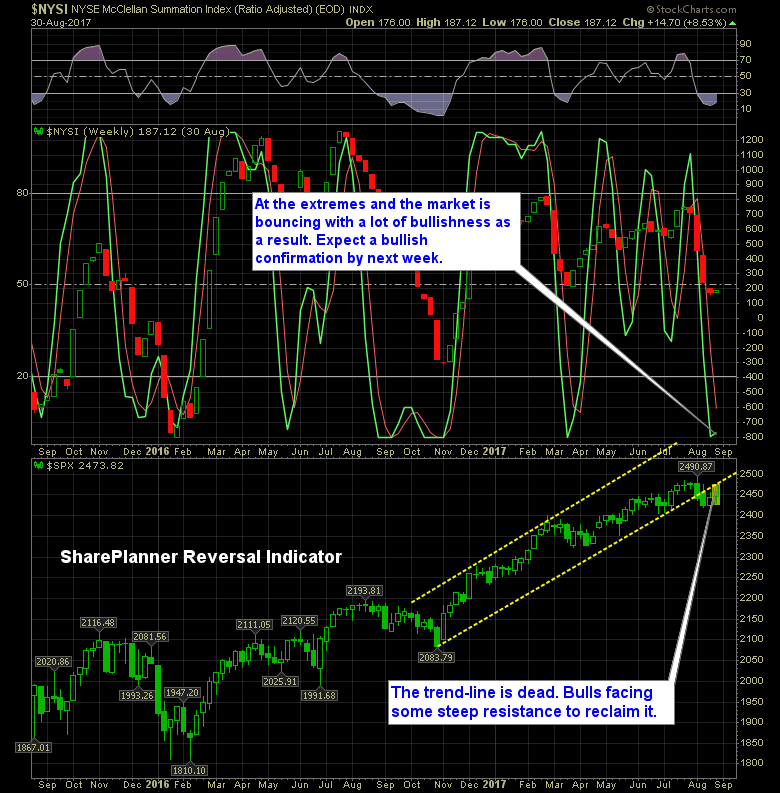

The bulls have a change in the reversal indicator Up until this week, the SharePlanner Reversal Indicator, had been pointing lower, but if you remember last week, I mentioned that we would probably get a bullish signal on the reversal indicator.

Technical Outlook: Yes, for an 8th straight day, the S&P 500 (SPX) sold off. The expectation of a bounce is strong here, and quite surprising we haven’t even seen any significant attempts at it yet. Last time SPX was down 8 straight days was in 2008. The most troubling aspect of this decline is how light it

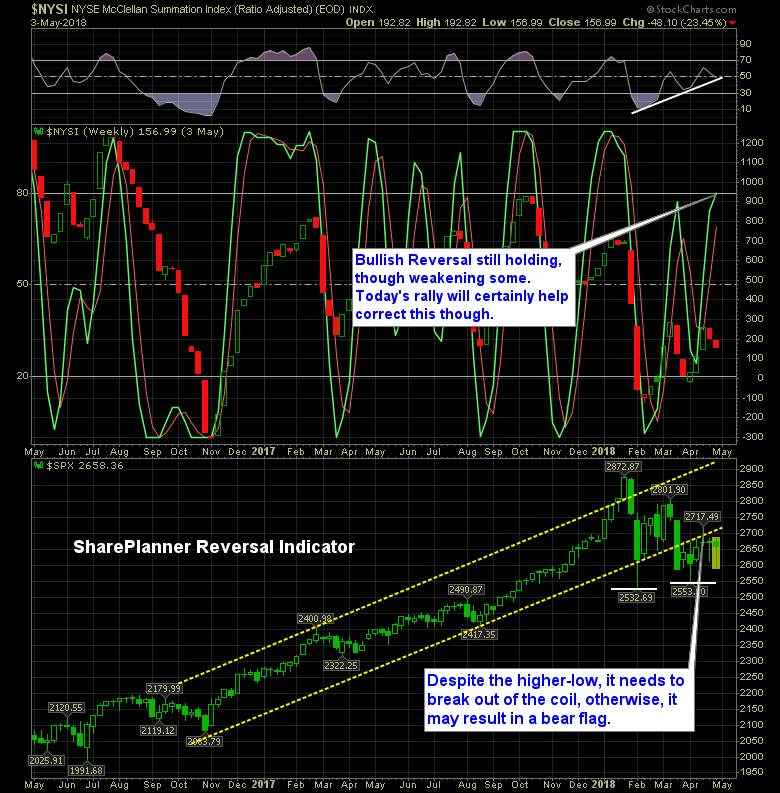

Technical Outlook: The whipsaw price action in S&P 500 (SPX) continued yesterday with a hard bounce following two days of selling. The price action is sporadic and unpredictable at this juncture. Very topsy-turvy – Last Thursday you had a bullish break above recent consolidation. Following Monday’s price action, you had a bear flag pattern playing