Do Emotions Help Traders? A Surprising Perspective In the world of stock market trading, conventional wisdom often suggests that emotions are a trader’s worst enemy. But do emotions help trader’s success, or do they hinder a trader as tradition would have us believe? My goal with this article is to challenge the popular notion

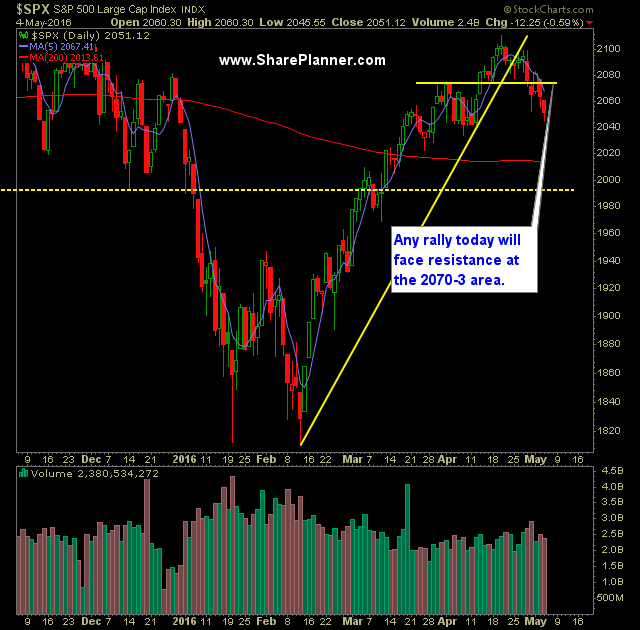

Technical Outlook: SPX sold off for the fourth time in the last five days and closed yesterday below the lows from last week. There was almost a test of the 50-day moving average yesterday but the dip buyers stepped in before that could take place. Again yesterday afternoon we saw the dip buyers come in

Don’t go away in May, instead learn to consistently profit in your trading by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I

One of the members of the SharePlanner Splash Zone Today pointed out a nice trade setup in GIS and so I thought I’d dissect it for you and give some thoughts on it. Quite a nice trade setup really, with a readily definable risk/reward to it. Obviously, this isn’t a trade that is going to

Technical Outlook: Another sell-off in SPX yesterday that once again saw the bulls buy the dip at the days lows and drive the price higher, thereby eliminating a good chunk of the day’s losses. It is hard to say that the bears have full control of this market when the bulls manage to rally the

Don’t go away in May, instead learn to consistently profit in your trading by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I

The bulls should be getting worried here. Yes, they find a way to rally the market off of its steep lows every time we see a sell-off, and we are seeing that happen again today, but the theme is that the bears are being relatively persistent in the last few weeks by putting its boot

Technical Outlook: SPX followed up with Friday’s afternoon recovery with a bounce to the upside yesterday that saw price reclaim the 20-day moving average and stall out at the 5-day moving average. Technically, very little improvement. On the 30-min chart of SPX, the rally simply took price straight into the neckline resistance of the head