Solid day for Google (GOOGL) today despite its desire to close as close to $700 without actually going over it ($699.95 to be exact). But also important is the move above the new breakout level and there was really no struggle whatsoever with it. This bodes well as the week progresses. Though with earnings

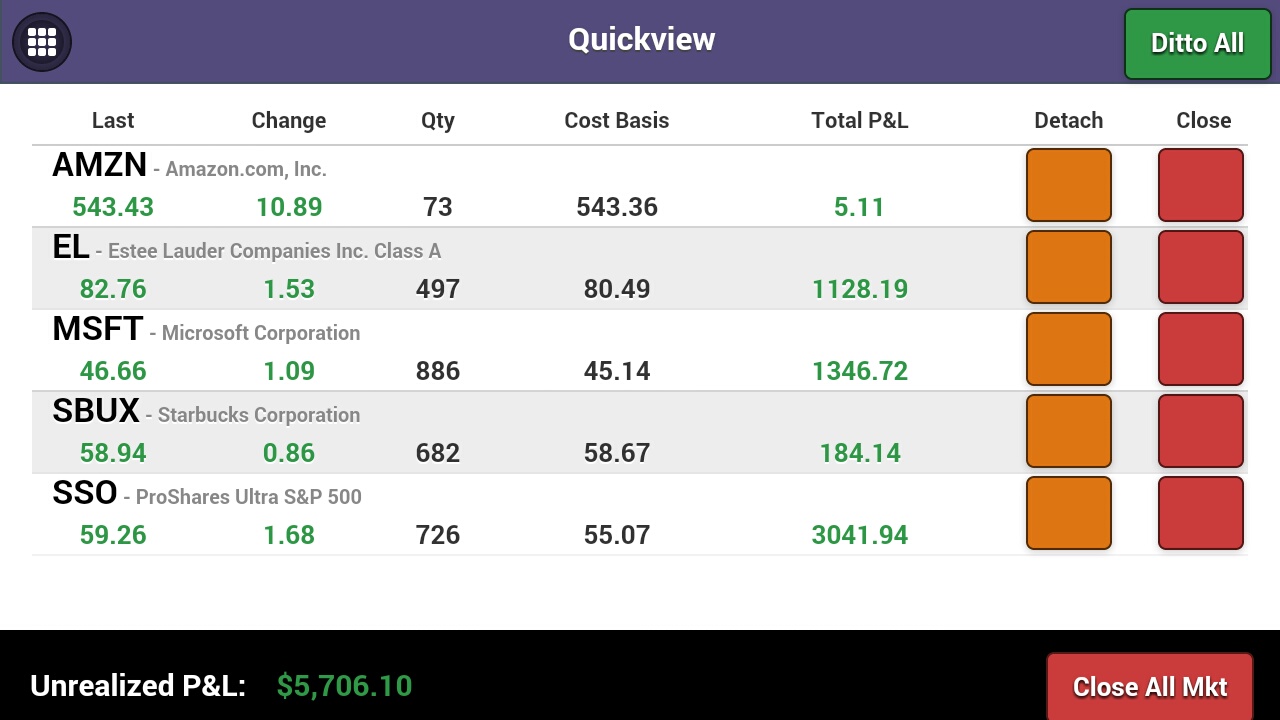

It was another strong week for the SharePlanner Splash Zone. Check out one trader's portfolio using Ditto Trade's trading automation service for my swing-trade alerts: Not to mention I closed out Starbucks (SBUX) right before the close for a 2% gain. October is off to a solid start, but even with the market still down

The T2108 is an indicator that I like to look at daily for gauging market direction and it has lately been on fire! At the close today, 58% of stocks will now be trading above their 40-day moving average. That is the highest reading this indicator has seen since 4/28 of this year. The indicator

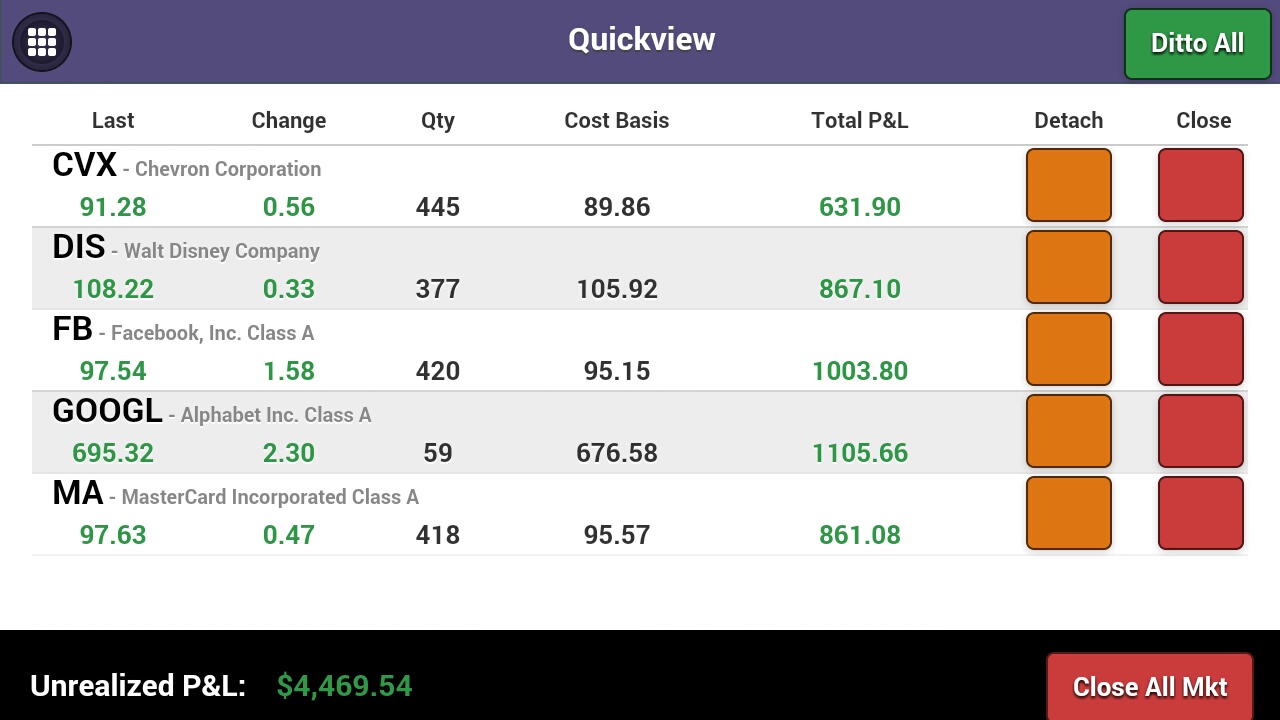

Here's an example of one member's portfolio today in the SharePlanner Splash Zone, achieved by trading my real-time trade alerts: To say the least, it was another solid day in the SharePlanner Splash Zone. In fact, he didn't have to place a single one of these trades. It was all done automatically through his brokerage

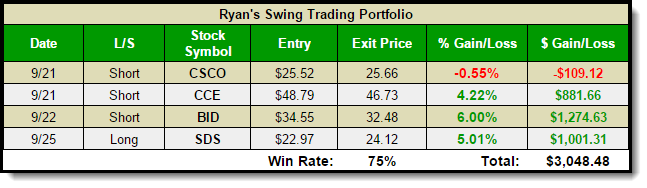

It was a trouble some month for the stock market. The S&P 500 was down -2.7%. The quarter was troublesome for the stock market. The S&P 500 was down -7%. For the year, the S&P 500 is down -5.2% Yet despite all of that, the SharePlanner Splash Zone portfolio is up nearly 5%…and despite the September being

Listen, the market was down bad today, and I mean real bad. It was a blood bath that had no end to it until that final bell rung. There was no relief in site for traders and their positions. However, myself and members of the Splash Zone did not suffer at the hands of the stock market.

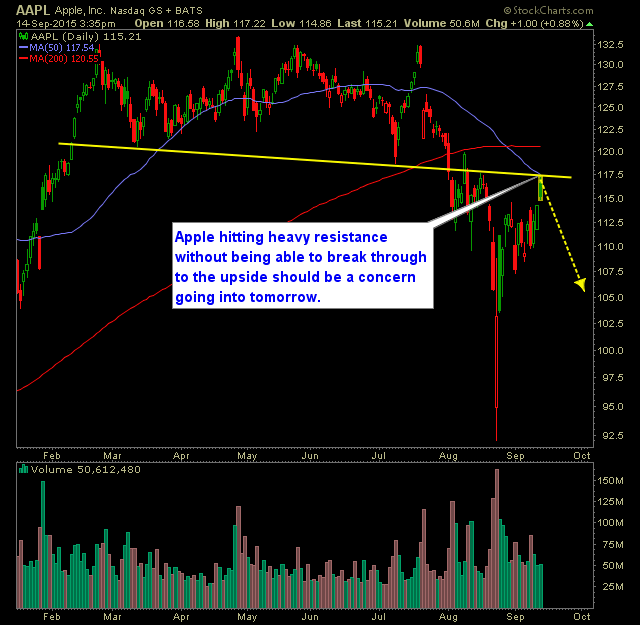

Check out this chart of Apple (AAPL) tell me that I shouldn’t be worried if I were actually in this stock? I’m not saying it won’t break through the resistance, but my gosh that is is a solid rejection off of it today. If the stock fills today’s gap, tomorrow, then proceeds to move

If there could possibly be a more uninspiring week of trading, please tell me, because this market was an utter bore this week. When September 17th comes and goes and we finally know the Fed's rate decision, I for one will be an extremely happy camper. Any market that is this hung up on a

Listen, I hate this market as much as anybody else. On the surface it seems like an easy market to short, but when a market can rip off +100 point rallies in just two trading sessions, shorting and covering is just as difficult to squeeze out a profit as buying and selling is. When the

There is absolutely nothing to like about the SWKS chart. It has ugly written all over it. There is no disputing the fact that it has been on one epic run over the past two years, but that, my friends, looks to be over! It doesn’t matter which time frame you look at it