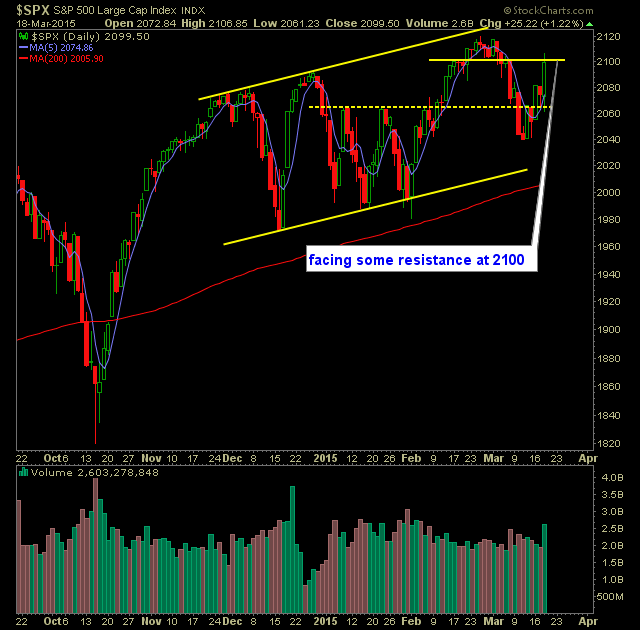

Technical Outlook (SPX):

- SPX held 2065 yesterday despite an intraday dip below, and managed to rally in a significant manner following the FOMC Statement yesterday.

- Despite “Patient” being dropped from the statement, the Fed went out of its way to still frame the statement as overly dovish.

- SPX regained the 20-day moving average yesterday.

- One of the significant attributes of this market has been the large day-to-day swings in equal but opposite directions, yet the market remains very much near break-even on the year. This makes for a difficult trading environment and the ability for swing-trades to hold their profits from one day to the next.

- SPX 30 minute chart broke out of a bull flag that was formed yesterday.

- On the 30 minute chart, SPX will need to make the morning’s weakness an opportunity to establish a higher-low.

- VIX managed to see one of its bigger moves of late, dropping 10.8% down to 13.97.

- 18.7% rise yesterday on T2108 (% of stocks trading above 40-day MA) to close at 53.8%.

- SPY saw its largest daily volume bar of 2015.

- Ideally for the bulls, they need to establish some follow through, because the market of late has had a difficult time establishing a move in either direction without an equal counter-move.

- Plenty of uncertainty in the market short-term. Euro and oil are major players in the market’s direction currently.

- Oil remains extremely volatile and becoming more so each and every day. Very difficult to trade – as are the oil stocks.

- The market doesn’t care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

My Trades:

- Sold WFC yesterday at 55.96 for a 0.6% gain.

- Sold SCHW yesterda at 30.6 for a 1.3% loss.

- Added one new position yesterday.

- Will look to add new long positions if the market shows signs of rebounding off of the morning lows.

- 20% long.

- Remain long JNPR at 23.64

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.