My Swing Trading Strategy

I booked gains in Amazon (AMZN) for a +2.7% profit as well as Microsoft (MSFT) for a +3.1% profit. Both solid trades. I am only left with one long position coming into Monday. I will look to see whether the morning weakness holds and if it does, consider adding a short position or two to the portfolio.

Indicators

- Volatility Index (VIX) – Small pop on Friday of 4.4% resulting in a doji candle pattern and the potential for a short-term bottom and pop higher.

- T2108 (% of stocks trading above their 40-day moving average): Lower-lows and lower-highs still in place and it suggests that this market has more room to fall in the coming weeks.

- Moving averages (SPX): Could break back above and hold that break above the 10-day moving average. The 50-day moving average was also broken too. Expect the 5-day MA to get taken out at the open today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Only Telecom and Utilities traded higher on Friday, while Technology and Energy lagged the entire market. For a full sector analysis, check out my latest post here.

My Market Sentiment

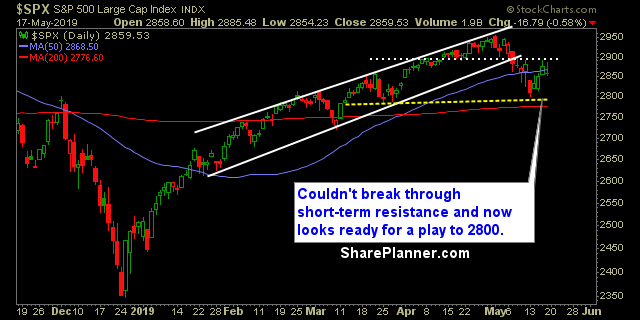

Futures opened up on a positive note Sunday night, but couldn’t hold it into the Monday open as the trade war starts to permeate its way through Tech as well. Watch for a bounce attempt at the open, otherwise, assume that lower prices are likely from here, including a test of the 2800 level, which if broken, would confirm a head and shoulders pattern.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 10% Long

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How does war impact the stock market and what are the potential risks and hazards that impact traders attempting to remain profitable in their swing trading? In this podcast episode, Ryan Mallory covers everything managing the volatility that comes with the headline risk, dealing with heightened levels of emotions, securing open profits, and market exposure to uncertainty in the stock market.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.