There is still one more day of trading left in the month of May, but I decided I’d go ahead anyways and post my performance for the month.

Overall a solid month. Remember, until this past week, there was very little to work with, and the rally on Tuesday caught everybody by storm as it was completely unexpected. Nonetheless, trading requires flexibility and being flexible means changing with the ebbs and flows of the market and that is just what I did throughout the month.

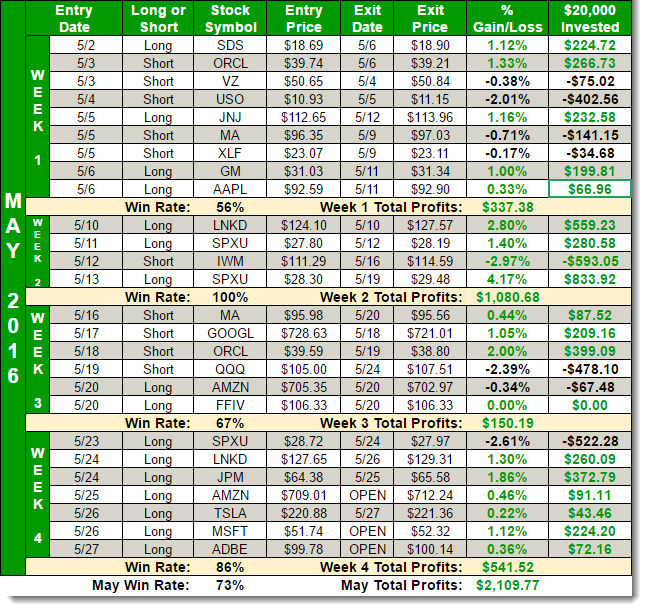

You’ll see in my performance table below, that there was plenty of long and short trades made throughout and it was pretty much evenly split between the two camps (counting SDS and SPXU as short trades).

The market for the month of May was as difficult as any and that is because the trading range was extremely tight and very unpredictable as the Dow Jones had a stretch of 11 days where it went up/down/up/down followed by an eight day stretch for the S&P 500 doing the exact same.

So for me and members of the SharePlanner Splash Zone to come out as well as we did is phenomenal, and should this market finally start to trend again in June, regardless of the direction, I’ll be ready.

One of the key aspects to trading, this month was taking profits when I had them and doing so aggressively. Had I not done this, the returns in May would have, no doubt, been in the red. I did not give any of the short positions much room to run against me and the same could be said about the long trades too. My profits were made more so by making more trades with returns of 1-3% than it was by less trades returning and profits of 4-6%, simply because the market did not trend in any direction this month.

If you are interested in signing up with a service led by a trader that is constantly adjusting to the market and taking what the market will give rather than hoping for what he might get, then the SharePlanner Splash Zone is the place for you. Besides, where else are you going to find as transparent of a trader as myself, who is willing to post publicly the past performance of every single trade that he has made since 2011?

With my service you will get all of my swing-trade alerts in real-time via the chat room that I am in all day long, as well as via email and text. All the while, you will learn the strategies and approach that makes a person a successful trader.

With The Splash Zone, you will get my low risk and high probability trade setups that no other trading service can offer.

Start Your Free 7-Day Trial Today!

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.