This past week, I’ve spent writing about common market conditions and how they behave early on and what you can expect for the remainder of the day. I’ve received great feedback from readers on this series and for the most part, I think everyone understood what I was trying to accomplish with this series and

If you’ve missed my previous posts this week on predicting Market Action from the 1st hour of trading, I’d read these the first three posts as well with this one. Predicting Markets Part 1 Predicting Markets Part 2 Predicting Markets Part 3 So far, we’ve talked primarily about trending days and what kind of early

A small gap and then a big intraday move Today’s market scenario that I want to discuss is one that you’ve probably heard me warn about in the past in either various posts or in our chat room, but nonetheless, they end up usually being some of the worst trading sessions for the bulls, mainly

Discussing large market gaps higher Let’s get started on Part 2 of How to Predict Market Action From the 1st Hour of Trading by discussing the Heavy Market Gap-Ups. You’ll remember yesterday how I discussed gap-downs can be very difficult for the bears to hold on to the weakness. So the obvious conclusion then is that bulls

I’ve long been a fan of trading on multiple time-frames with daily being my primary chart-of-choice. As a swing-trader, I rely heavily on other time frames like the 30-minute for determining my entry intraday and then the weekly to see if there are any longer-term problems that are coming to the surface that the daily

Recently I was asked by one of my readers what do I determine to be a ‘Gap-Fill’ citing a lot of conflicting definitions, and vagueness surrounding this subject matter. First-off there are a few popular ways in which people will define this… – A gap-down is filled when price action the day of or in

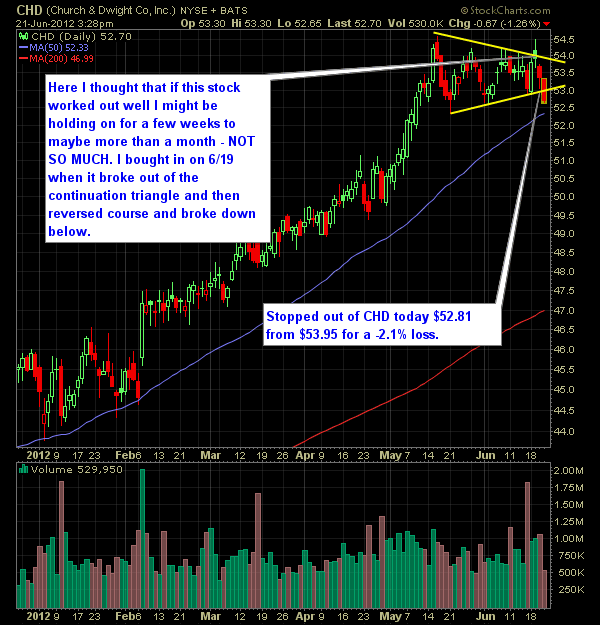

I posted my PCYC resounding success story which I made 16% off of it, but what kind of blogger would I be if I completely ignored those nasty trades, that despite discipline, focus, and strong setups, did nothing to better themselves after I got in them (yup – losing trades comes with the territory).

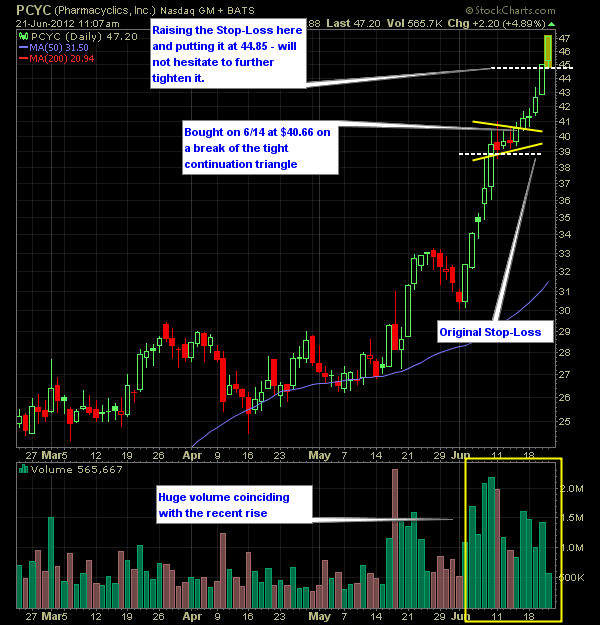

Pharmacyclic (PCYC) has been a great stock for me the past week. When I bought this stock back on the 14th I didn’t have some special insight that said “this stock is going to go up over 15%… I didn’t. Instead there was an opportunity there, and despite wanting to book gains and close it

…and before I could finish this post I am OUT – at $16.51 That happens from time to time. Literally as I got in on a beautiful head and shoulders pattern on the 5min SPX chart and inverse head and shoulders on the inverse 2x S&P 500 ETF SDS, there was “rumors” of a

There are plenty of reasons not to short Apple (AAPL) no matter how good the chart is. Let’s see: They are the biggest best company in the world They have a product with incredible demand despite a lagging world economy Cash flow is ridiculous and they can really cause a stir at