Pre-market update:

- European markets are 1.6% higher.

- Asian markets traded 1.0% higher.

- US futures are trading moderately higher.

Economic reports due out (all times are eastern): MBA Purchase Applications (7am), GDP (8:30am), Pending Home Sales (10am), EIA Natural Gas Report (10:30am), Kansas City Fed Manufacturing Index (11am)

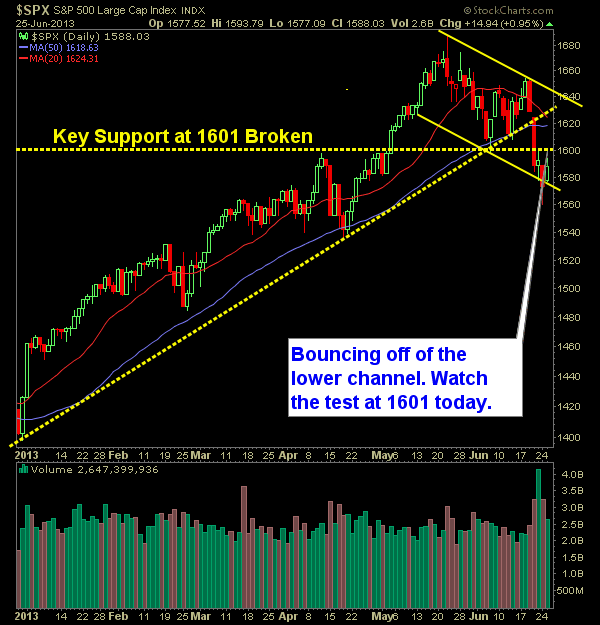

Technical Outlook (SPX):

- SPX provided me with the bounce I was looking for yesterday and is now trading inside of the Bollinger Bands now.

- I think this bounce has some legs to it, and expect to see an extended run.

- The one thing you are not seeing that typically accompanies a major market sell-off is continuous bad news coming out. We had the FOMC Statement and that has been it.

- I simply do not think the bears can keep driving this market lower without some form of a catalyst, besides the tapering comments made before by the FOMC.

- The more the SPX rises the more fear it will strike in the bears, which result in more covering out of fear of losing their gains from last week.

- Expect 1601 and 1608 to offer some resistance for the bulls to try and push through.

- GDP miss is probably going to stoke more hope that tapering will be put on hold.

- Lots of Volume continues to pour in over the last four trading sessions.

- Bounces in this situation can be extreme, because the the squeeze on short positions, and the urgency to capture profits from the big gains made over the previous trading sessions.

- As a result it often times leads to a mass exodus of bears trying to cover their positions all at once.

- We are oversold short-term.

- We have now established a lower-high and lower low for the first time in this market for 2013.

- With recent selling, we are now trading well below the 10,20, and 50-day moving averages.

- VIX dropped back into the 18’s.

- The S&P 500 is on the verge of having its first down month of 2013.

- Markets don’t care about the economy. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Added CME at 76.35.

- Added LPI at 20.28.

- Added GS at 153.16.

- Current Longs: PCYC at 80.56, WLP at 80

- I will look to add 1-2 new positions today.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.