My Swing Trading Approach

I’m 100% cash here. I’m not in a rush, to add positions, I’ll wait to see if the small amount of strength in the premarket can hold on, as the day moves forward. If so, I’ll add 1-3 new positions to the portfolio. Also will considering shorting the market if the risk/reward is there.

Indicators

- VIX – A massive 25% move yesterday, and up as much as 40% prior to the final hour of trading. Highest close since 4/25.

- T2108 (% of stocks trading below their 40-day moving average): A very damaging 15% decline yesterday and lowest close since 5/3. Stocks are much weaker right now then the indices are showing them to be. Currently at 54%

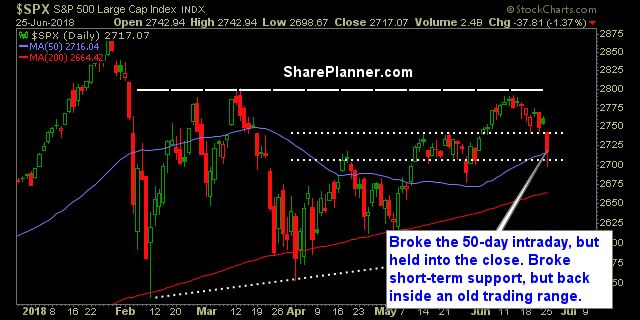

- Moving averages (SPX): Tested the 50-day MA, broke intraday, but held into the close. Additional selling will certainly take us down to the 200-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology was absolutely hammered yesterday as was Energy, with the former giving up all its gains on the month while the latter is near to confirming a head and shoulders pattern. Discretionary stocks took a massive hit led by Netflix (NFLX) and Amazon (AMZN). Money flowed into the Utilities as a capital safe haven.

My Market Sentiment

Broke the key 50-day moving average intraday, but an end of day rally barely preserved the MA. Back in an old trading range, as the market gave up most of June’s gains. Watch for whether a break of the 5/29 lows happens.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Which trading platform in 2026 should you be using? In this podcast episode Ryan talks about all the major platforms out there from TC2000 to TradingView, to TrendSpider and the Bloomberg Terminal. What are the perks and benefits to each one, and Ryan will also go over his lower-tier platforms that you might want to consider as well.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.