While nothing is impossible, if you would have asked me this morning if I thought the bulls would make a mega rally off its lows and rally about 35 points on the S&P to close barely in the green, I would have thought you were delusional. But that is what we got today, and honestly, I couldn’t have asked for anything better. This was exactly what needed to happen in the markets today, to get the bulls off their butts and back into the game.

For awhile there I actually was wondering if I was ever going to get that much needed bounce to reload my short positions on, and what we got today should lay the foundation for the bounce to occur. If you read my post from late last night, you will see that I got 51 short setups, and growing by the day, of which I would like to short – I’d do everyone of them if I could, but managing 51 positions simultaneously doesn’t sound like a load of fun to me.

So from here I am looking for the market to rally upwards of 4-6%, before I start aggressively adding new short positions to the portfolio (currently I am 100% cash).

On a side note, I was able to have a little fun today, jumping on the SPDRs wagon with scalp of SPY long at 105.59 with a stop-loss 104.8. I managed to get out at a predefined area of resistance at 106.32 for a respectable profit. Outside of that, I had nothing else going on.

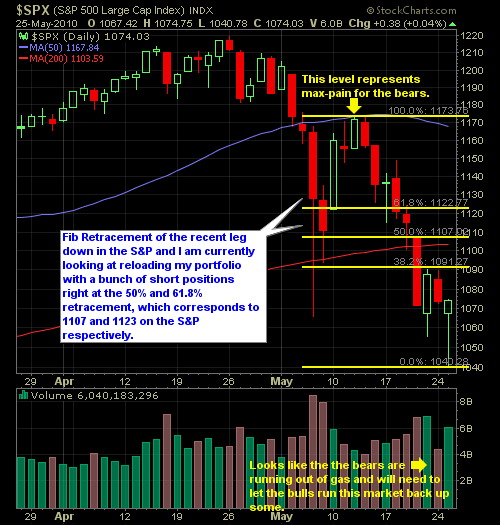

I’ve updated the chart from yesterday on the fib-retracement to incorporate today’s huge intraday sell-off and rally. Essentially the Short-Zone that I outline below has shifted downward about 5 points (i.e. the 50% and 61.8% range).

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.