Pre-market update:

- Asian markets traded 0.1% lower.

- European markets are trading 0.5% higherer.

- US futures are trading 0.4% higher.

Economic reports due out (all times are eastern): Jobless Claims (8:30), EIA Natural Gas Report (10:30), Fed Balance Sheet (4:30)

Technical Outlook (SPX):

- Dip buyers emerged in full force after the first hour of trading yesterday.

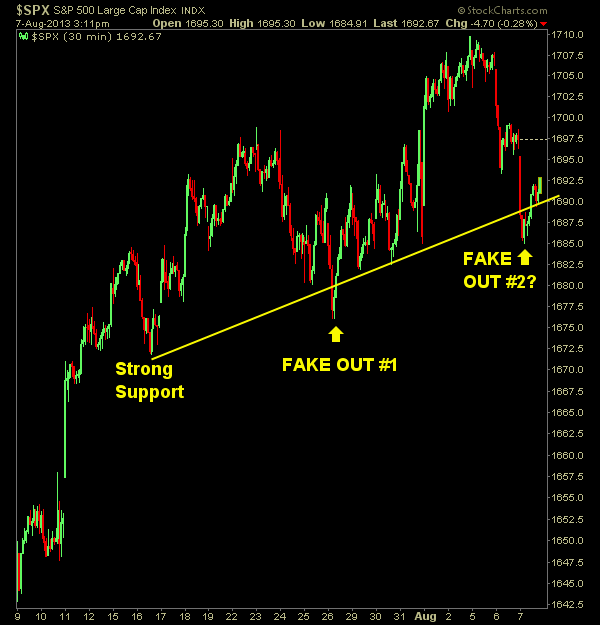

- The market found support on an intraday support level using the 30 minute chart (pictured below).

- Despite the SPX finding support on the 10-day moving average on Tuesday, it broke that MA yesterday. Now it’s trading right on the 20-day moving average today.

- Shooting stars on the VIX indicator has recently been a great indicator of a potential rally in the coming days.

- Volume in August has been even worse than what I saw in July.

- SPX is back off of of its overbought conditions. The shortest visit it has made since mid-April.

- Of much more importance is the 1676-1685 area. A healthy market won’t creep below 1685. However, a complete shift in the market would take place if SPX were to close below 1676.

- Also broken yesterday was the rising trend-line off of the 6/24 lows. But in Tuesday’s trading plan, I mentioned how this would ultimately happen in order that the rising trend-line would flatten out and lose some of its extreme steepness.

- 30-minute chart shows the possibility of a head and shoulders being formed.

- There is little, and I mean almost no reason to be short this market right now. None. Not with the Fed’s policy or until that changes.

- 1676 is a very key level for this market in the case of a sell-off. That would create a new lower-low.

- I remain a buyer in this market. The opportunities to swing short are far too unpredictable, choosing to focus on the long side is the best way to manage risk and maximize profits at this juncture.

- Markets don’t care about the economy. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Sold BA at 105.69 for a 0.4% loss.

- Sold GS at 162.29 for a 3.1% loss.

- Sold BLK at 280.59 for a 1.7% loss.

- Added CMI at 121.60 and one other positions yesterday.

- Currently 80% long/20% cash.

- Current Longs: COG at 77.21, ASML at 89.63, HRB at 30.19, SJM at 104.63, HUM 91.08, CS at 29.91.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.