For the past four or five months our morning trade setups have primarily been short setups, but today the focus will be stocks with long setups. The market is showing strength in recent weeks, and I wouldn’t be surprised to see this last through the end of the year (sometimes referred to as a “Santa Rally”).

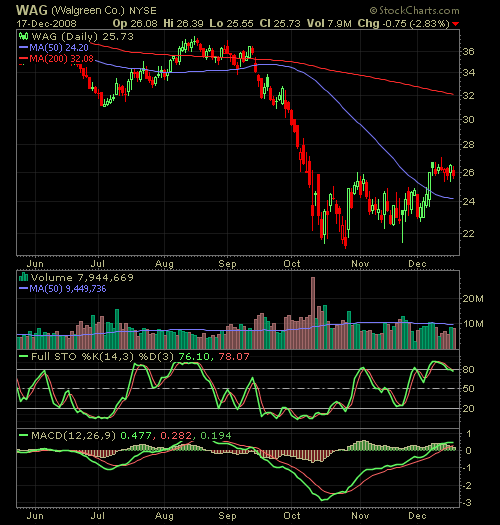

Pretty healthy chart in the short-term (ignoring the enormous sell-off from most of this year) but if you look in November, when the market put in new lows, WAG was putting in higher lows, and then over the past 10 trading days, has managed to consolidate above its 50 day moving average – a definite plus. We wouldn’t be surprised to see a potential breakout in the coming days in this particular stock.

Click below to see our other Trade Setups…

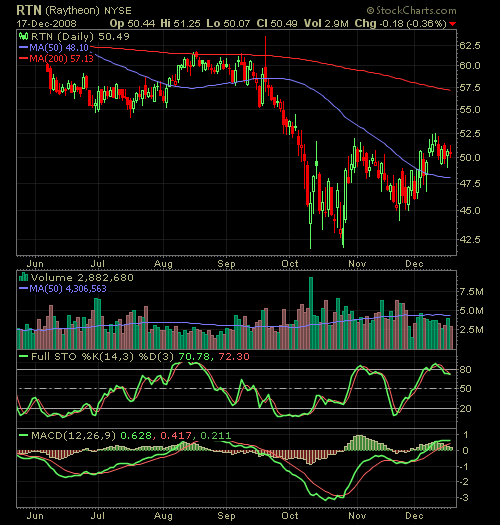

Raytheon is our favorite of the three chart postings, and has a very distinctive cup & handle pattern that has formed from October through November, and looks like it has another one forming (though not confirmed) from November through December. The one thing that concerns us with this chart is the lack of volume that was seen in its most recent rally from mid-November through December.

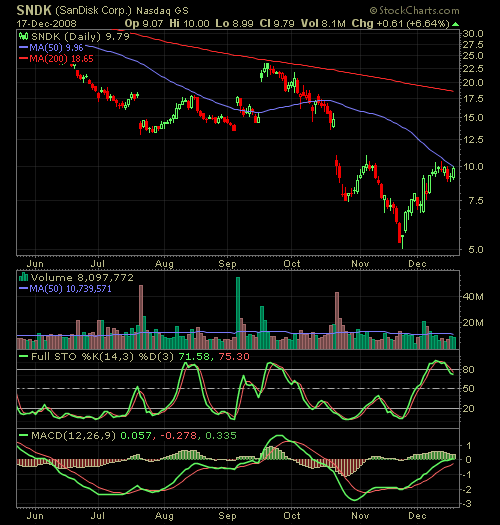

This chart is shown more for informational purposes rather than a legit setup. However, the consolidation at current price levels is very nice, but has been unable, as of yet, to break the 50-day moving average. Another reason why we shy away from this stock, is that since mid-November, it has already doubled in value and the potential for some profit-taking is there. You do have a bullish divergence with the MACD and the new lows that were set in November with its stock price, but the fact that it is in a price competitive industry (see Garmin (GRMN) for an example of what happens to popular stocks when their products become price competitive), and the stock itself has been a market laggard in recent years, makes this a “no-trade”.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.