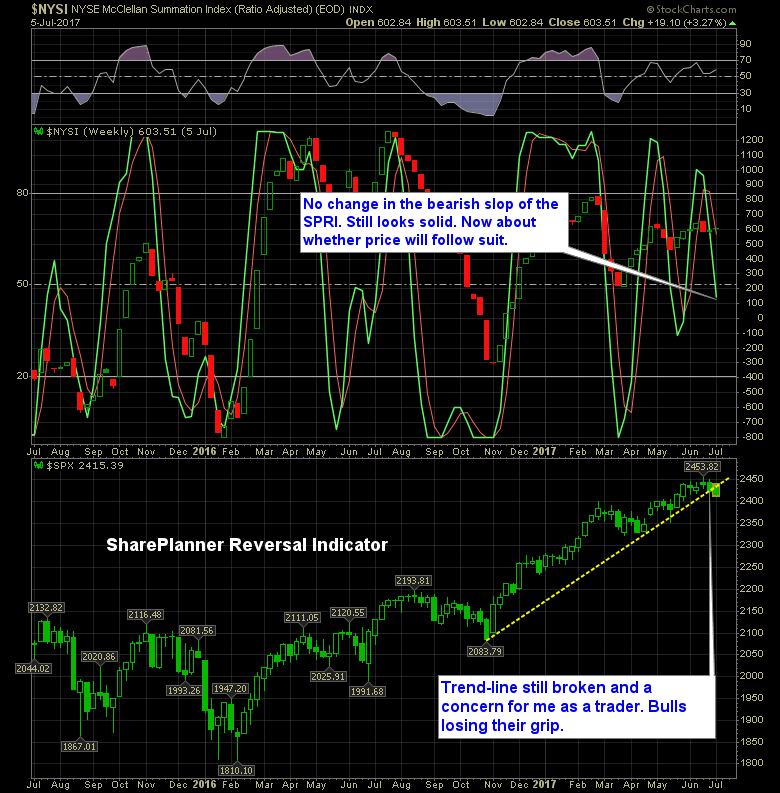

The market right now is not conducive to the bears. Getting heavily short right now, is certainly a fool’s game.

I’m not even sure I understand the title of the article, but hey, I provide you with a bearish watch-list you can trade from every week, but just because I provide you with one, doesn’t mean you should be making use of it. Right now is one of those times. Heck, I don’t even know

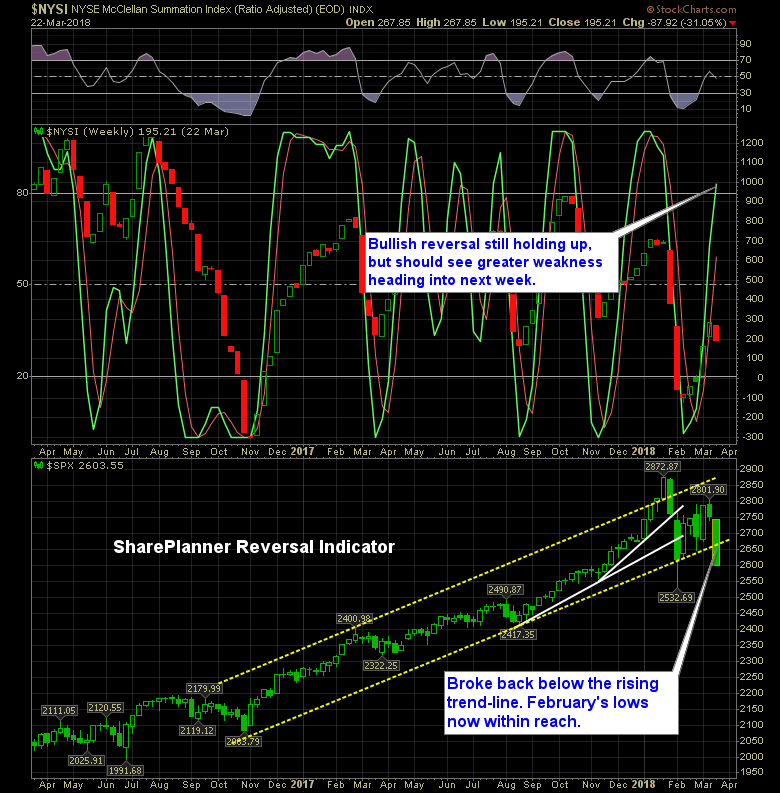

This has not been a good week for the bulls. They have fully lost control of the market. When I pulled up the SharePlanner Reversal Indicator, I fully expected it to show a bearish reversal in the works, but it is still riding strong to the upside. Of course, it hasn’t priced today’s action just

Considering all the fireworks we have seen so far in 2018, this week here, has to be the most boring trading weeks so far. Fear not, the summer time is around the corner, and there will, no doubt be some mind numbing weeks there as well.

The bulls had everything going for them, and then they pulled a rabbit out of their hat and sank this market. I didn't even know that was still a thing! For so long now the bears have been the incompetent ones and now all of a sudden the bulls are the ones that completely head-fake

My Swing Trading Approach I plan to play it cool today. Right now, I have one short position as I exited my long positions yesterday. I could get heavily long on this dip, but I need to see some evidence out of this market that the lows from yesterday want to hold into today.

Breaking the 50-day Moving average may change the feel of this market all together. The 50-day moving average has held strong for this market since last year's election. There has been a few breaches around the 50-day MA, so it hasn't been a clean hold every time, but in large part, despite the breaks that

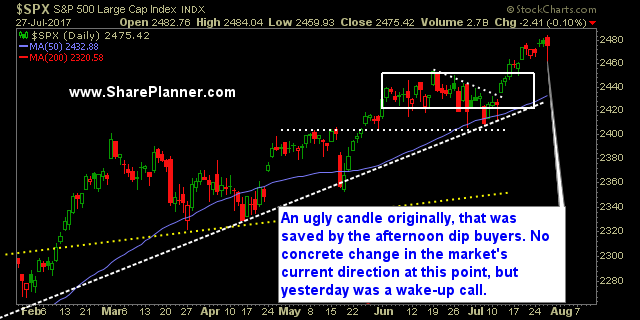

We all need some short setups in our lives every once in a while right? Well, the S&P 500 is breaking the 20-day moving average and looking to make a move back down towards the 50-day moving average. I’ve closed out half of my long positions and holding on to a few longs still. while

List of bearish trade chart setups that I have put together I’ve put together a list of bearish chart setups for you to take a look at. Here is what’s so tough about this market for many traders. Outside of the first trading day of the month. The market hasn’t done anything for the bulls.

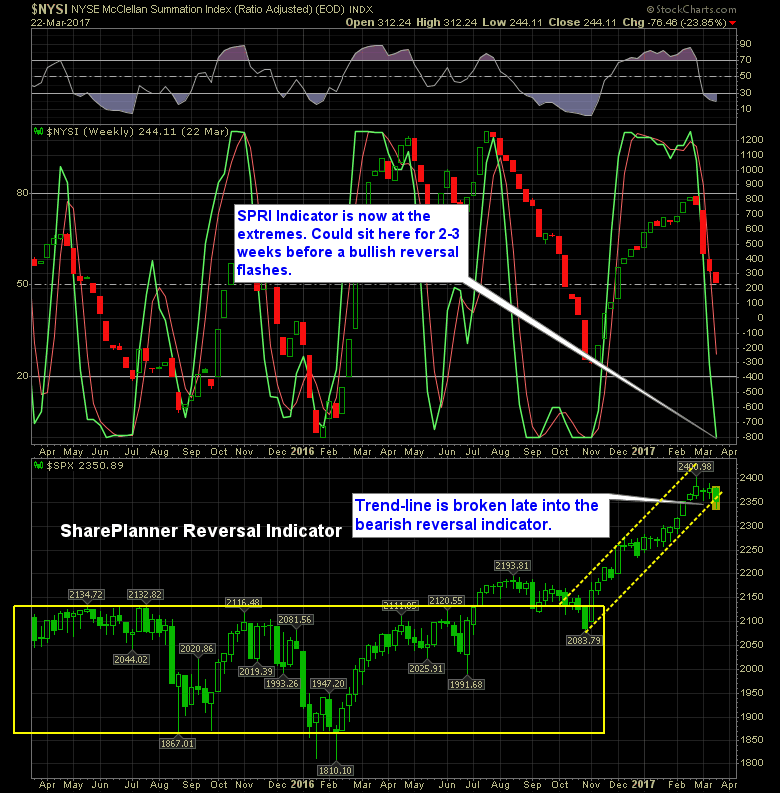

SharePlanner's Trend Reversal Indicator hitting extremes here Over the past 8 years of the bull rally, just reaching a bearish extreme has been, in large part, a difficult task to pull off. But we have that now, and the bearish trend reversal indicator, from a textbook standpoint, should hover here for 2-3 weeks, but recent