Technical Outlook:

- A day of rest for the market yesterday – Dow and SPX finished flat, while small caps and tech pulled back a shade.

- Futures looking at a significant gap up this morning following a well received JPM earnings report.

- Considering price action yesterday, it wasn’t surprising that SPY volume dropped off some and was below recent averages.

- Nice bull flag pattern on SPX 30 minute chart.

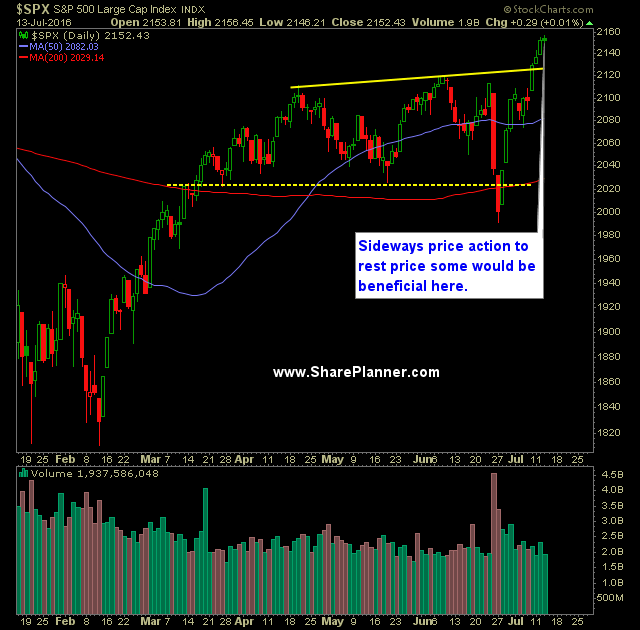

- Difficult place for the bears at this juncture. You can try to short the market and call a top, but there is no basis. There is no more range and the topping patterns from the past two years have been negated.

- If the bears were to change the tune of this market, they could start by breaking key support (previously range bounce resistance) at 2120.

- SPX is in line to challenge 2200 in the coming days.

- VIX index actually sank 3.8% yesterday snapping a two days winning streak. Breaking and closing below 13 will be a key move for VIX and the market as a whole.

- At this point, and with the election ahead, I’d expect the market to keep rallying higher. At this point I don’t expect there to be a rate hike between now and the election. To do so would impact the market and thereby the election. I don’t think the Fed wants that.

- There is a great deal of bullishness to this market right now despite the prevalent amount of worry. It has been over two years since the market has actually seen a legitimate rally and so it wouldn’t be surprising to see this market continue its current trend higher as shorts are forced to face the new reality of the market.

- In the very near term, the market is getting stretched, so some profit taking could be in store, though I don’t expect it to be enough to drag prices significantly lower.

- At this point, it can be said that the market is climbing the “Wall-of-Worry”.

- Market is assuming that rate hikes are pretty much off the table for all of 2016.

My Trades:

- Did add any new swing-trades to the portfolio yesterday.

- Did not close out any swing-trades yesterday.

- Will look to add 1-2 new long positions today.

- Currently 40% Long / 60% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I cover the expectations that we should be setting for ourselves as swing traders, from the number of trades we should be expecting to take, how long and how short we should be in our trading portfolio, as well as what the expectations for a win-rate should be.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.