Monday’s Swing-Trades: $AMZN $FB $PHM Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Amazn (AMZN)

Summer volume starting to kick in high gear on the stock market. The volume buzz on the TC200’s charting platform has their proprietary volume buzz indicator at -55% today, and continues to fade into the afternoon trading session. I suspect we will continue to see much of this throughout the next couple months, like we

My Swing Trading Strategy I booked gains in Amazon (AMZN) for a +2.7% profit as well as Microsoft (MSFT) for a +3.1% profit. Both solid trades. I am only left with one long position coming into Monday. I will look to see whether the morning weakness holds and if it does, consider adding a short position or two

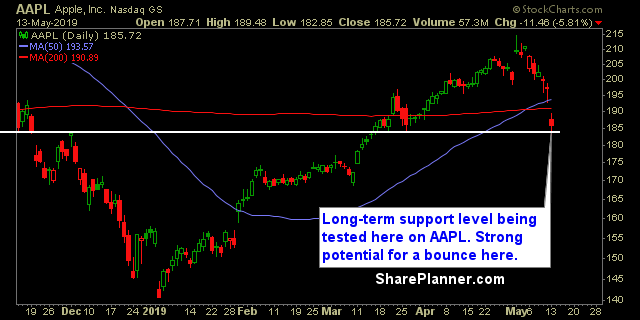

Tuesday’s Swing-Trades: $AAPL $AMZN $MUR Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Bounce Play #1 Apple (AAPL)

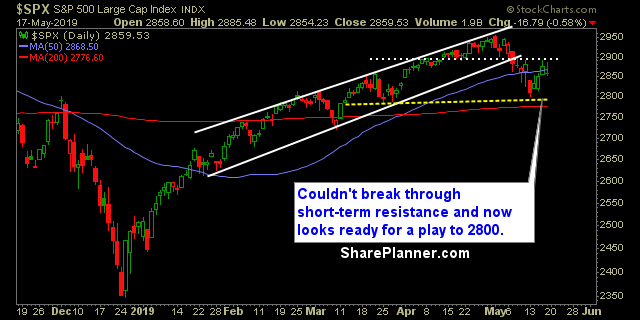

My Swing Trading Approach Stopped out of one position but added another on Friday. Holding respectable gains in two of my positions, but likely to stay put as the market remains on uncertain footing at recent highs. The market continues to have issues over the past week with fading morning gains, throughout the afternoon. I

My Swing Trading Approach I was stopped out yesterday in Square (SQ) for a +6% profit, and Amazon (AMZN) for a very small profit. I picked up another long position late in the afternoon, looking to play a bounce in the market today. I’ll look to add another long position this morning if

My Swing Trading Approach I closed out my Short Inverse ETF in SPXU for a loss yesterday, but early on, added Amazon (AMZN) and Square (SQ) to the portfolio. Not sure if I'll be adding anything else today, the market will have to jump back into rally mode for me to do so. Indicators Volatility

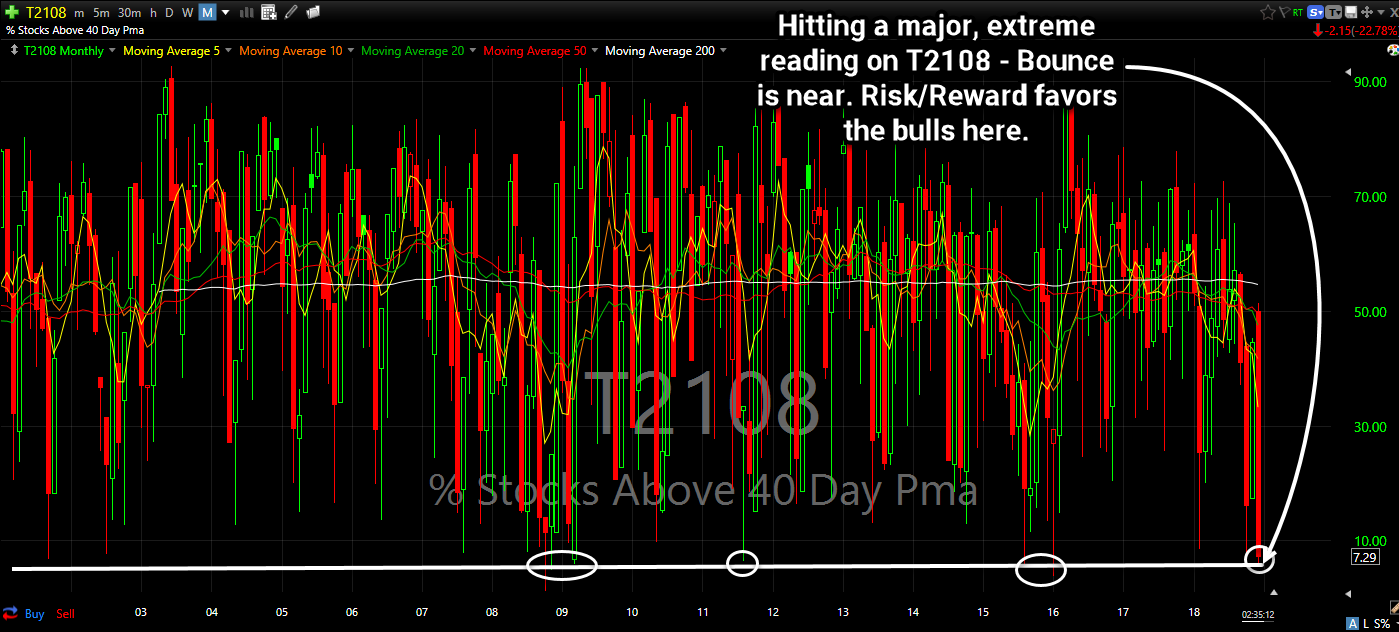

It takes a lot to get the market this oversold, and usually it comes on the heels of the bulls becoming completely exasperated. And that is what happened today when the bears drove this market another 65 points down on the S&P 500 following yesterday’s Fed sell-off, which happened to be the worst reaction ever