Do Emotions Help Traders? A Surprising Perspective

The Myth of Emotionless Trading

Popular thought among traders is that emotional people aren’t suited to trade in the stock market. But is that really true?

The Myers-Briggs Test and Trading

When I took the Myers-Briggs test to see what I would come out as, my reading was an INFP.

- I – Introversion

- N – Intuitive

- F – Feelings

- P – Perception

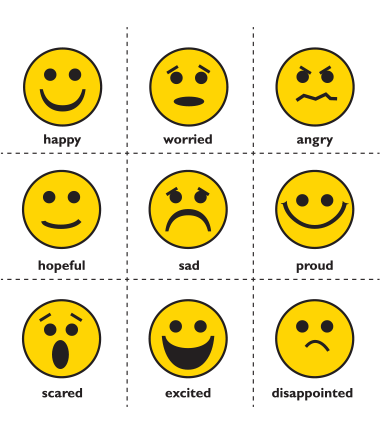

Notice that I have the “feelings” rating which most traders would freak out by if their tests came back as such. Feelings tie in with emotions and emotions is what historically leads to bad decisions by traders.

Do emotions help traders? Let’s explore that some more here, because I actually think it is a good thing.

The Advantage of Emotional Awareness in Trading

Having a “T” instead (thinking) would be equated with a trader who doesn’t “feel” and thereby doesn’t have to worry about their emotions at all. I would disagree though and say that for traders a personality that is more inclined toward the feelings side of the coin would suggest to me the increased likelihood of someone who actually recognizes the role of his/her feelings in trading and recognizes how they can affect one’s trading decisions.

Having a “T” instead (thinking) would be equated with a trader who doesn’t “feel” and thereby doesn’t have to worry about their emotions at all. I would disagree though and say that for traders a personality that is more inclined toward the feelings side of the coin would suggest to me the increased likelihood of someone who actually recognizes the role of his/her feelings in trading and recognizes how they can affect one’s trading decisions.

Personal Experience with Emotions in Trading

I’ve been on the side of trading where emotions get the best of me, and over the years I have had to learn how to harness their affects on my trading. The thinker may never realize the role of emotions in their trading, even though those emotions still exist, they simply are not acknowledging any role that they might have in their trading.

Managing Emotional Extremes

I know that I can get angry at a series of losing trades, and I have to make sure that I don’t project those feelings towards my next trade. Or when a trade doesn’t go right for me, I have to make sure that frustration doesn’t cause me to shut down and ignore the market all together.

On the flip side, when in the middle of an incredible winning streak, I have to insure I don’t get overwhelmingly cocky and over-confident and start thinking that that I can win on any trade and then suddenly find myself trading UVXY and TVIX or something crazy like that.

The Drawbacks of Over-Thinking in Trading

As for the “thinking” trait, I actually think this hampers traders more than they might care to realize. I can’t tell you how many traders that I have met and trained over the years that are major thinkers and how much that gets in the way of them trading profitably.

Common Pitfalls for “Thinker” Traders

- They can’t trade using a simple approach

- They often find themselves victimized with paralysis by analysis

- Every chart they look at comes across as bullish and bearish at the same time

This isn’t good. The market doesn’t reward traders for being good thinkers. In fact, that is why, historically, lawyers doctors, scientists, etc. make for horrible traders – they simply think that they can out-think the market, when in reality it is always the market that gets the last laugh.

Balancing Emotions and Analysis in Trading

So whether you are a thinking or feelings kind of a person, don’t let your dominant trait be exploited by the market. Instead, recognize it for what it is, keep the emotions at bay, and don’t overthink your trades.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Each year I like to take a moment to reflect on my swing trading from the prior year. The 2025 trading year offered a lot to be happy about, but it also changed my views in a number of ways and gave me some lessons to take from it, as well as some new perspectives to take into 2026 as I navigate the stock market for yet another year. I'm hoping this moment of reflection in this podcast episode will be as beneficial for you as it was for me in making it.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.