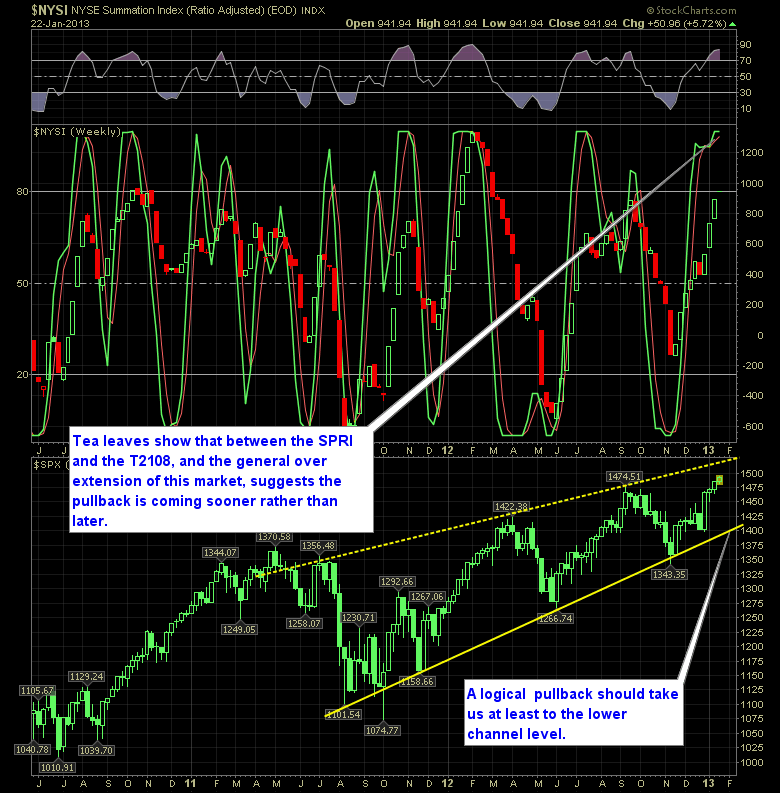

Reversal Indicator aligns itself with all the other warning signs we are seeing

The SPRI while not yet giving us the extreme reversal reading that we are seeking after, there’s not doubt we should probably get that reading within the next week or two. We’ve yet to see the market finish lower overall on the weekly time frame yet this year. Such a rally hasn’t been seen since July of 2012 when the market rallied six straight weeks.

Whether we match that feat again or not is anyone’s guess, but what we can conclude is that the VIX is at the same lows that we saw back in July of 2007, which was right before we witnessed one of the greatest financial cliamities of our time, the T2108 that I posted yesterday is showing an extreme readings that has almost always led to a greater sell-off. and we are seeing price action butting its head against a rising price channel, which could be the trigger point for that pullback I’m looking for.

Here’s the SharePlanner Reversal Indicator:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, it swing trading really worth it when you have a full-time job and does it make sense to spend the time and resources towards becoming a successful trader when you already are working that 9-5 job that doesn't really let you focus on the stock market each day? Ryan will cover how he traded when he was in the corporate world, and the strategies that one can use to allow you to find success in the stock market, even when working full-time.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.