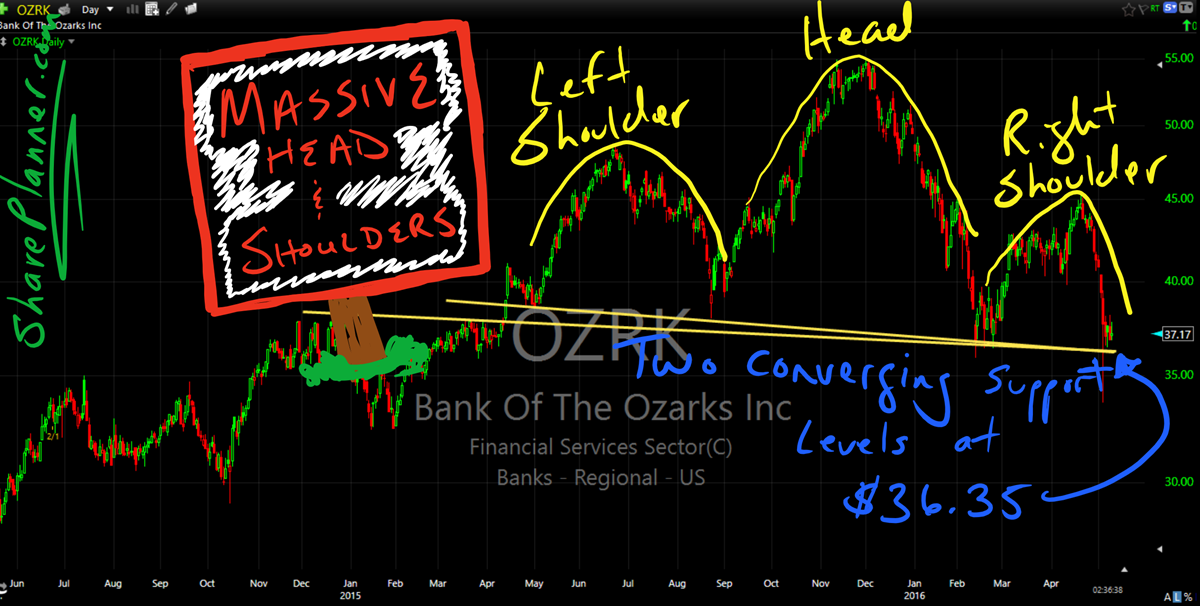

I came across this stock today in my scans and my gosh, it could be the single worst and most bearish stock chart out there right now. It is Bank of the Ozarks (OZRK) and it is U to the G to the L to the Y, UGLY. Here it is on the daily chart:

I came across this stock today in my scans and my gosh, it could be the single worst and most bearish stock chart out there right now. It is Bank of the Ozarks (OZRK) and it is U to the G to the L to the Y, UGLY. Here it is on the daily chart:

It is the best rally that the market has seen in over a month. But there is plenty to be concerned with here still. For one, SPX doesn’t seem to crazy about wanting to push through the 20-day moving average, but it hasn’t been rejected by it yet either. If a hard rejection happens

Technical Outlook: Yesterday marked an extremely boring an inconsequential day of trading In the final hour of trading, SPX gave up all of its gains on the day and finished nearly flat. The big concern for me on the chart is that there is now a very obvious head and shoulders pattern that is forming

Don’t let May waste away, instead learn to consistently profit in your trading by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I

Stocks so far today have been up and down and not showing a clear sense of direction here. That may change going into the afternoon or in the days ahead. But I think for now, it has to be respected, the reversal in price action on Friday and where it took place at – on

Technical Outlook: SPX experienced a hard reversal on Friday where price found buyers at and around the 50-day moving average and ultimately ended up resulting in an 18 point reversal off the lows of the day. Despite all the days of selling that was to be had last week, SPX finished just eight points lower

Don’t let May waste away, instead learn to consistently profit in your trading by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I

Technical Outlook: Attempted bounce early on yesterday eventually resulted in a sell-off in the afternoon that saw SPX finish lower for the fifth time in the last six trading sessions. A late day rally attempt yesterday fell apart. Yesterday marked the first time since 3/24 that SPX sold off three straight days. Volume on

Don’t let May waste away, instead learn to consistently profit in your trading by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I