This is a stock screen similar to “Stocks That Are Breaking Down” (but just the exact opposite). A lot of these stocks are positioned for breakouts in the near future. If you are a momentum trader, you have to take a look at the charts of the stocks listed below. Each of them were hand-picked from a

I tend to run this screen in markets like the one we are currently trading in. Where it is overbought beyond measure, facing overhead resistance, and anything and everything that I measure the market reversal possibilities against, is screaming “Watch-Out Below!”. And that is the exact kind of market we are dealing with here. So

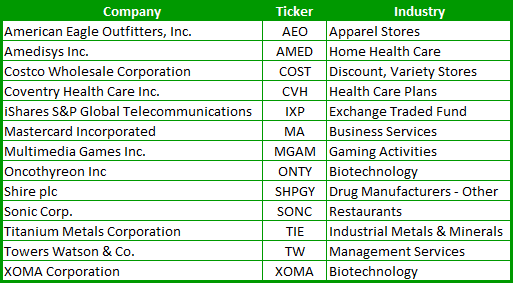

The stocks below are showing signs of, or already in the process of, breaking down as the smart money appears to be leaving them in a subtle manner. There are stocks trading at its peak and finally showing some vulnerability, while on the other extreme, there are stocks that have been in a channel near

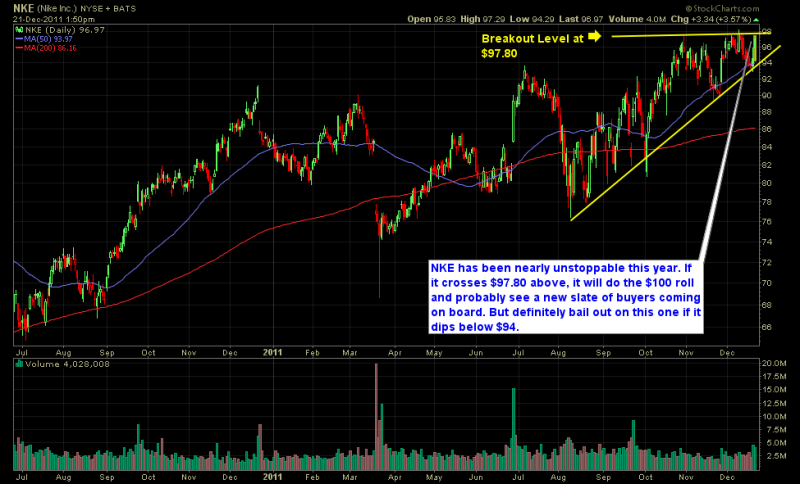

This is a stock screen similar to “Stocks That Are Breaking Down” (but just the exact opposite). A lot of these stocks are positioned for breakouts in the near future. If you are a momentum trader, you have to take a look at the charts of each of these stocks listed below. Each of the stocks below

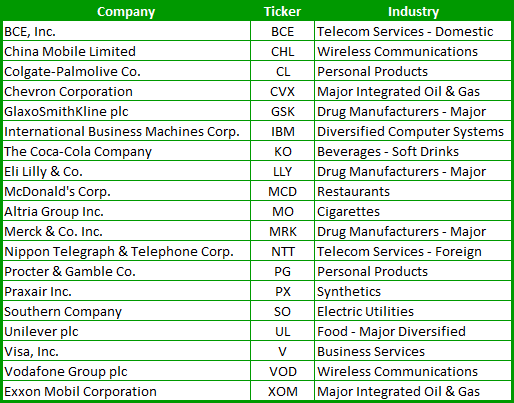

This is by far, one of my favorite stock screens that I run. I have probably found more winning stocks (and big % ones at that) off of this screen, than any other one that I run. These stocks make it a habit to trade on their own merits and not that of the market itself.

For the bears this is a disappointing day, they came strong out of the gate, but with an hour left in the market, the bulls are fighting their way out of the whole they dug early on. I wouldn’t put a lot of weight into what we are seeing as volume is drying up quickly

Market continues to weaken by the day, not in huge fell swoops, like we saw in July and August, but slowly and steadily. As the new year approaches, more and more I believe we’ll see continued selling in the broader markets. But at some point, there will be a time to buy, and finding the

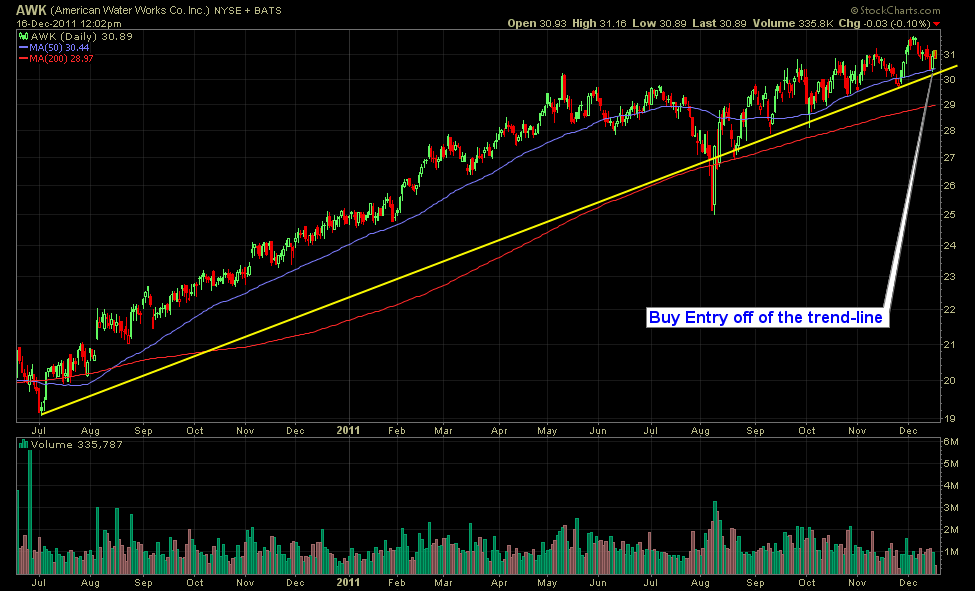

This is a modified version of the “Stocks That Only Go Up” stock screen, and what I’m trying to do here, is outline four stocks that have solid trend-lines that represent beautiful trading opportunities once they decide to pull back. And what you want is a decent pullback in the broader markets, because these stocks

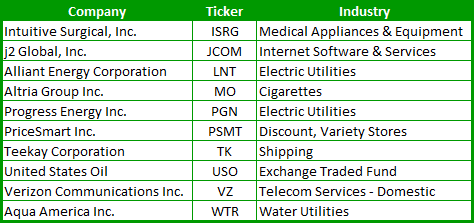

Here are 5 stocks that are showing some promising signs of moving higher, despite the market moving lower this week. Going forward if this market gives us a bounce of any kind, stocks like those listed below that have bucked the trend and remained positive, should do very well. Bank Regional holders (RKH)

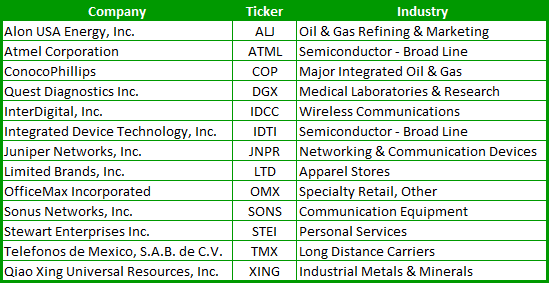

Unlike any of my other screens, this stock screen focuses only on stocks trading under $10/share, and have a market cap of around $1 billion or less (I’ve included a few above that threshold this time around though). As for the variables that I used in the screen, I focused on fundamentals, particularly companies that