Technical Outlook:

- SPX sold off for a third straight day and for the seventh time in the last eight trading sessions.

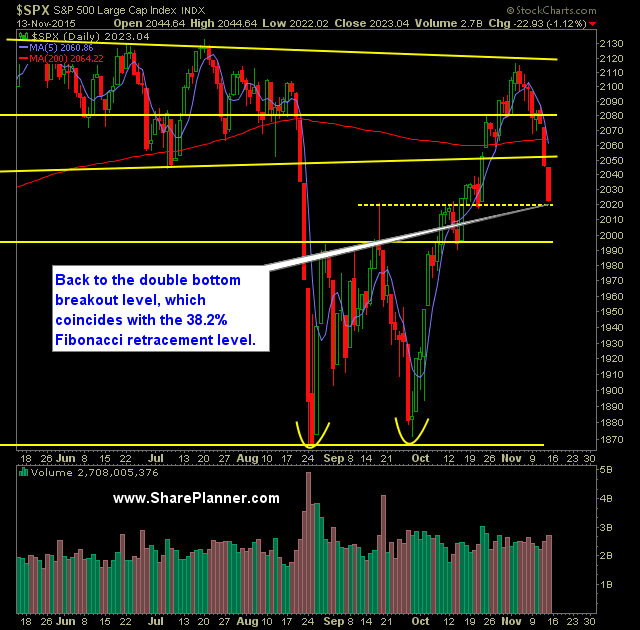

- Current retracement has price back to the double bottom breakout as well as the 38.2% Fibonacci retracement level.

- All the major moving averages have been broken with the exception of the 50-day moving average which now rests at 2007.

- Attacks in Paris, France initially caused the markets to drop an initial 1% in after hours trading but have now managed to rebound as they have rallied from over night lows and into positive territory.

- At this point, you have to be aware of the strong possibility of a market bounce, whether it is sustainable or not, it is bound to happen in the near term as SPX has managed to drop 93 points in the last eight trading sessions.

- The head and shoulders pattern that confirmed on SPX 30 minute chart has now reached its textbook targets to the downside.

- VIX closed at its highest levels since 10/2/15 and finished above 20 for the first time since then.

- T2108 (% of stocks trading above the 40-day moving average) continues to sell-off and breakdown, now at 38.1%.

- A break below Friday’s lows would likely take the current sell-off down to the 50% Fibonacci retracement level at 1995, which is also a key support level going forward.

- SPY volume was notably higher, above recent averages and the highest since 10/22.

- A rate hike is expected out of December’s Fed meeting. However, I still would not be surprised if the Fed backed out of raising rates yet again. They’ve been doing just that for years now.

My Trades:

- Added one new long positions to the portfolio yesterday.

- Stopped out of FB at $103.92 for a 3.1% loss.

- Stopped out of CRM at $76.55 for a 3.4% loss.

- Stopped out of NFLX at $107.93 for a 2.2% loss.

- 40% Long / 60% Cash

- Remain long: FDX at $157.91 and three additional positions.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I explain whether it is a good idea or not to rapidly increase the size of your portfolio if you come across a sum of cash. A lot of traders will do this without ever recognizing the emotional toll it can have on you as a swing trader and the awful mistakes you can make in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.