Two new positions today in the portfolio – the first one was Walt Disney (DIS), and the second one was Goldman Sachs (GS). The latter of which is shown for you below. Notice the clear breakout. I typically wouldn’t buy a stock in financials based on the their recent weakness, but today offered some hope

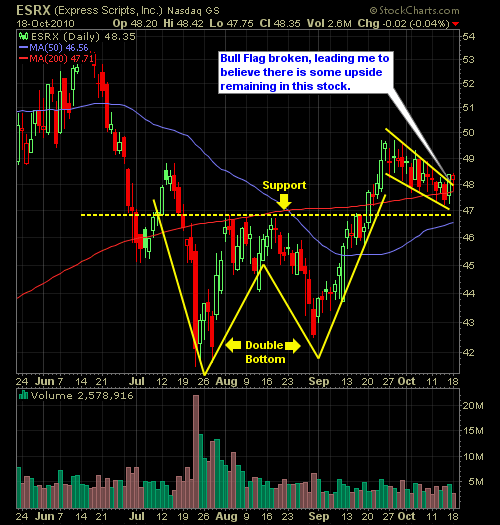

After closing out of a few losing positions throughout the day, I’ve added Express Scripts (ESRX) @ $48.18. I’ve placed my stop-loss at $46.42. What is so appealing here is the nice bullish flag that has broken in the past few days, indicating that it is ready to resume the upward trend. Here is the

The market has recovered off of its lows, and now finds itself trading in a fairly tight trading range. With today being Options Expiration Day, I won’t be surprised by any outcome. However, if I were to guess, I would say that we’ll see the traditional wave of buying in the final hour again, if

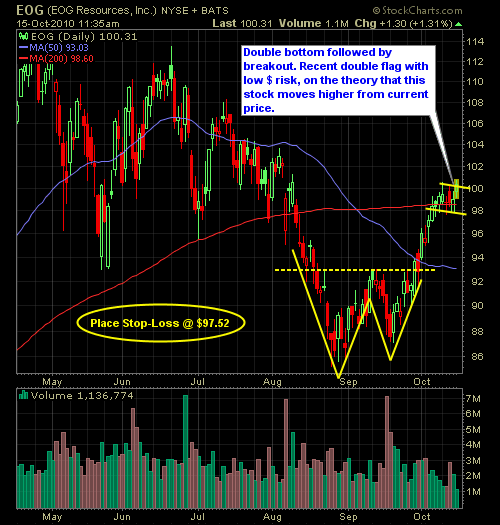

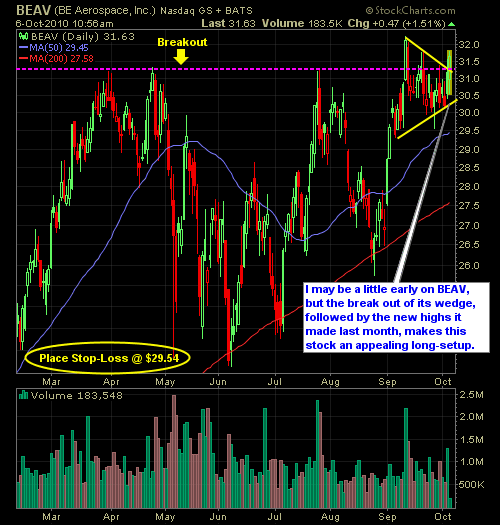

I sold my position in BE Aerospace (BEAV) this morning – kind of regretting it at this point as it has made a nice bounce since I sold it – but I can’t think too long and hard about it. In its place, I picked up EOG Resources (EOG) at $100.50 off of the assumption

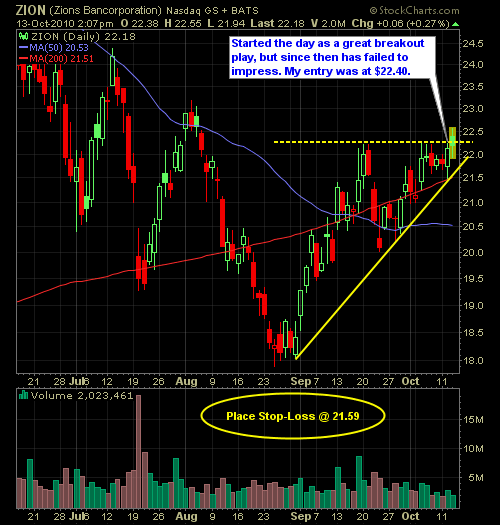

There is always a runt in the litter, and yesterday, despite some very nice gains in the portfolio, ZION (an early morning addition) was signaling “Breakout” across the board. As a result, I put about 5% of my capital in this stock, and early on, I was feeling pretty good about things, as it went

My entry on this position stunk, no doubt about it. But there was really no way to play it other than to put a buy-stop on it as soon as it hit $22.40 (breakout price). However, what I wasn’t expecting to see was the head fake the the bears gave us, by erasing most of

The market is starting to show signs today, slowly but surely, that it is trying to move higher on the day. As a result, I am buying some shares of DirectTV (DTV) after some nice consolidation formed a bullish flag, which falls in the category of continuation patterns. My stop-loss is fairly tight only allowing

The market is trying to find its identity still this morning. Employment did not have the effect that many were thinking (including myself) it would have – which is starting to become a trend with these major reports, where we get a lot of reaction, but ultimately we settle somewhere around where we started. Below,

So far this morning the market is simply content with trading sideways. I’m taking a hit in BEAV this morning after a tremendous breakout session the day before. I’ve added Penske Automotive (PAG) to the portfolio this morning on a double-bottom confirmation. My stop is pretty tight on this one, offering a high-reward/low-risk profit opportunity.

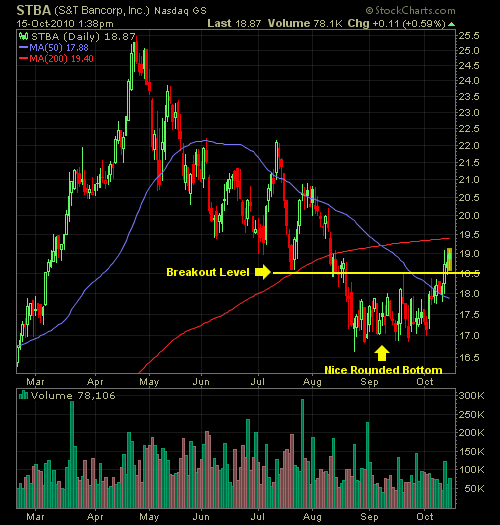

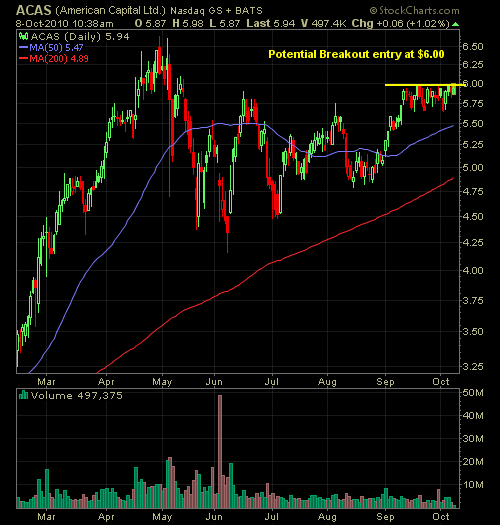

I may be a little early on this trade, but the breakout above resistance, furthered by the breakout from its recent wedge is what caused me to pull the trigger on this one. The market is all over the place today – no clear direction for the at this moment. But I wouldn’t be surprised