February, though the shortest month of the year, was by far the longest trading month for me.

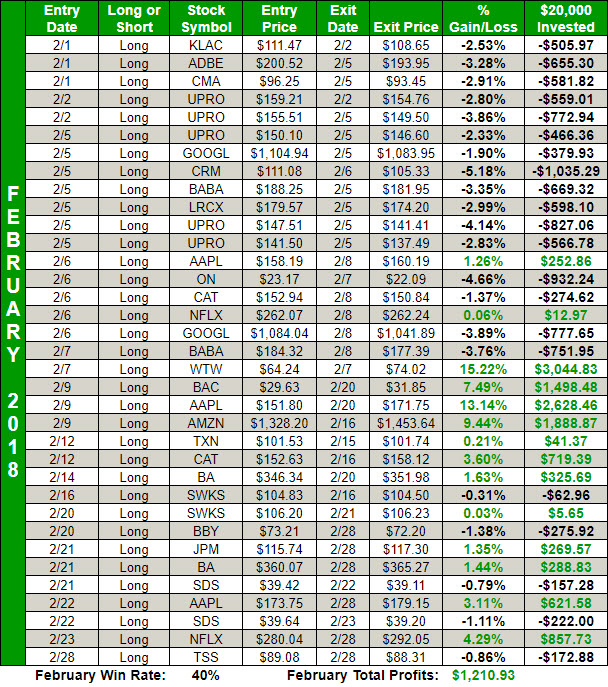

Here are my results:

It was the month that seemed to go on forever. We saw +10% declines, a test of the 200-day moving average, which wasn’t even tested in 2017, followed by a 10% rally of its own on the S&P 500. Before the end of the month, QQQ would be testing its all-time highs again.

There was a lot of action and it was a departure from the dull and all to predictable market of 2017.

Ultimately, the S&P 500 and Russell both finished 3.9% lower on the month and the Nasdaq was down 1.9%.

I think it is easy to say that the selling we saw in the beginning of the month caught everyone by surprise, We were enjoying one of the best months in ages, and then out of nowhere the rug was pulled out from underneath the market.

The standard deviations beyond the norm of typical price action was extreme! I took a hit early in the month, and I didn’t like it one bit! I started trading less positions, and even then I wasn’t finding much success.

I tried to buy the dip at key support levels using UPRO, but it would get quickly wiped out, sometimes in minutes.

It was a tough market.

However, I knew the key was to trade few positions and to minimize the losses as much as possible – both of which, I was doing.

The turning point came on February 7th, when I pulled off a 15.2% profit on a trade in Weight Watchers (WTW). I expected it would be a swing-trade, but ultimately it saw me taking profits the same day I made the trade. In a perpetual bear market, someone hands you a 15% profit to the long side, you take it and don’t look back.

In the days that followed, I would wait for my opportunity with the market and for it to bottom. It eventually did on February 9th when the S&P 500 tested the 200-day moving average and bounced ferociously.

I incrementally added three positions:

- Bank of America (BAC) at $29.63

- Apple (AAPL) at $151.80

- Amazon (AMZN) at $1328.20

All three of them did phenomenally well, with me profiting 7.5%, 13.1% and 9.4% respectively, in the days that followed. That was the turning point in my portfolio and 12 of my next 17 trades would be profitable, returning the portfolio to GREEN, for the month.

What is so interesting about this particular month is that I was only profitable on 40% of my trades. Most people think that you have to always be 50% right to be successful.

But you don’t.

My historic average in the Splash Zone has been about 56%, and while hitting that number is great, it isn’t the key to my success. I seek to make my trades result in four different outcomes:

- Big Profit

- Small Profit

- No profit

- Small Loss

What you don’t see on there is “big loss”. When I can keep the losses small as I did in February when the trades were not working in my favor, I stayed calm, and continued waiting for the right opportunity to get long again, that is where I can maintain a level of success trading in the stock market even when the trades, from a percentage stand point, are not going my way.

In fact, I have had a month where I was only 25% right on my trades (Iet’s not do that again though), and still finish profitable. It can happen.

Now you may ask, “why don’t you short the market?”

Oh, I do, but you have to be careful of doing so when the market has already dropped 150-200 points in just a few days on the S&P 500, because the risk-reward becomes very skewed. Would I have been profitable had I just closed my eyes and pulled the short lever? Sure! But the risk parameters were horrible, and the market was poised for a bounce at some point in the near future.

So I held off shorting the market in early February. There was about 5 solid days there that you had to profit from the market decline in February (not counting the last two trading sessions), so the window of opportunity was small, and once the 200-day moving average was tested, it didn’t base, or trade sideways, it ripped higher 87 points off its lows in one day.

Overall, there was a lot of great learning opportunities from February. Looking back I would have liked to of been more patient with the UPRO trades, but in the end, the returns were positive in the Splash Zone, while the overall market returns were very negative.

I would say that was a successfull month of trading for me!

If you’d like to be part of my trading community and receive all of my real-time trade alerts, you can do so, by signing up for the SharePlanner Splash Zone and get started on a free 7-Day Trial. With your subscription, you will receive all of my real-time trade alerts, entry prices, stop-loss, target price and rationale for each trade that I make. So sign up today and start profiting!

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.