Episode Overview Far too often swing traders expect far too much from the capital they are trading with. In this podcast episode of swing trading the stock market Ryan talks about setting realistic expectations for you and the money that you are trading. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan

$TNX nearing a breakout again, watch as it approaches the 4.2% area. . $MARA price action will be heavily dependent of Bitcoin price action going forward, but technically, MARA weekly has very little resistance until the low-$30's. $HAL so far holding the rising trend-line, but would prefer it make a higher-high first, before retesting.

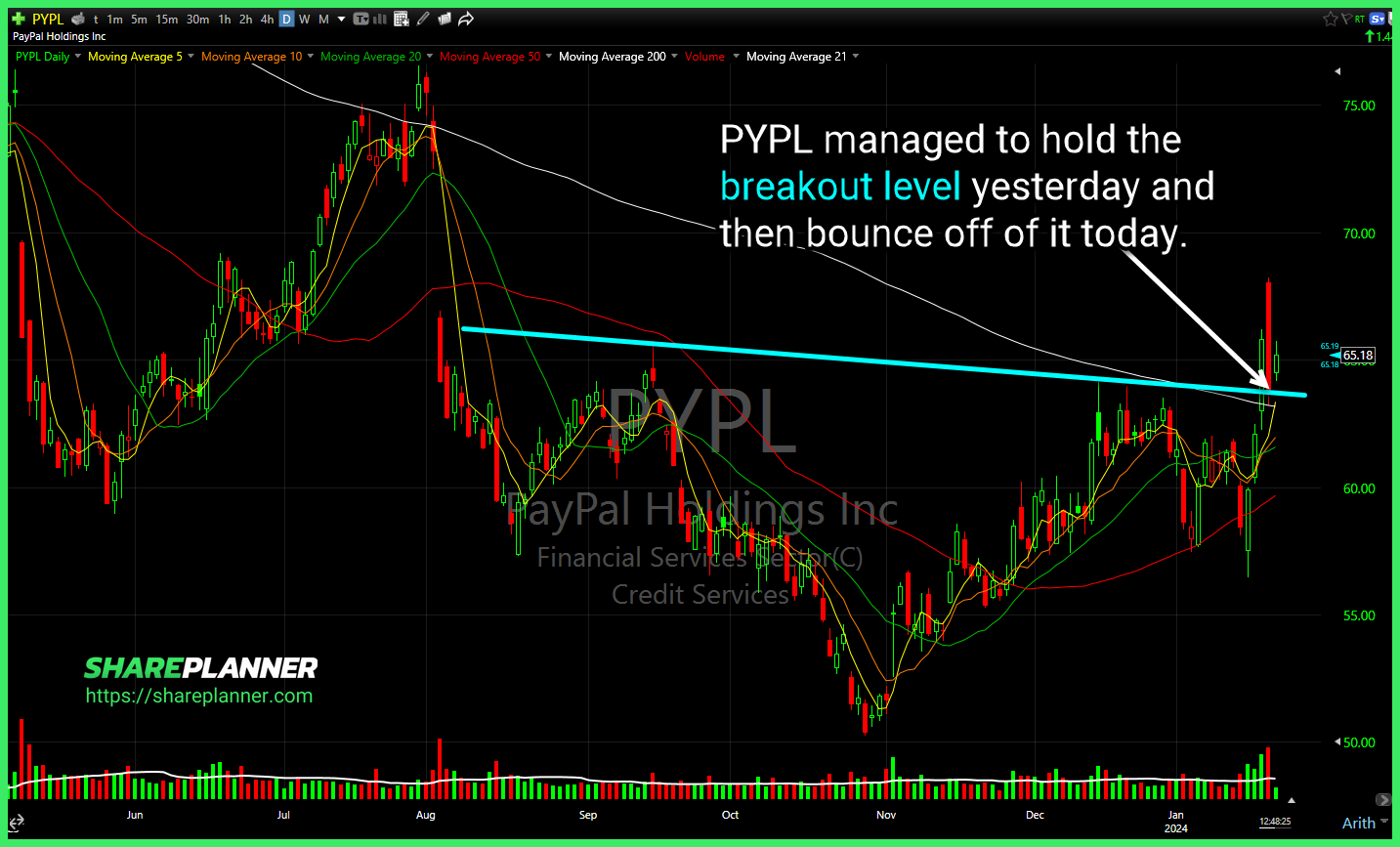

$PYPL managed to hold the breakout level yesterday and then bounce off of it today. . Earnings gave $UAL a boost right back through the resistance that was holding it back. $BTC.X 3 support levels to watch as bitcoin has broken short-term support levels and now in a free fall here.

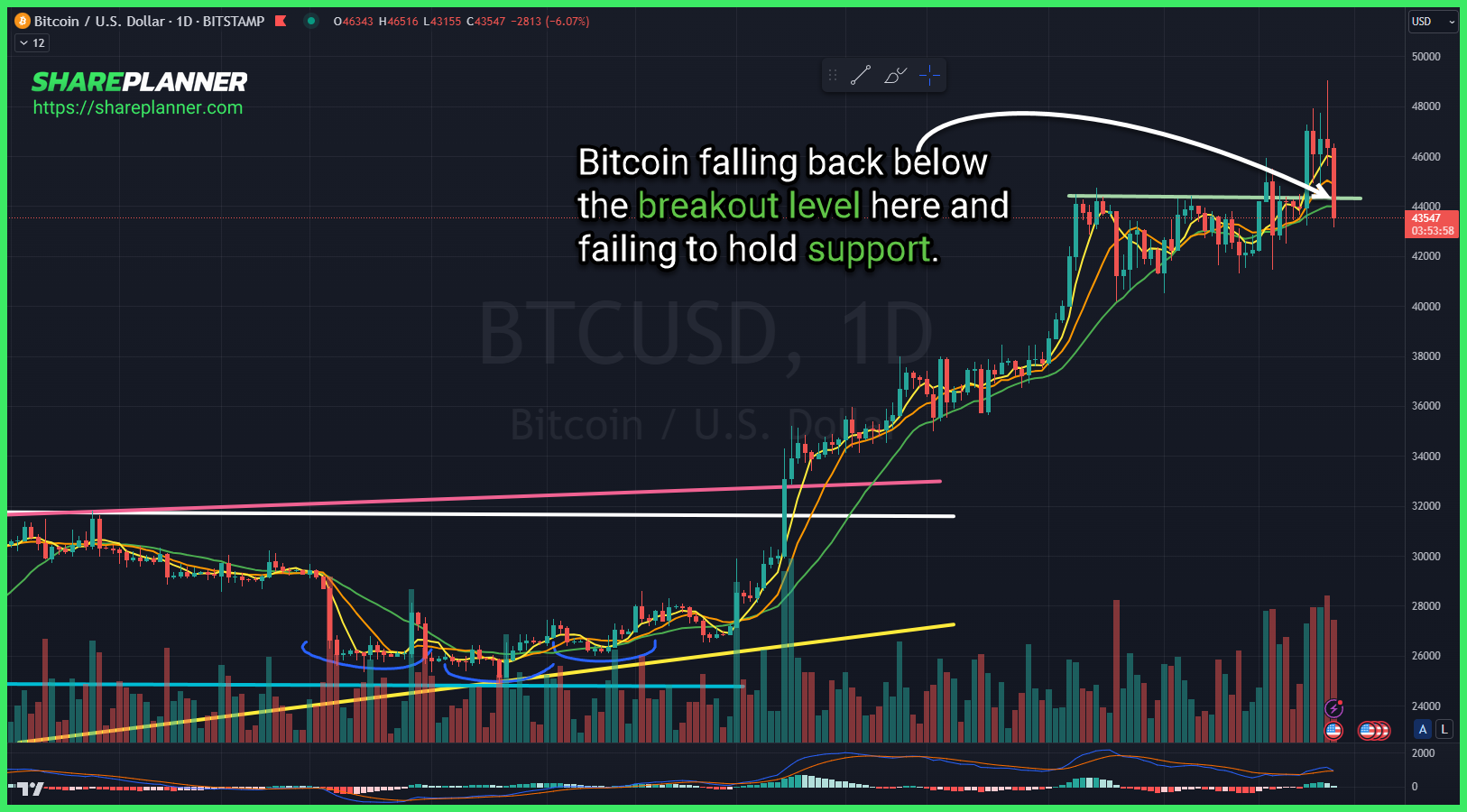

Bitcoin falling back below the breakout level here and failing to hold support. Double top formed in Delta Air Lines (DAL), just about to confirm. Baidu (BIDU) breaking to the downside on this triangle pattern.

Episode Overview Ryan Mallory reviews swing trading in 2023 and what he expects in 2024. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] Reflecting on the Podcast and Trading PurposeRyan opens with a reminder of why he started the podcast, to help traders succeed by managing risk and letting winners run. [1:05]

Bitcoin $BTC.X crashing & breaking the rising trend-line off of the January lows. $LNG Rising parallel channel, with a hard bounce off the lower channel band. Looking for a move back to the upper channel band from here. Pullback to the rising trend-line in place seems to be the most logical area to target a

Episode Overview Ever wondered how to gauge the overall sentiment of the stock market? In this podcast episode, I cover how I detect changing sentiment in the stock market via technical analysis. From detecting early warning signs of a downturn to catching the optimistic wave of a bull run, this episode will help arm

Episode Overview When earnings season arises, how do you swing trade your stocks with earnings reports? Do you hold your stocks through earnings and risk a major collapse in the share price, or do you sell it right before the announcement. Ryan provides his insights on how to play earnings and whether there is really

$WW looks like a double top on its way to continued trek towards $0. lol

Episode Overview After two and a half years of trading one swing trader finally makes back all his losses. But as traders should we be looking to simply break even? Is that even a good approach to successful trading in the stock market? In this podcast episode, Ryan will detail thoughts on this common thought