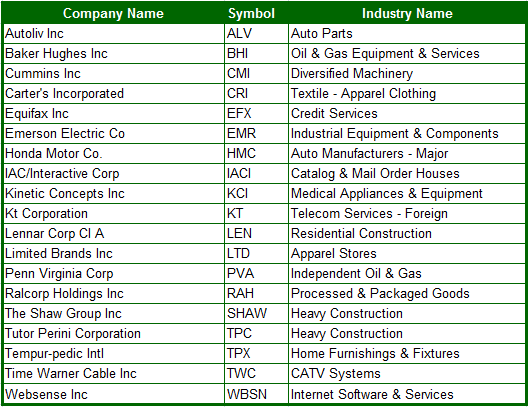

Below are the screen results of stocks that have a book value per share that is more than its price per share. Like last time, I just want stocks selling at HALF their book value. Also, I wanted only those stocks that are showing an increase in interest from the institutions (i.e. they are gobbling up

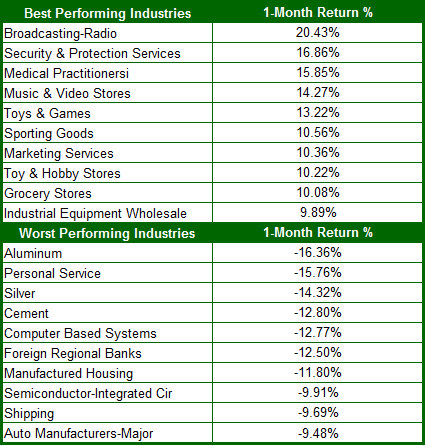

Here are the past month’s best and worst performing industries. Some quick observations here, 1) Broadcasting & Radio is on top with a 20.43% return. I guess with all the spending and corruption in D.C., the masses are running to talk radio and the ad revenue as a result is through the roof (how is

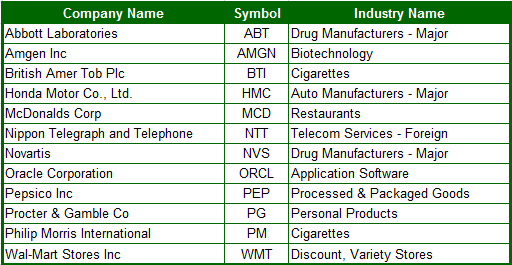

If you are looking for some conservative plays out there, thinking that there are pending storms on the horizon, I would look no further than the list below. I’ve run a screen to find those stocks least affected by the markets mood’s and emotions, and are to be considered the best of the best stocks

Once again the market is in the rally mode and trying to shake the bears out of all their positions. But fear not, I provide you with a whole arsenal of stocks that are prime for the shorting. It seems like these days that whatever bearish stock screen that I run, there is a myriad

Here’s an update on the stock screen I first introduced about a month ago. By far one of my best screens in determining who is buying what on the street. Below you will find those stocks that are, among other variables that I use, 1) Gaining an increased amount of coverage by brokerage firms and analysts,

Below are the screen results of stocks that have a book value per share that is more than its price per share. Like last time, I just want stocks selling at HALF their book value. Also, I wanted only those stocks that are showing an increase in interest from the institutions (i.e. they are gobbling up

The list below offers a number of stocks that are showing a loss of interest by the streets, and while some of them may not be showing a total breakdown when looking at price alone, the indicators that I use for this screen, and the manner in which I use them show that there is

Here’s a look at the Best and Worst of the past month across all the industries. Compared to previous months, the chart below doesn’t show near as much volatility in the markets, and the individual performances of each industry are grouped pretty close to each other. For a comparison check out the performances for December. Notice

This here happens to be one of my favorite stock screens that I run, especially in the type of market environment that we are currently seeing. That’s because the stocks below, represent some of the most technically sound companies being traded. They have managed to keep their uptrend intact despite market conditions, and when

These are the famous words of M.C. Hammer’s “Can’t Touch This” – and below are some stocks that are also breaking down, but the good thing is, that you can touch these and have them as your own (or at least borrow them, sell them, and buy them back later at a cheaper price). So