Over the past four trading sessions, the market has no doubt looked weak. Prior to what is at this point, a four-day pullback, the markets were sitting at extremes and begging for a pullback. Now that we’ve got it, it’s important to see the manner in which it is pulling back and what we are

There’s a couple of caveats I’ve got to mention first here. The first, I’m not looking to add any short positions to my portfolio, because there’s not a significant breakdown at this point in the indices, and to think otherwise is based more on speculation than anything else. However, I’m constantly screening for short setups,

Let me tell ya… It wasn’t easy finding 4 stocks that were bucking the trend and close to, or in the process of breaking down. But I did, and I earned a little overtime in the process. Nonetheless, out of the four stocks below, I like Silver (SLV) the best. That thing has one

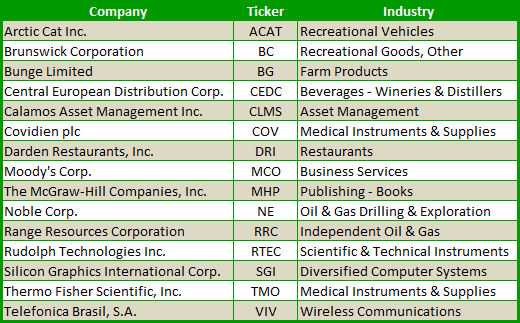

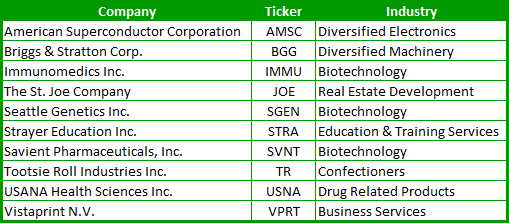

By far one of my best screens in determining who is buying what on the street! What you will find are those stocks that, among other variables that I use, 1) Gaining an increased amount of coverage by brokerage firms and analysts, and 2) Being upgraded on a regular basis. This is a good screen to

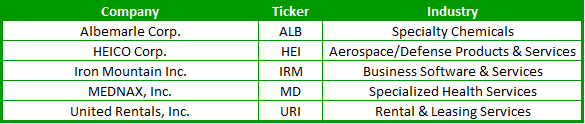

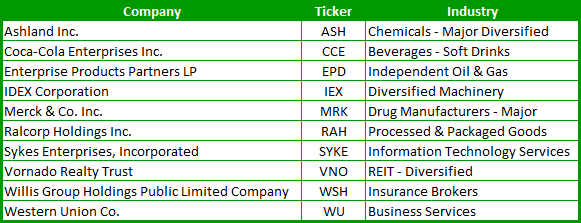

What you have below are three stocks that I found that are trading well below their book value (in some cases as much as 1/4). But what you also have on the chart is some potential breakout plays that are developing. So this is an example of where fundamental analysis can easily be coupled with

What you have below are three stocks that I found that are trading well below their book value (in some cases as much as 1/4). But what you also have on the chart is some potential breakout plays that are developing. So this is an example of where fundamental analysis can easily be coupled with

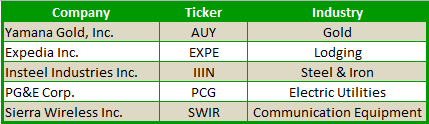

I just finished going through the charts this afternoon, and here are five stocks that I believe will make for great setups heading into the close and into tomorrow. LONG: Rogers Corp (ROG) – breaking out of the long-term triangle pattern it is in.

Below are the charts of small-cap stocks that have been heavily shorted by the street, and should the market continue to rally like we are seeing here today, then these stocks could see their share price launch into the stratosphere because of the bears being forced to cover their short positions in the stock. Based

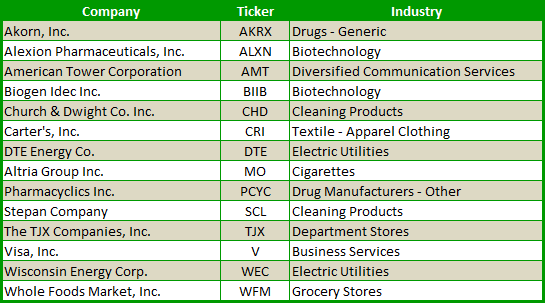

I’ve been running my scans this afternoon looking for stocks that, should this market continue to rise, are ready to lead the pack in the traditional breakout sense. Most of the stocks below are all at or slightly above price resistance levels, and once again, assuming this market can continue this rally that we are