This particular chart on the S&P 500 (SPY), expects a major sell-off starting in 2026.

T2108, which measures the % of stocks trading above their 40-day moving average, is lagging significantly, and should be more in the 70% range.

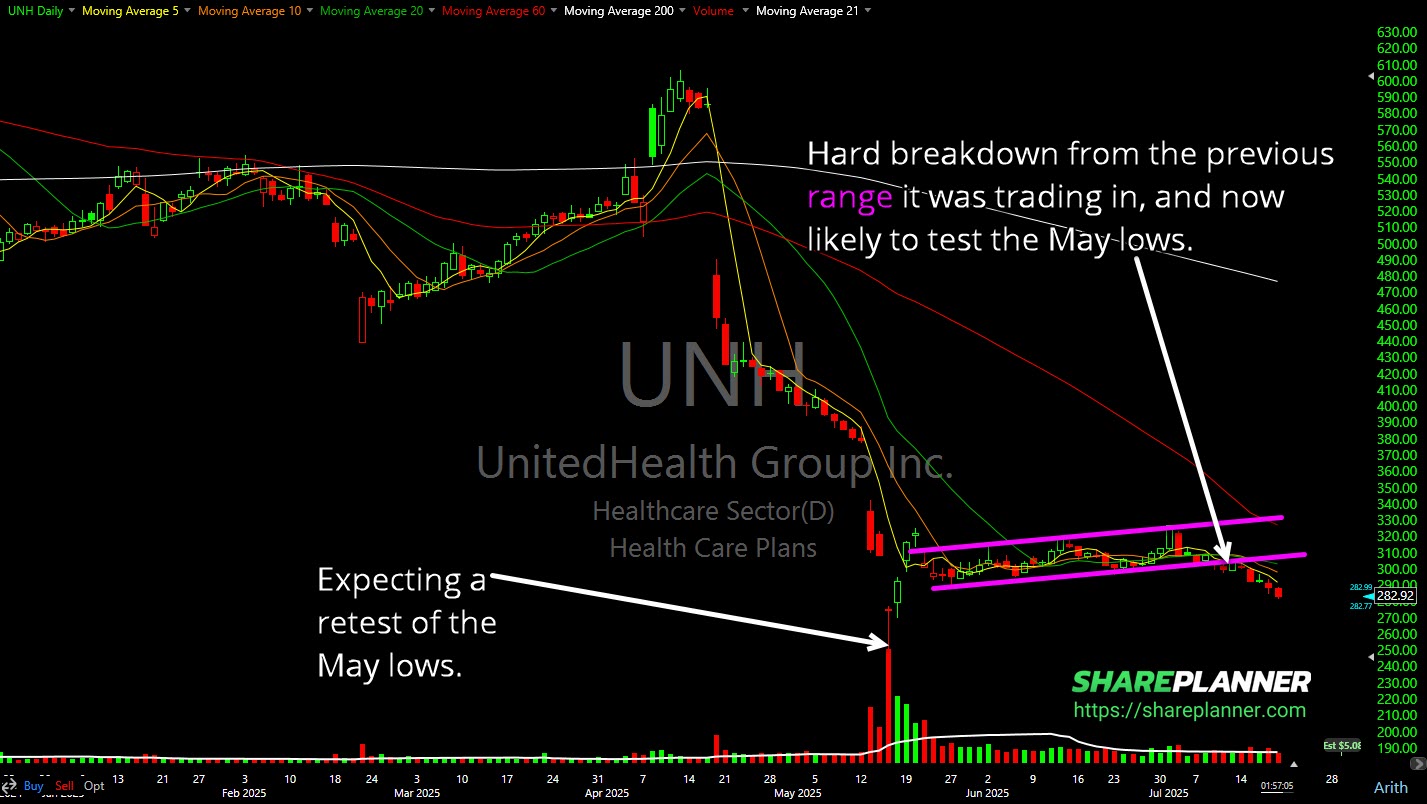

UnitedHealth (UNH) still can't find itself a bottom.

The Utilities ETF (XLU) is currently in breakout mode, can this defensive play sustain the breakout though?

Don't forget that recessions take place after the yield curve stops being inverted and begins to steepen.

Chipotle (CMG) looking prime for a bounce off support and rising trend-line.

0DTE puts are getting dumped hard and fast today, which helps to explain this rise in the stock market.

How are there only 40% of stocks on the NYSE trading above their 200-day moving average? All about the mega-caps.

Since mid-May, the decoupling of RSP vs S&P 500 continues to increase.

Rumors of Jerome Powell being fired led to a fury of call buying in SPDRs Technology Sector (XLK)