Technical Outlook: A rare down day for the market – in the case of SPY, only its second in the past seven trading sessions. And as we have seen of late, the sell-offs are quite often mitigated by a huge swell of buying into the close that wipes out all of the day’s losses

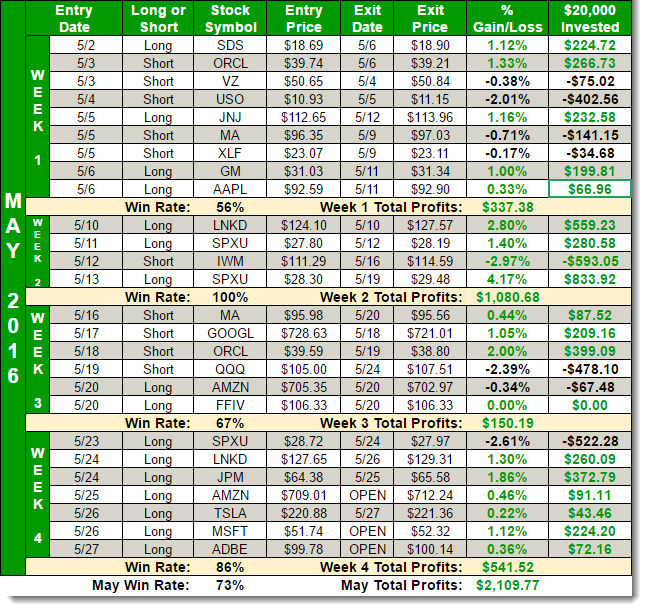

It was a great month of trading during the month of May. Get ready for an even better one in June by signing up for the SharePlanner Splash Zone. See for yourself what a membership can do for your portfolio by signing up for a Free 7-Day Trial. With your membership, you will get each and

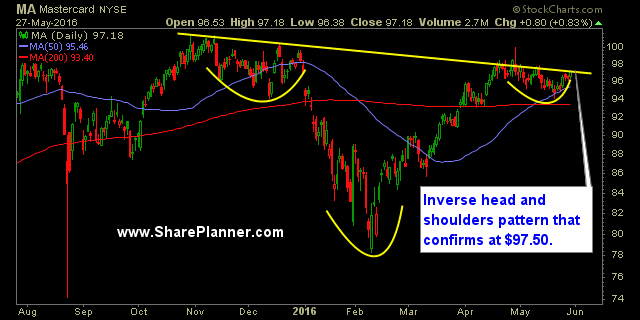

I wouldn’t go as far to day that it is a head and shoulders pattern on Boeing (BA) because if it is, that left shoulder is pretty dilapidated, not to mention the right shoulder as well. But there is a clear line of support between $125.00 and $125.80 that if price can push through

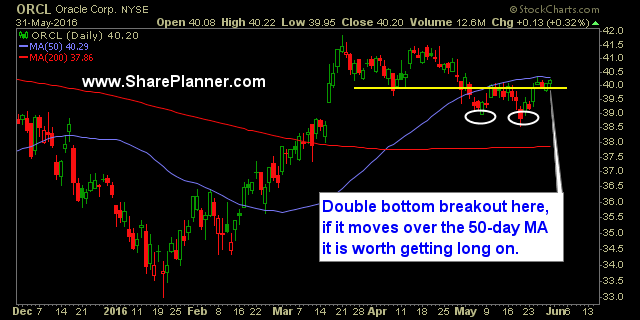

The bulls are off to a slow start, but at this stage of the rally, give them the benefit of the doubt. I can justify shorting a stock, as long as it is to hedge some existing gains on current long positions. But to be net short right now on this market, as the bulls

Technical Outlook: Quiet move in the market on Friday that led to another nice gain for the bulls. Slight uptick in volume on Friday but well below recent volume averages. This market has all the makings of a market the wants to continue to move higher, however, there are numerous resistance levels overhead between the

The month of May looks to be another profitable for traders in the SharePlanner Splash Zone. See for yourself what a membership can do for your portfolio by signing up for a Free 7-Day Trial. With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as

Happy Memorial Day Everyone! With the stock market closed, I hope you enjoy the day off with friends and family. But more importantly I hope that you take some time out of your schedule to reflect on the brave sacrifices and ultimate price that America’s finest men and women have paid, and their families have

There is still one more day of trading left in the month of May, but I decided I’d go ahead anyways and post my performance for the month. Overall a solid month. Remember, until this past week, there was very little to work with, and the rally on Tuesday caught everybody by storm as it

Trading is setup to create maximum frustration and elicit maximum emotion from the trader. Trading is not meant to be made up of clear cut decisions that are easy to make nor decisions that won’t lead to regret. I want to build off of the post I did yesterday entitled, “Emotions Are Part of Trading

Technical Outlook: SPX finished just barely in the red (while SPY finished just barely in the green) yesterday, and consolidating nicely at its 6-day highs. The head and shoulders pattern that the bears had eagerly been waiting to have confirm, has been nullified. All eyes are on the 1:15pm Janet Yellen speech. There is