My Swing Trading Approach The sell-off on Friday, cast a dark cloud on the market as Amazon earnings was unable to lift the market as most expected. I am out of tech for now, and will will keep my portfolio light going into the week, and will only add new positions if the market can

I cover the following stocks: Facebook $FB, Amazon $AMZN, Netflix $NFLX, Alphabet $GOOGL, and Apple (AAPL). I cover the following stocks: Facebook $FB, Amazon $AMZN, Netflix $NFLX, Alphabet $GOOGL, and Apple (AAPL).

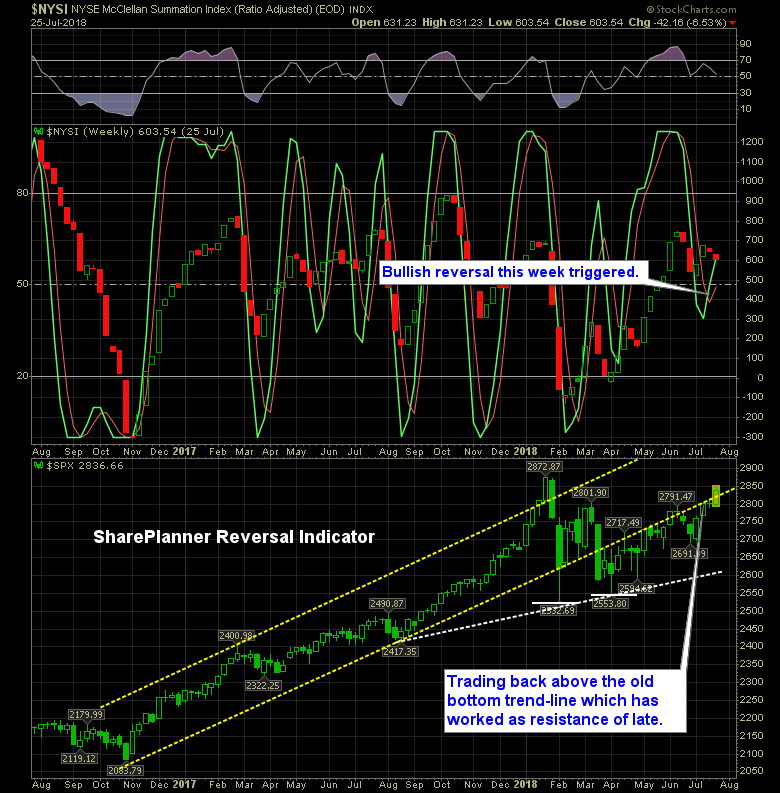

The bearish reversal in June is no more. The bulls have managed to correct the ship and put together a bullish reversal of their own. With strong price action over the last three weeks, market behaviors confirms the reading on the SPRI.

My Swing Trading Approach I’m focused on managing my existing positions coming into today and the risk associated with each of them. Tech will negatively affect the market today, due to Facebook (FB) earnings. I’m not against adding more positions today, but the market will have to show it is willing to look past FB’s sell-off

My Swing Trading Approach I’m 100% cash here. I’m not in a rush, to add positions, I’ll wait to see if the small amount of strength in the premarket can hold on, as the day moves forward. If so, I’ll add 1-3 new positions to the portfolio. Also will considering shorting the market if the

I know there are a lot of frustrated swing traders out there. I know that trading high volatility markets hasn’t been easy for most traders. I get that. The headline risk is insane, we are in the winding up earnings season, tariffs are in play, the market has the feel of being on the tail

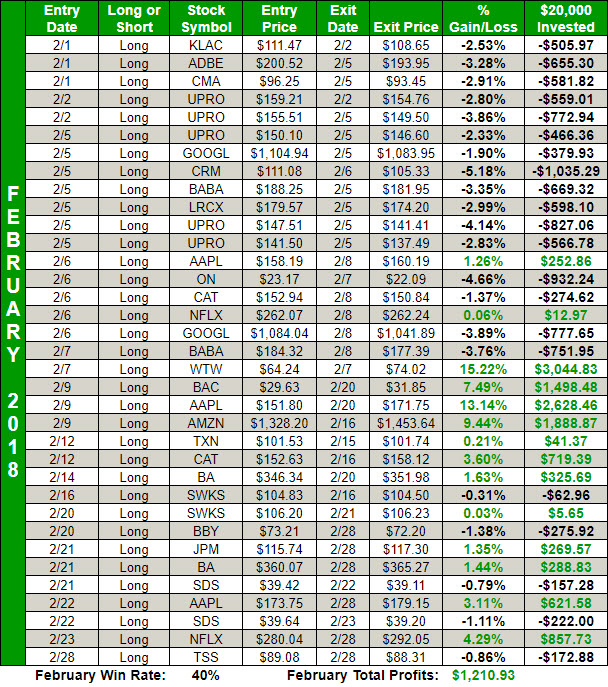

February, though the shortest month of the year, was by far the longest trading month for me. Here are my results: It was the month that seemed to go on forever. We saw +10% declines, a test of the 200-day moving average, which wasn't even tested in 2017, followed by a 10% rally of its

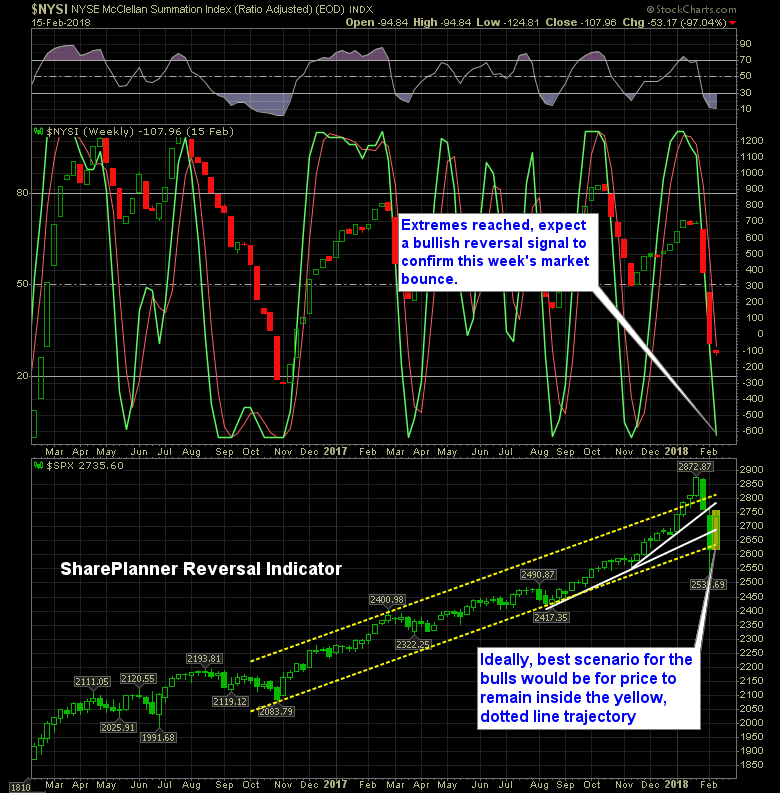

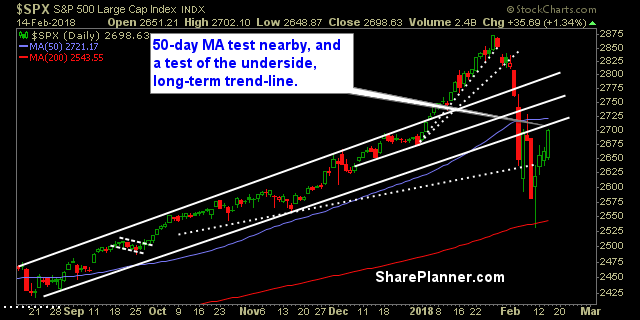

Last week’s sell-off hit extreme reading on the SharePlanner Reversal Indicator. Following the bounce off of the 200-day moving average on the S&P 500, it is no surprise, that we saw one of the best one-week rallies in years. However, with a three-day weekend ahead of us, next week represents another chapter in what has

My Swing Trading Approach I have large gains in Bank of America (BAC), Apple (AAPL) and Amazon (AMZN) after buying the dip last Friday, and have added a few more positions since. Will look to add more if there are more opportunities that arise. Indicators

Thursday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Amazon (AMZN)