Here is a quick recap of what we saw in the market today and what we expect. Today we pretty much had a trend day. Market runs up quickly in the morning and begins to move sideways for the remainder of the day. This a great thing if you are long from yesterday but if not then you are pretty much left on the sidelines. Traders trying to go long (usually from boredom) typically get shaken out before the day is over. It is also not a good time to short the market just because things are getting lifted up to extreme levels. Shorting is usually better the days following. Today’s close where we zoomed lower and the rocketed higher is the only part of today that stands out.

For what I can count, the bulls did 4 good things to help their case today:

1. We pushed over the 50 day moving average. This is the first time we’ve been able to do that since the sell off. We have tried several times in the past but always quickly sold off before breaking through.

2. We have killed the series of higher-lows and lower-lows. The best way to tell a trend (in any timeframe) is by spotting higher-highs/higher-lows or lower-highs/lower-lows. We have been in a downtrend marked by the grey circles around the lower-highs and lower-lows. Today we broke above the previous lower-high and killed the series. We now have a chance to make another series.

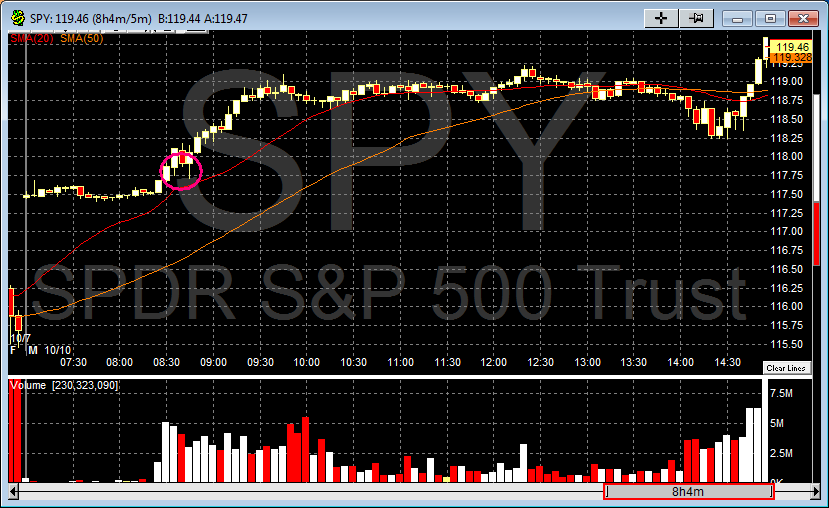

3. On the SPY (5min chart – pictured above) the purple circle marks our break through the 50 day moving average and the slight retest. As you can see the test of the 50 day moving average was quickly bought up and the market zoomed higher. If we come back to retest the 50 day moving average on the daily chart I believe it too will be bought up.

4. The VIX reacted positively to the push higher. Not only did the VIX fall but more importantly the VIX implied volatilies really fell. This shows that people are not buying protection for this market.

Right now we are still in a range bound market and will continue to be until we break 123.51 or 110.27 (on the SPY). Continue to play the range by selling at the top and buying at the bottom.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.