Technical Outlook:

- FOMC Statement came out yesterday and was more dovish than the previous statement, however, the market failed to rally behind it.

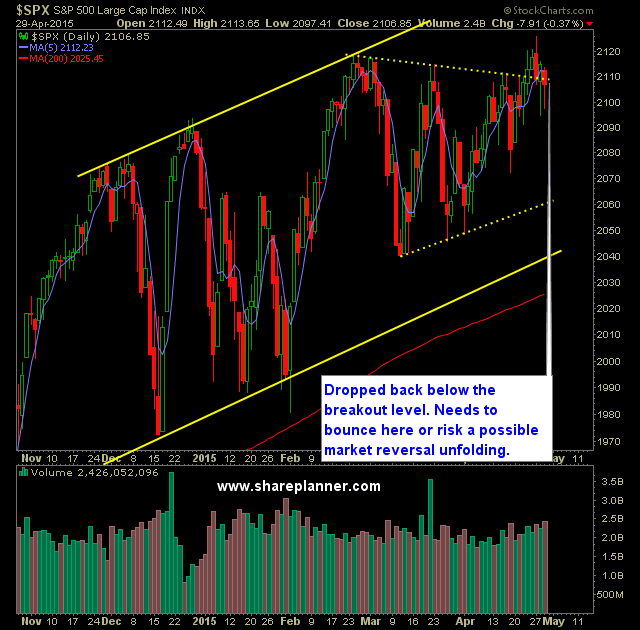

- Today’s open threatens the current uptrend that is in place. A move below 2089 would be very problematic today.

- Russell index closed slightly below the rising trend-line off of the October lows.

- VIX popped 8% yesterday to close at 13.39.

- T2108 (% of stocks trading below their 40-day moving average) showed increased weakness by dropping 9.1% to 56%.

- SPX 30 min chart showed a series of lower-highs over the past few days of trading.

- SPY volume was noticeably higher and above average yesterday. Typical to see that on FOMC days.

- I think you do have to be come a bit more weary here with the behavior of the market at its all-time highs. There isn’t much momentum flowing into stocks here.

- Bulls need, in the near-term hold the lows of yesterday at 2094 with 2089 representing a break of the rising trend-line off of the October lows.

- The market doesn’t care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

My Trades:

- Closed out CRM yesterday at $78.20 for a 15.1% gain.

- Closed out ORCL yesterday at 44.60 for a 0.9% gain.

- Did not add any new positions yesterday.

- 20% long / 80% cash.

- I’ll consider adding 1-2 new positions today dependent on the strength of today’s price action.

- Remain long: CAT at 85.26, AER at 46.92.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.