There’s a couple of caveats I’ve got to mention first here. The first, I’m not looking to add any short positions to my portfolio, because there’s not a significant breakdown at this point in the indices, and to think otherwise is based more on speculation than anything else.

However, I’m constantly screening for short setups, because I’m a firm believer in being ready for possible market reversals, and when those times come, I don’t want to be scurrying around looking for shorts in the process… instead I prefer to be Boy Scout ready.

And, even if I was bearish on the market, I wouldn’t use this moment for getting short, as we are at an S3 support level on the intraday pivots, which means that its likely there is limited downside from this point on.

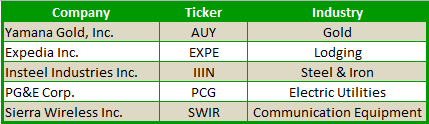

So with all that said, the screen below are for those stocks that have primarily been on a solid uptrend of late, but are starting to show signs of breaking down along with a loss of interest by the street as a whole. So if you are looking to short this recent market rally, use the list below as bit of a primer to get your bearish energies flowing. Most of these stocks look pretty good when just looking at price and volume from a long-term perspective, however, what is concerning is some of the glaring bearish divergences that are popping up. One such indicator is the Time Segmented Volume – TSV that shows all of the stocks below in the negative, which is a good indicator that the longs are starting to get a bit skittish in their current positions, and are taking profits as a result.

Here are the 5 Short Setups

.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Trading what you see and not what you think is one of Ryan's popular trading expressions that he has lived by in his 30 years of trading experience. In this podcast episode Ryan explains why it is so important to not think your way through the market but to be a trader who sees what to trade and reacts accordingly. If you are struggling as a trader, it may very well be that you aren't seeing but thinking your way through your swing trades.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.